In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)10/31 Report--

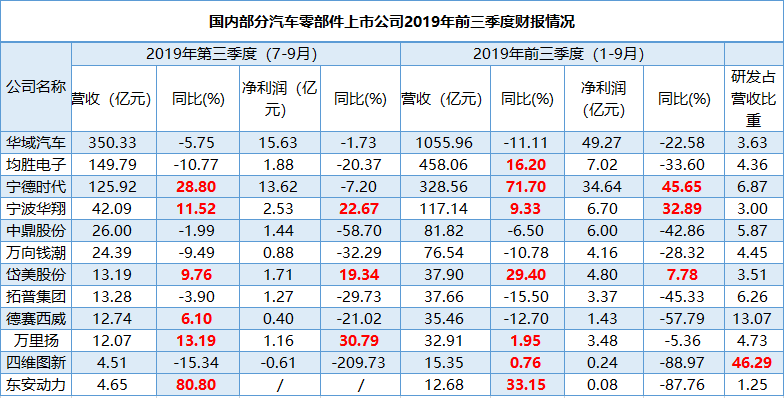

At the end of October, major auto companies have released their results in the first three quarters, and some listed auto parts companies in China have also released their results in the first three quarters of 2019. This time, the statistics are 12 auto parts companies that have already announced their results in the first three quarters.

In terms of revenue in the third quarter, Ningde Times, Ningbo Huaxiang, Daimei shares, Desai Xiwei, Wanliyang and Dongan Power achieved year-on-year growth. Among them, Dongan Power had the largest growth rate, with operating income of 465 million yuan in the third quarter, an increase of 80.8% over the same period last year. The second is the Ningde era, with a revenue of 12.592 billion yuan, an increase of 28.80% over the same period last year. It is also the only parts company with a revenue of more than 10 billion yuan in proportional revenue growth.

Huayu Automobile, Junsheng Electronics, Zhong Ding shares, Wanxiang Qian Chao, Top Group and Siwei Tuxin six companies achieved a year-on-year decline in operating income in the third quarter. The biggest decline was Siwei Tuxin, with revenue of 451 million yuan in the third quarter, down 15.34% from the same period last year, followed by Qunsheng Electronics, with revenue of $14.979 billion in the third quarter, down 10.77% from the same period last year.

In terms of net profit in the third quarter, 12 spare parts companies showed a situation of "falling more and increasing less". The net profits of Ningbo Huaxiang, Daimei and Wanliyang were 2.53,1.71 and 116 million yuan respectively, with the largest increase in Wanliyang, 30.79%. The second was Ningbo Huaxiang, which increased by 22.67%, and finally Daimei shares, which increased by 19.34%.

Eight other companies (not disclosed by Dongan Power) declined compared with the same period last year, while two companies, Siwei Tuxin (- 209.73%) and Zhongding shares (- 58.70%), fell by more than half, while Huayu Automobile had the smallest decline (1.73%).

In the first three quarters of this year, 12 auto parts companies achieved a total operating income of 229.004 billion yuan and a net profit of 12.119 billion yuan.

In terms of revenue in the first three quarters, seven companies achieved year-on-year growth, including Qunsheng Electronics, Ningde Times, Ningbo Huaxiang, Daimei shares, Wanliyang, Siwei Tuxin and Dongan Power, while a total of five companies showed year-on-year declines. including Huayu Automobile, Zhongding shares, Wanxiang Qian Chao, Topp Group and Desai Xiwei.

Among them, there are four companies with operating income of more than 10 billion yuan in the first three quarters, namely Huayu Automobile (105.596 billion yuan), Junsheng Electronics (45.806 billion yuan), Ningde era (32.856 billion yuan) and Wanxiang Qian Chao (11.714 billion yuan). Among the four car companies, only Huayu Automobile fell 11.11% compared with the same period last year, while the other three companies increased by 16.20%, 71.7% and 9.33% respectively compared with last year. And the Ningde era has the largest growth rate among the 12 enterprises.

In terms of net profit in the first three quarters, the net profits of the 12 auto parts companies, Ningde Times, Ningbo Huaxiang and Daimei were 3.464 billion yuan, 670 million yuan and 480 million yuan respectively, of which Ningde era had the largest growth rate of 45.65%. The other two increased by 32.89% and 7.78%, respectively.

Of the other nine auto parts companies, three fell by more than half, namely, Desai Xiwei (- 57.79%), Siwei Tuxin (- 88.97%) and Dongan Power (- 87.76%), while Wanliyang had the smallest decline of 5.36%.

In addition, the proportion of R & D in revenue basically fluctuates around 5%. Of course, there are exceptions. For example, D & D accounts for 13.07% of revenue, 46.29% of new R & D, while Dongan Power, in contrast to Siwei Tu Xin, accounts for only 1.25%.

Since 2019, due to the grim car market, China's car sales have not met expectations, even to the "Golden Nine and Silver Ten" two months, still continue to decline. According to data from the China Automobile Association, China's automobile production and sales in the first three quarters of this year were 18.149 million and 18.371 million respectively, down 11.4% and 10.3% respectively from the same period last year.

The severity of the auto market affects not only car sales, but also upstream auto parts companies. From the above analysis of the 12 auto parts companies, except for a very small number of companies have obvious recovery, the vast majority of companies' losses are still obvious.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.