In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)11/08 Report--

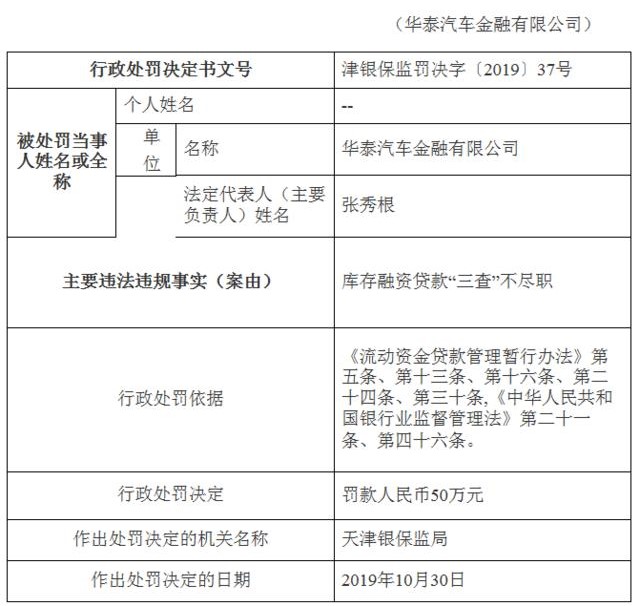

According to the administrative penalty information released by the Tianjin Banking and Insurance Supervision Bureau on November 7, Huatai Auto Finance Company failed to perform its duties in the "three checks" of inventory financing loans, and the Tianjin Banking and Insurance Supervision Bureau imposed a fine of 500000 yuan on Huatai Auto Finance Co., Ltd.

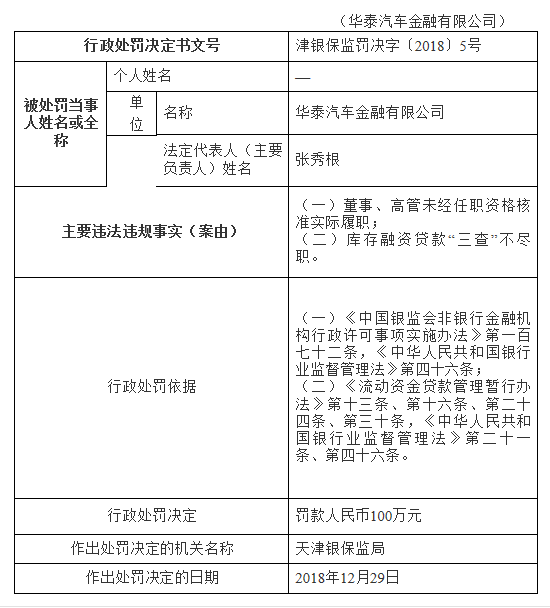

It is worth noting that on January 10 this year, Huatai Automotive Finance was punished by Tianjin Banking and Insurance Supervision Bureau with a penalty of 1 million yuan because directors and executives actually performed their duties without qualification approval and failed to perform their duties in the "three checks" of inventory financing loans.

According to Tianyan check information, Huatai Auto Finance Co., Ltd. was founded in 2015 with a registered capital of 500 million yuan. Its largest shareholder is Huatai Automobile Group Co., Ltd., with a shareholding ratio of 90%. The second largest shareholder is Bohai Bank Co., Ltd., holding 10% of the shares.

Huatai Auto Finance has been fined twice by Tianjin Banking Regulatory Bureau, which has a lot to do with the poor management of Huatai Automobile, a major shareholder, in recent years.

Data show that Huatai Automobile was founded on December 18, 2000, is a new energy vehicles, traditional cars and auto parts as the main business of the independent brand car company. Huatai has launched three SUV models, Santa Fe, Traka and Polige, as well as Lusheng E70 and Huatai B11, but because of its limited technology, Huatai can only rely on imitation, so Huatai has been burdened with the title of "shanzhai" for a long time.

There is also the name of "sales fraud" behind the name of "shanzhai". In 2010, Huatai reported sales of 81435 vehicles to the China Automobile Association, an increase of 30560 over the same period last year, but the actual number of Huatai cars in 2010 was 15950, an increase of only 1280 over 2009. Because of serious misrepresentation, the China Automobile Association once showed Huatai's sales as zero in the production and Marketing Express in 2011.

As a result, it is difficult to be sure whether Huatai's announced sales are true or false, but according to its reported sales, Huatai sold 71200 vehicles in 2015 and 73000 in 2016, while in 2017, Huatai's sales soared by 81.64% to 132600.

Because the surge in sales has given Huatai confidence, Huatai said at the 2017 auto show that sales would reach 200000 in 2018, exceed 500000 in 2020, and launch nearly 30 new cars in the next three years.

The ideal is very plump, but the reality is very bony! Instead of reaching 200000 in 2018, sales fell 9.0 per cent to 120700. Huatai's monthly sales in the first half of this year were about 3000, and sales plummeted in July and August, with a total of 114s sold in two months.

In 2017, when Huatai's sales were booming, dawning Group transferred 5.28% of Liaoning dawning shares to Huatai Motors. Huatai Motors did not complete the acquisition of dawning shares until September 27, 2018 because of many problems. Huatai's problems began to emerge at this time.

After the completion of the acquisition, Huatai did not bring a good prospect to dawning shares, but led to a series of collapses in dawning's profits. The net profit of dawning shares in 2017 was 316 million yuan. After Huatai Motor acquired dawning shares in 2018, dawning shares lost 128 million yuan, and dawning shares lost 90 million yuan in the first half of this year, down 975.28 percent from the same period last year. In addition, due to poor management, Huatai Motor after the acquisition of dawning shares, its shares were frozen many times.

In early 2018, Huatai Motor was in arrears with employees' wages, and Huatai Automobile was also sued by employees. Nowadays, banners of Huatai Automobile defaulting on employees' wages and dealer payments can be seen everywhere in Huatai Automobile-related places.

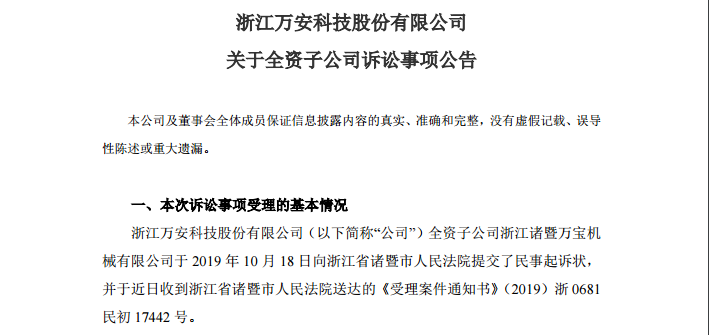

On November 5 this year, Wanan Science and Technology announced that its wholly-owned subsidiary Zhejiang Zhuji Wanbao Machinery Co., Ltd. submitted a civil lawsuit to the people's Court of Zhuji City on October 18, saying that the defendant Tianjin Huatai car body was in arrears with payment and failed to make timely payment in accordance with the time limit stipulated in the contract. As of the date of prosecution, Tianjin Huatai still has 13.17 million yuan in loans and outstanding default interest.

In addition, according to CCTV financial reports, Huatai Motor's three major production bases in Rongcheng, Shandong, Tianjin and Ordos, Inner Mongolia, all stopped production, the factory was silent, the roar of machines could not be heard, and the open space the size of a football field was covered with half-meter-high weeds.

From the seal on the door, we can see that the date is August 29, which basically coincides with the collapse of Huatai Motor and R & F real estate financing. Previously, it has been reported that Huatai Motors and R & F Real Estate have reached a partnership, the two sides will cooperate in new energy vehicles, self-driving and other aspects and said that R & F Real Estate has bought a stake in Huatai Motors. On Aug. 22, R & F said it decided to suspend further cooperation because of the "poor" market response to the cooperation.

In fact, as early as the second half of 2018, Huatai Automobile has been repeatedly exposed by the media that the factory has stopped production, arrears of suppliers and wages of employees, and so on. In October this year, the media also revealed that four auto companies, including Huatai Motors, would enter bankruptcy proceedings at the end of the year. After a few days of silence, Huatai Automobile came forward to refute the rumors, saying that the content of the company's bankruptcy was maliciously fabricated. Huatai Motors is actively taking measures to reduce the risk.

Now Huatai Motor is facing a number of debt expectations, and the amount of compensation in suspected litigation cases is as high as 2.2 billion yuan. Some lawyers said that the overdue debt of Huatai Motor is fatal to Huatai Motor and has reached the conditions for bankruptcy.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.