In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)11/08 Report--

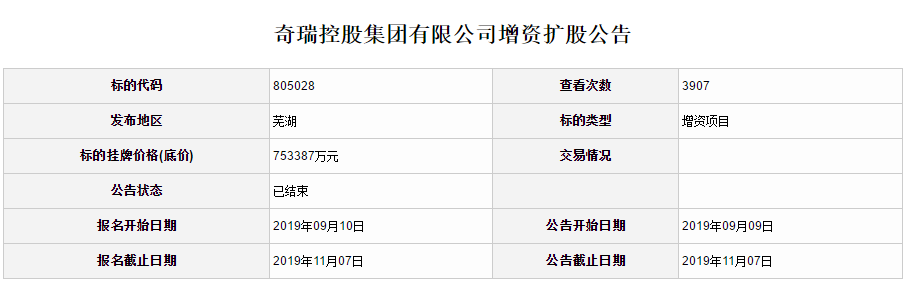

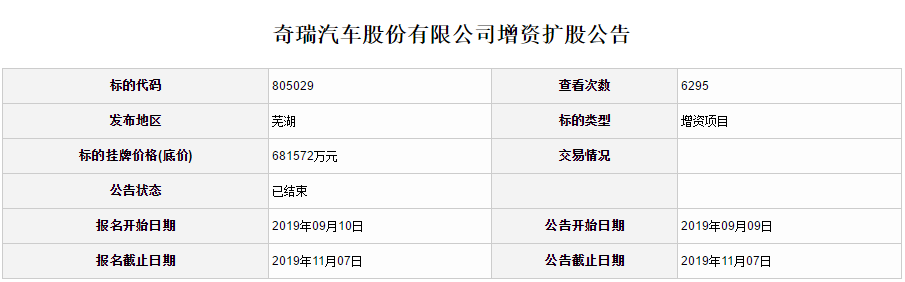

Today, we learned from the announcement of the Yangtze River property right Exchange that the capital increase and share expansion projects of Chery Automobile Holdings Co., Ltd. and Chery Automobile Co., Ltd. were extended.

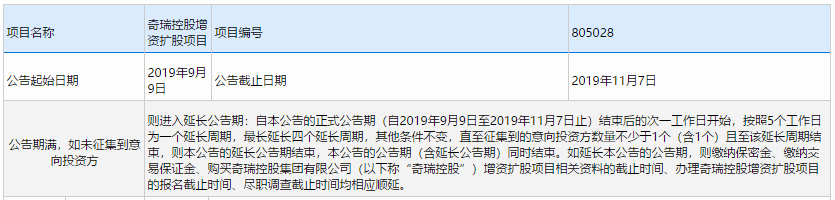

According to the extension notice, starting from the next working day after the end of September 9 to November 7, there will be an extension cycle according to five working days, with a maximum of four extension cycles, and other conditions remain unchanged, until the number of interested investors recruited is not less than 1 (including 1) and until the end of the extension period, the extension notice period of this announcement ends, and the announcement period (including the extension notice period) ends at the same time.

After the postponement of the capital increase and share expansion project on November 7, a total of two companies paid 4.7 billion yuan in intention money, namely, Tengxing Yangtze River Delta (Haining) equity investment partnership and Qingdao Wudaokou New Energy Automobile Industry Fund (limited partnership).

According to Tianyan, Tengxing Yangtze River Delta was registered on July 22 this year, and its company has a total of 10 shareholders. They are natural shareholder Jinyi, Jingfu Asset Management Co., Ltd., Xin chain Tongda (Beijing) Information Service Co., Ltd., Haining Jianshan New District Development Co., Ltd., Haining Asset Management Co., Ltd., Shanghai Resheng Industrial Co., Ltd., Yueqing Nanshang Investment Co., Ltd., Shanghai Shanzhuo Industrial Co., Ltd., Shanghai Jiaying Liusheng Investment Co., Ltd. And Volkswagen New Energy Technology Co., Ltd. On the other hand, Qingdao Wudaokou was established on August 22, which is very close to the time when Chery released the mixed reform project.

Chery insiders said that Tengxing Yangtze River Delta delisting is more likely, but technically both companies are likely to be delisted.

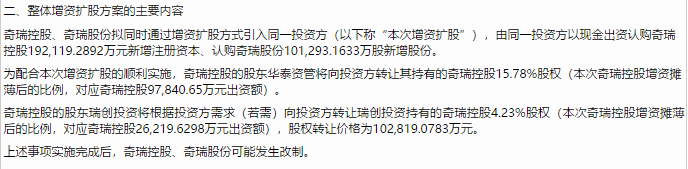

In addition, after the completion of the capital increase and share increase, Huatai Capital Management, a shareholder of Chery Holdings, will transfer its 15.78% stake in Chery Holdings to investors, according to an announcement issued by the Yangtze River property Exchange. Rui Chuang Investment, a shareholder of Chery Holdings, will transfer its 4.23% stake in Chery Holdings to investors according to the needs of investors (if necessary). After the implementation of the above matters, Chery Holdings and Chery shares may be restructured.

The largest shareholder of Chery shares is Chery Holdings, with a shareholding ratio of 31.33%, according to Tianyanchan data. Chery shares was registered and established on January 8, 1997. it is a state-owned holding enterprise engaged in automobile production, with total assets of 90.42 billion yuan. Up to now, the industry of Chery shares is no longer limited to automobile manufacturing, but also dabbles in auto parts, trade, shipping, finance, tourism and other industries.

However, Chery Holdings currently has a relatively high debt, with a load of more than 68.5 billion yuan, according to data for the first half of the year. Chery Holdings also rarely publishes specific figures on its liabilities.

Under the financial difficulties, Chery is still trying to save itself in the transformation of the enterprise. In April 2018, Chery put forward the "Lion Strategy" to make further efforts in the field of car networking and self-driving. However, the blessing of new technologies also means more funding needs.

It is worth mentioning that although the debt is relatively high, Chery's sales have improved continuously in recent months. Chery sold 68358 cars in September, up 5% from a month earlier and 2.4% from a year earlier. Chery sold a total of 506820 vehicles from January to September. In October, Chery sold a total of 70300 vehicles, up 5.2% from a year earlier and 2.9% from a month earlier; it sold 577000 vehicles from January to October this year.

According to the survey, this is the second time that Chery has carried out a mixed reform. After the mixed reform failed in 2018, Chery resumed the mixed reform on September 2 this year, introducing investment by increasing capital and shares. The capital increase and share expansion project was officially listed on September 9 and ended on November 7.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.