In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)11/12 Report--

Recently, Bick battery encountered a debt whirlpool, affecting the nerves of many listed companies. So far, four companies, including Rongbai Technology, Dangsheng Technology, Hangke Technology and New Zebang, have issued reminders about the risk of accounts receivable, involving about 731 million yuan.

Bick Battery, founded in 2001, started with 3C batteries and was once a battery supplier to Hewlett-Packard, Dell and other notebook manufacturers. In 2008, Bick batteries began to enter the field of new energy vehicles. As an established lithium battery company, although it is not a listed company, it has a complete industrial chain in the A-share market. Upstream, including Science and Technology Innovation Board's Rongbai Technology, Hangke Technology and gem Dangsheng Technology and other material suppliers, while Zhongtai Automobile, Haima Motor and other car manufacturers are important downstream customers.

In the "serial debt" encountered this time, it is not that Bic Power does not want to pay back the money, and it is also in the agony of being a creditor. In this industrial chain, Bick Power acts as both the debtor and the creditor.

Since the evening of November 7, Rongbai Technology issued an announcement that night, exposing the risk that bills receivable from Bic Power may not be recovered when due, totaling 208 million yuan. Rongbai Technology also said that Zhengzhou Bic, a wholly-owned subsidiary of Bick Power, had used a total of 204 million yuan in property ancillary projects and equipment as collateral to guarantee the debt, but the realized value was far lower than the original value due to depreciation and other factors.

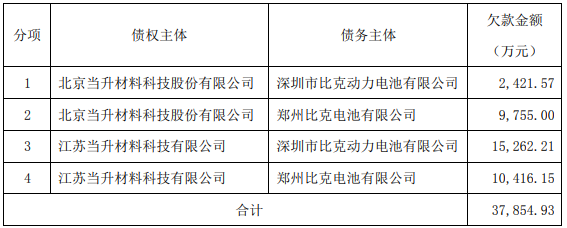

Then, Dangsheng Technology and Hangke Technology also disclosed accounts receivable from Bic Power, which were 379 million yuan and 106 million yuan respectively.

On the evening of November 11, New Zebang also issued a reminder about the risk of accounts receivable. As of the date of disclosure of the announcement, the company and its wholly-owned subsidiary Norlette Bick Battery had a combined account receivable balance of 38.1447 million yuan.

In fact, it all started with Zhongtai Motors. Bick Power is one of the important suppliers of Zhongtai automobile power batteries. In 2014, Bick batteries began to provide new energy vehicle batteries for Zhongtai Motors. Battery supply accounts for more than 50% of Zhongtai's total production. But since then, due to problems with Zhongtai's auto capital chain, it has been unable to repay Bic Power's debt of about 650 million yuan, which worsened Bick Power's ability to repay funds, and eventually spread to other related companies.

On November 8, Zhongtai Motors announced that Zhongtai Motor had received a letter from controlling shareholder Tieniu Group that the shares held by Tieniu Group had been judicially frozen, with a total of 356 million shares frozen. In this regard, Bick Power also responded that in order to collect the claims, the company filed a subrogation lawsuit against the Iron Niu Group. "in addition to the lawsuit, we have been actively negotiating with Zhongtai, and Zhongtai has also shown a positive attitude towards repayment."

According to the financial results released by Zhongtai Automobile, the company's operating income in the first three quarters was 5.401 billion yuan, down 59.59% from the same period last year, while the net profit of shareholders belonging to listed companies lost 760 million yuan, down 283.02% from the same period last year. From January to September this year, the net cash flow generated by operating activities was-1.797 billion yuan.

Some people in the industry said that since the beginning of this year, the automobile market has suffered a continuous decline and has not been able to get out of the decline so far. With the dividend period of state subsidies, the decline of subsidies has greatly slowed the growth of new energy companies. The reshuffle of new energy vehicles is more intense, which affects the whole body. Once there is a problem in one link of the industrial chain, it will inevitably damage the interests of other enterprises in the whole chain. This is true of Bick Battery, New Zebang, Rongbai Technology, Hangke Technology and so on.

At present, as one of the most important subsidiaries of Bic Battery, Zhengzhou Bic has been caught in the plight of partial suspension of production and pay, and the problems of the listed companies involved may not be solved in the short term.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.