In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)11/14 Report--

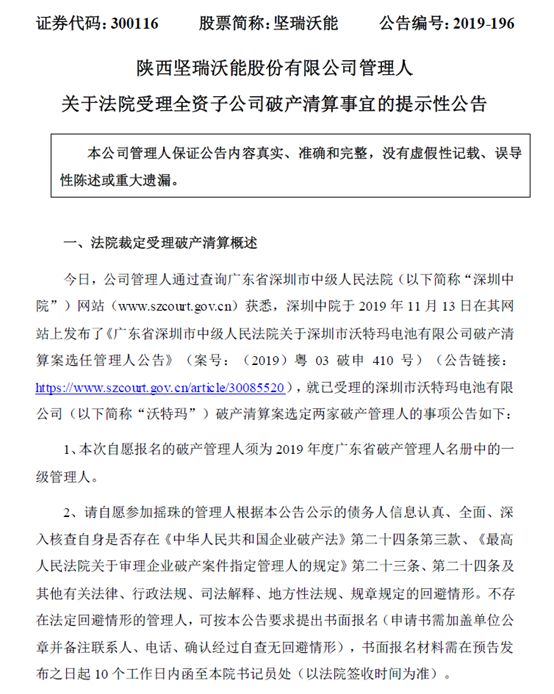

The Shenzhen Intermediate people's Court ruled on November 7, 2019 to accept Huang Ziting's application for bankruptcy liquidation of Shenzhen Watma Battery Co., Ltd., according to a notice issued by Jianrui Woneng. It means that the former battery giants have fallen.

According to the preliminary investigation of Shenzhen Intermediate people's Court, Shenzhen Watma Battery Co., Ltd. is still in operation, with more than 800 employees and foreign liabilities of about 19.7 billion yuan, of which the debt owed to 559 suppliers is about 5.4 billion yuan.

According to public data, Shenzhen Watma Battery Co., Ltd., headquartered in Shenzhen, China, was established on April 30, 2002. It is one of the first enterprises in China to successfully develop new energy vehicle power batteries and take the lead in large-scale production and batch application. It ranks among the top three power batteries in China, second only to Ningde Times and BYD.

However, what is different from the former two is that Watma mainly carries electric commercial models such as buses / special-purpose vehicles, and few passenger models, including bus enterprises such as Zhongtong and Jinlong, and customers of special vehicles such as Dongfeng, FAW, heavy truck, Dayun and so on.

In the three years after 2015, under the appeal of the Ministry of Industry and Information Technology for the development of the new energy vehicle industry, the shipments of Watma batteries reached 1.37GWh, 2.47GWh and 1.98GWh respectively, firmly occupying the third place in the power battery industry. In 2015, Watma made a net profit of 276 million yuan, a 123-fold increase over the previous year.

At this time, more than 35000 new energy vehicles across the country are equipped with Waterma power battery system, operating in 31 provinces and cities across the country, and exported to more than 40 countries and regions on six continents, with a domestic market share of 26.6%.

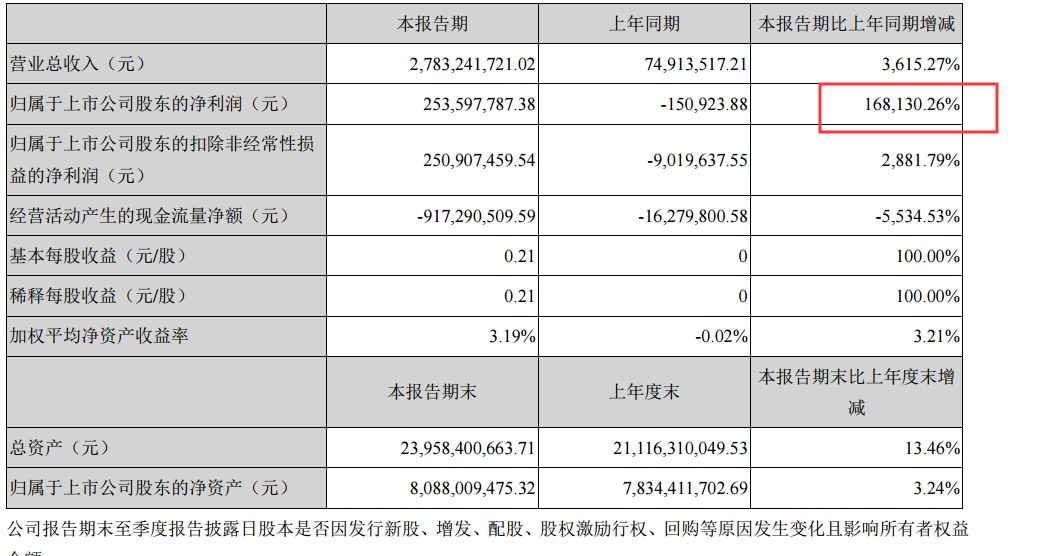

In 2016, a listed company, Jianrui Fire, took a fancy to Watma's growth and eventually bought it for 5.2 billion and renamed it Jianrui Wareng. Although the net profit growth in the first quarter of 2017 reached a rate that astonished all industries-1681 times. But then it began to go down gradually.

The main reason is that since it was acquired by Carewaleng, Waterma has adjusted its strategy to significantly increase the scale of production in order to trade larger sales in exchange for lower production costs and increase market share. However, after 2016, the state began to adjust new energy subsidies, and many car companies received fewer and fewer subsidies as a result.

What is more deadly is that in order to curb fraud, the new policy of new energy subsidies has added a new rule that "non-individuals need to purchase new energy vehicles and operate for more than 30,000 kilometers to receive subsidies", which will take effect in 2017. The payback cycle of downstream customers has been extended for at least one year, making the company's inventory turnover more difficult.

On the other hand, compared with Ningde era, BYD and other competitors, Watma technology route is single, mainly rely on lithium iron phosphate battery and the energy density increases slowly, the market demand gradually decreases.

Until last year, Watma issued a notice to all employees, admitting publicly for the first time that it had encountered "financial difficulties" in the first half of 2018, and said that in order to solve the career development impact of insufficient orders and financial difficulties on all employees, all employees will have a six-month holiday from July 1, 2018. So far, I have not heard the news of resuming work.

Poor management has been caused by misjudgment on the technical route of power batteries and the development of the enterprise, resulting in a shortage of orders, and the parent company has been dragged down by problems such as debt, which means that the parent company will face bankruptcy liquidation again if it is difficult to lend a helping hand to Watma's plight.

Ginrivonen said that if the people's court ruled that Waterma went into liquidation, it would have a positive impact on the resolution of the debt crisis the company is currently facing. Because once Watma enters the process of bankruptcy reorganization, the frozen assets and litigation faced by Centro will be released and terminated in the form of compulsory judicial decisions, and Centro will also be able to carry out debt restructuring.

In fact, due to the impact of national policy compensation, it has a very great impact on the field of new energy. Once there is a problem in one link of the industrial chain, it will inevitably involve the interests of other enterprises in the whole chain. Just like the Bic battery, which is mainly supplied to new energy car companies such as Zhongtai Automobile and Huatai Automobile, because the car companies face performance losses, they are unable to give money back to the upstream, making it impossible for the Bic battery to be repaid upstream and fall into "serial debt".

So far, four companies, including Rongbai Technology, Dangsheng Technology, Hangke Technology and New Zebang, have issued reminders about the risk of accounts receivable for the Bic battery, involving about 731 million yuan.

Nowadays, in the face of the downturn of the car market and the decline of subsidies for new energy vehicles, automobile companies are facing unprecedented pressure, and their automobile-related industries are all involved, especially the power battery industry, which is the main part of new energy vehicles. It's even more difficult.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.