In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)11/29 Report--

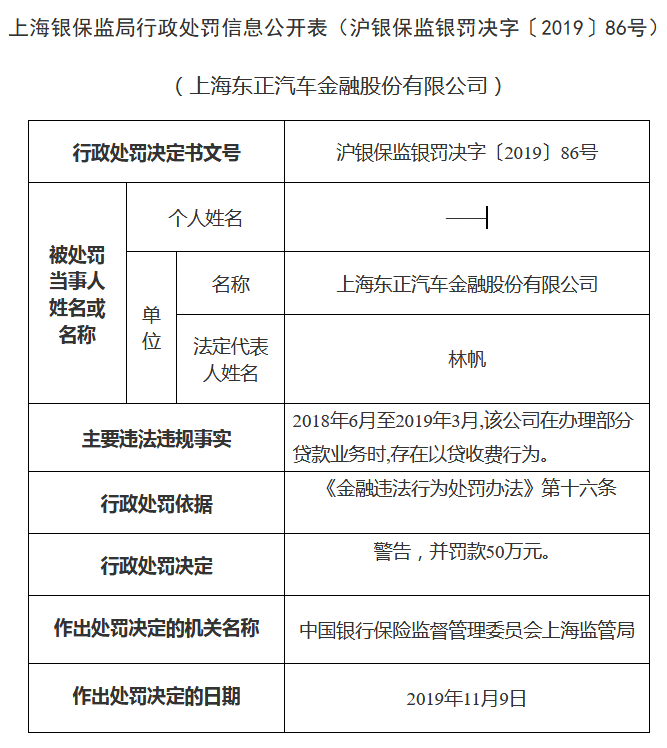

Since the beginning of this year, the car loan business violations have been severely investigated and dealt with, and a number of companies have been punished one after another. On November 27th, the China Banking and Insurance Regulatory Commission issued an administrative penalty decision, which showed that Shanghai Dongzheng Auto Finance Co., Ltd. charged for loans when it handled part of its loan business from June 2018 to March 2019. According to Article 16 of the measures for punishment for Financial violations, the Shanghai Banking and Insurance Regulatory Bureau decided on November 9 to impose a warning on Dongzheng Financial and fined 500000 yuan.

According to data, Dongzheng Financial was established in March 2015 and is the first domestic auto financing company approved by the China Banking and Insurance Regulatory Commission to be established with a dealer group as the background. Dongzheng Financial is a joint venture between China Zhengtong Automobile Service Holdings Co., Ltd. And Dongfeng Automobile Group Co., Ltd., covering some luxury brands, including BMW, Mercedes-Benz, Audi, Porsche, Jaguar, Land Rover, Volvo, Red Flag and so on.

Mercedes-Benz Auto Finance Co., Ltd. was punished a few months later after the incident of female owners of Mercedes-Benz in Xi'an exposed the illegal collection of financial service fees by dealers in April this year. The China Banking and Insurance Regulatory Commission released a penalty information form on Sept. 11, showing that Mercedes-Benz Auto Finance Co., Ltd. imposed an administrative fine of 800000 yuan according to law because of "serious deficiencies in the management of outsourcing activities."

Mercedes-Benz Financial has said, "Mercedes-Benz Financial will not charge any financial services fees from dealers and customers. Dealers are independent legal entities, and Mercedes-Benz Financial is a partner, and we have no authority to restrict dealers."

In view of the chaos of automobile consumer loans, on October 23, the China Banking and Insurance Regulatory Commission issued the Circular on issuing Supplementary provisions on the Supervision and Management of financing guarantee companies, which clearly stipulates that "car dealers shall not engage in automobile consumer loan guarantee business without approval." The circular requires that without the approval of the supervision and administration department, automobile dealers, automobile sales service providers and other institutions shall not engage in automobile consumption loan guarantee business, and the stock business that has been carried out shall be properly settled; if it is really necessary to carry out relevant business, a financing guarantee company shall be established in accordance with the provisions of the regulations to conduct relevant business. The supervision and administration department shall step up efforts to crack down on financing guarantee companies that operate in violation of laws and regulations and seriously infringe upon the legitimate rights and interests of consumers (guarantors), and timely inform the banking financial institutions of the relevant situation, jointly protect the legitimate rights and interests of consumers.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.