In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-23 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)12/12 Report--

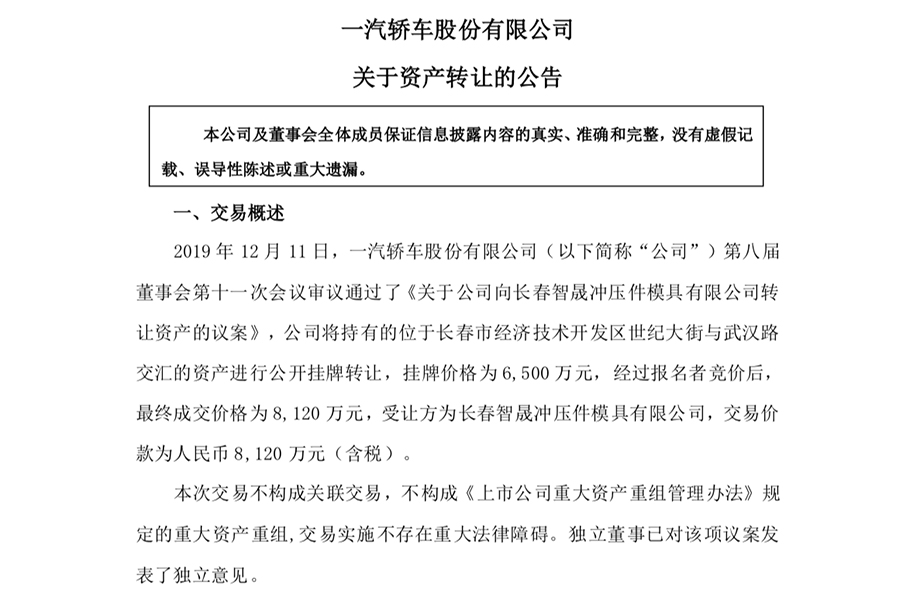

On December 11, FAW car issued two announcements in succession, showing that the company will hold assets located in Jingkai District of Changchun City for public listing and transfer at a listing price of 65 million yuan, and the transferee is Changchun Zhisheng stamping Die Co., Ltd. the final transaction is 81.2 million yuan, and the transaction is expected to increase the company's profit by 57 million yuan in 2019.

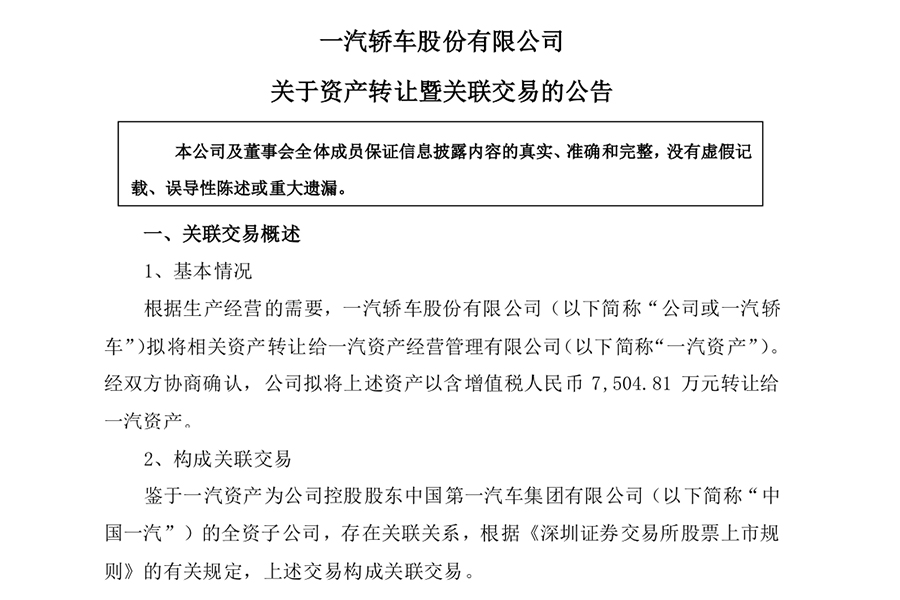

Another announcement shows that the company plans to dispose of the property and transfer it to FAW Asset Management Co., Ltd. (FAW assets) at 75.0481 million yuan. The transaction is expected to increase the company's profit by 48 million yuan in 2019. The two deals are expected to increase the company's profits in 2019 to a total of 105 million yuan.

FAW car said that it will help invigorate the company's inefficient assets, solve the problems left over from history, and optimize the company's asset structure, which meets the needs of the company's strategic development; at the same time, it can increase the company's working capital and improve the efficiency of the use of funds. better help the company's independent cause.

On August 30, FAW cars disclosed the draft restructuring, using 100% equity in FAW cars as purchased assets, which was replaced with the equivalent part of FAW Jiefang 100% stake held by FAW.

The draft shows that FAW plans to buy a 100% stake in FAW Jiefang. After the completion of the transaction, FAW's shareholding in FAW cars has further increased from 53.03% to 83.41%, and the main business of FAW cars will also be changed to commercial vehicle R & D, production and sales.

On September 27, FAW issued a notice saying that SASAC of the State Council approved the asset restructuring and agreed in principle.

On November 28th, FAW car announced that in order to further optimize the size of the company's equity after the transaction and comprehensively consider the company's ability to pay cash, it plans to cancel 3.5 billion yuan of matching fund-raising. FAW Jiefang 100 per cent equity held by FAW was purchased through major asset replacement, share issue and cash payment.

On December 10, FAW car announced that the shareholders' meeting passed a number of bills, such as "the proposal on the company's major asset replacement, issuing shares and paying cash for asset purchase and related transactions". It means that the asset restructuring of FAW cars will enter the implementation stage.

Among the six major automobile groups in China, FAW Group is the only automobile company that has not been listed as a whole. Due to the complex internal structure and the problem of inter-industry competition, the overall listing failed.

In order to speed up the overall pace of listing, FAW Group accelerated the reorganization of internal assets.

On November 29, FAW Fuwei also announced that the company plans to sell 5% of its stake to Geely Yadong State-owned Capital Investment Co., Ltd. After the completion of the transaction, FAW Group is no longer the largest shareholder of FAW Fuwei, and Yadong Investment has become its largest shareholder. at the same time, the actual controller of FAW Fuwei has been changed to Jilin SASAC.

On December 8, FAW Xiali announced that its controlling shareholder, China first Automobile Co., Ltd., would transfer its holding stake in FAW Xiali to China Railway Materials Co., Ltd. All the existing assets and liabilities of FAW Xiali are placed in the subsidiary designated by the controlling shareholder of the company, and at the same time, the controlling stake of China Railway Wusheng Technology Development Co., Ltd. is purchased by issuing shares to purchase assets, which constitutes a major asset restructuring of the listed company.

In recent years, the development of FAW cars is not very good. The financial report shows that in the first three quarters of this year, FAW cars achieved revenue of 17.292 billion yuan, down 6.95 percent from the same period last year, and net profit loss of 267 million yuan, down 297.33 percent from the same period last year.

At present, FAW cars have two major passenger car brands, namely FAW Pentium and FAW Mazda. According to the data, FAW Pentium sold a total of 104000 vehicles from January to November, up 43 per cent from a year earlier. From January to November, FAW Mazda sold a total of 80998 vehicles, down 19.4% from a year earlier.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.