In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)01/17 Report--

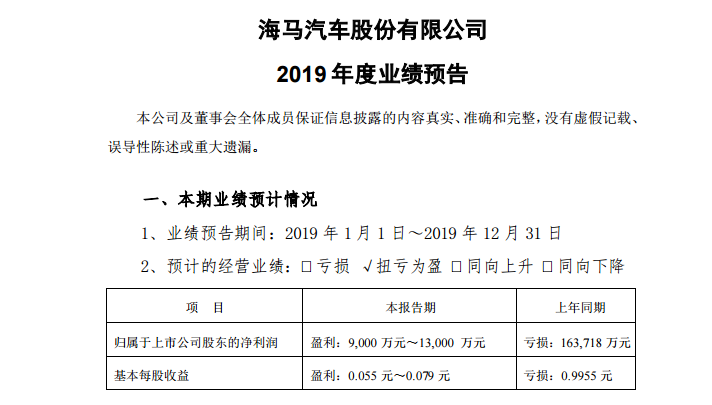

On the evening of January 16, * ST seahorse issued a 2019 performance forecast. * ST seahorse expects the 2019 performance to turn into a profit, with a net profit of 90 million yuan to 130 million yuan for shareholders of listed companies, compared with a loss of 1.63 billion yuan for the same period in 2018.

Against the background of a sharp decline in car production and sales, the shares of listed companies have been given a "delisting risk warning", and the shares of Haima have been changed to "* ST seahorse". Seahorse is expected to retain its shell successfully by selling idle real estate, transferring the shares of its subsidiaries and turning losses into profits through government subsidies.

Sale of idle property

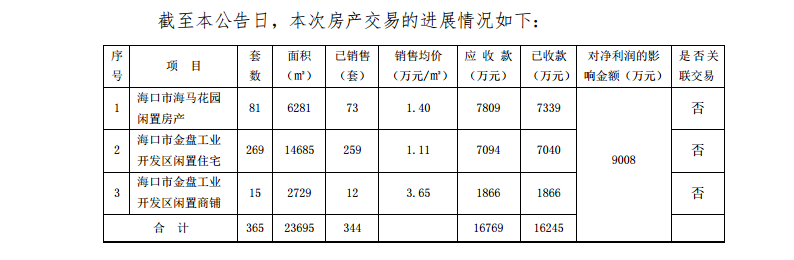

Haima sold a total of 401 idle properties in Haikou and Shanghai in April and May last year, including 36 in Shanghai's Pudong New area and 365 in Haikou, with receivables of 1.4605 trillion yuan.

On the night of the 2019 performance forecast, Haima disclosed the progress announcement on the sale of idle properties, which showed that Haima currently sold 344 properties with a collection of 162 million yuan, in view of the fact that the above idle property sales accounted for 94.25%. The company will no longer disclose the progress of idle property sales in the future.

Seahorse has estimated that after the proposed real estate sale, Haima Motor is expected to achieve a cumulative asset disposal amount of about 334 million yuan, affecting the company's net profit of about 170 million yuan. For now, the earnings are in line with expectations.

Transfer of subsidiary shares

On July 6, 2019, Haima transferred its 39% stake in Henan Haima property Service Co., Ltd. to Qingfeng Real Estate at a price of 116 million yuan. On September 26, 2019, Haima transferred its 100% stake in Shanghai Haima Research and Development Co., Ltd. to Ruizhishang Industry at a transfer price of 806 million yuan. Haima Motors made a profit of 430 million yuan in this transaction.

Government financial subsidy

On July 30, Haima Automobile invested in the establishment of Qingyan New Energy Technology Co., Ltd. (hereinafter referred to as Qingyan Technology), with a registered capital of 200 million yuan, and the legal representative is Lu Guogang, general manager of FAW seahorse. The business scope is for the development of new energy technology, technical services for new energy vehicles and accessories, etc.; in September 2019, Haima Automobile and Haima New Energy won special funding subsidies in 2019 in Zhengzhou. In December 2019, Haima Automobile appeared in the list of enterprises to support the promotion and application of new energy vehicles in Zhengzhou announced by the Zhengzhou Industrial and Information Bureau.

In addition, according to the third quarter of 2019 results released by Haima Motor, the first three quarters of 2019. The total government subsidy for Haima Motor included in the current profit and loss is 68 million yuan.

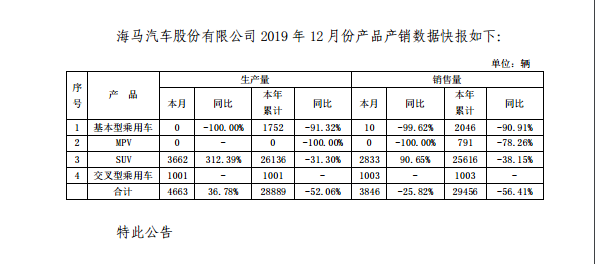

However, selling houses and divesting lossmaking assets are only stopgap measures. If Haima wants to boost its performance, it needs to start from the source and boost car sales. However, judging from the current data, it is difficult for Haima to boost sales significantly. In 2019, Haima sold 29500 vehicles, down 56.41% from a year earlier; December sales were 3846, down 25.82% from a year earlier. Among them, only 10 cars were sold and the output was 0, while the production and marketing of MPV was 0.

Although Haima is expected to turn a profit and preserve its shell in 2019, it actually does not rely on its automotive products, but to make a profit through the sale of real estate and the transfer of equity. However, for Haima, this is not a long-term solution. In 2020, the situation of the auto market is still grim, and the reshuffle of the auto industry is intensified. If Haima cannot make a real profit through cars in 2020, then it is likely to repeat the 2019 scenario in 2020. However, in today's declining Chinese auto market, it is still not optimistic to rely on cars to break through the siege.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.