In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)02/05 Report--

Tesla's share price set a new record again. Tesla's share price closed at US $887.06, up 13.73%, with a total market capitalization of 159.888 billion. At present, Tesla's total market capitalization has surpassed that of Germany's Volkswagen, second only to Japan's Toyota (with a total market capitalization of about US $227 billion), and ranks second among global automakers.

Tesla's rising share price is not unreasonable.

In 2019, Tesla's production and sales both exceeded 360000 vehicles, a record high. Tesla Shanghai Factory was officially put into production in the fourth quarter of 2019 and officially delivered to users on January 7. due to Tesla's price reduction of domestic models, coupled with subsidies for new energy vehicles and exemption from purchase tax, domestic Model 3 is sought after by many consumers.

On January 29th, Tesla announced its 2019 results, showing that Tesla achieved a total revenue of US $24.578 billion in 2019, an increase of 14.6% over the same period last year, and a net loss of US $862 million, compared with a loss of US $976 million in the same period last year.

Panasonic's battery joint venture with Tesla made its first quarterly profit on Feb. 3, and the loss of the battery plant operated by Panasonic and Tesla in Nevada has been made up. In addition, Tesla is also working with Ningde Times, which will provide Tesla with lithium-ion power batteries from July 1, 2020 to June 30, 2022.

Affected by the above multiple benefits, it seems not surprising that Tesla's market value continues to rise, but whether Tesla is worth this market value remains to be seen.

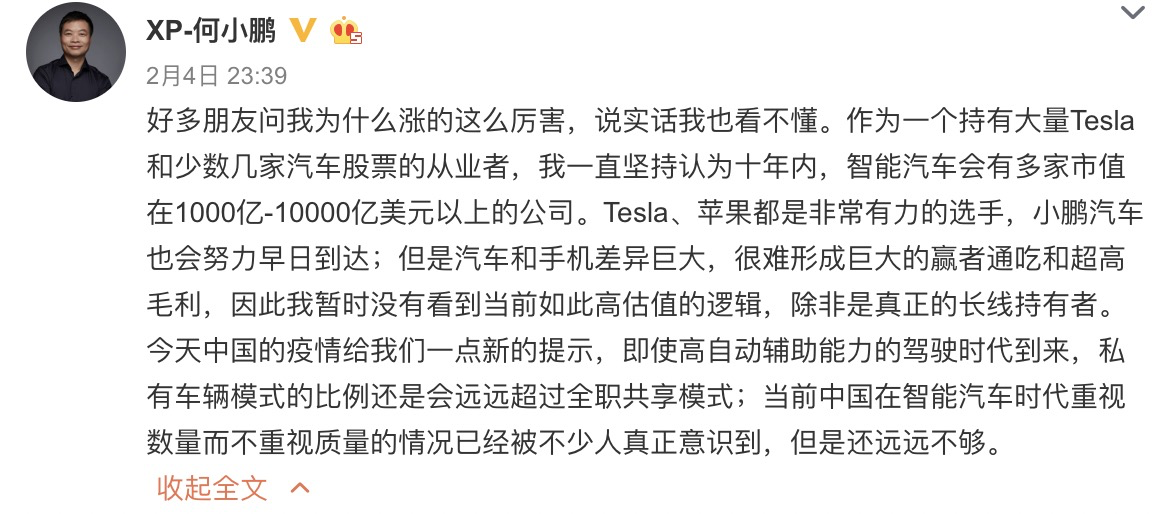

He Xiaopeng, CEO of Xiaopeng, also posted on Weibo that "I don't understand why it has risen so much". He Xiaopeng said that he holds a large number of shares in Tesla and believes that Tesla's market capitalization is expected to reach 1 trillion US dollars, but he does not see the logic of such a high valuation, unless he is a real long-term holder. "

Industry insiders believe that Tesla is indeed a great company, with a total market capitalization surpassing Volkswagen to become the second automaker, but the substantial increase in Tesla's share price does not accord with Tesla's profit. Although the market capitalization exceeds 150 billion US dollars, it does not mean that Tesla is worth so much money. Tesla's stock price will not go up all the time. Now it seems to be just a bubble effect.

From the perspective of stock price growth, Tesla has indeed made great changes. A number of models under Tesla, who are committed to the development of pure electric vehicles, have been put into production one after another and are expected to be made in China. At present, whether Tesla is worth the market value after the increase is not the main question, because at present Tesla is still in a state of loss, when new energy vehicles have not yet become the main driving force of consumption in the automobile market. Tesla's future situation is not clear.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.