In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)02/08 Report--

Sun Yuchen, founder of Bochang coin, has finally realized his wish to have dinner with Warren Buffett, the god of shares, according to media reports. The two sides discussed many topics at dinner, including some views on Tesla, an American electric car company.

Earlier, Sun Yuchen, founder of Bo Market currency, bought the opportunity to have lunch with Warren Buffett for $4.568 million, and later postponed the plan on the grounds of "sudden kidney stones." Half a year later, Sun Yuchen posted 15 tweets in a row on the evening of January 23, detailing the details of the dinner, including the mention of Tesla.

It is understood that Buffett did not agree with the Tesla company invested by Sun Yuchen. Although Buffett thinks that Tesla's CEO Musk is a great entrepreneur, he feels that Tesla is not a good investment company at present. Because the competition in the automobile industry is still fierce, all of Tesla's competitors have a lot of cash reserves, so they will not quit easily.

According to Sun Yuchen's Twitter message, the time for dinner with Buffett was on January 23, and Tesla's market capitalization also experienced a new surge in market value, reaching as high as $968.99 in the day, but then fell back. as of the close of trading on Feb. 7, the market capitalization remained at $134.8 billion, still surpassing the century-old Ford and GM, ranking second in the world after Toyota of Japan.

Perhaps in the view of Buffett, the god of stocks, short-term growth does not mean anything. after all, he has always held stocks for a long time, even for more than a decade, so in the short term, although Tesla's market capitalization has repeatedly reached record highs, it is still not favored by Buffett.

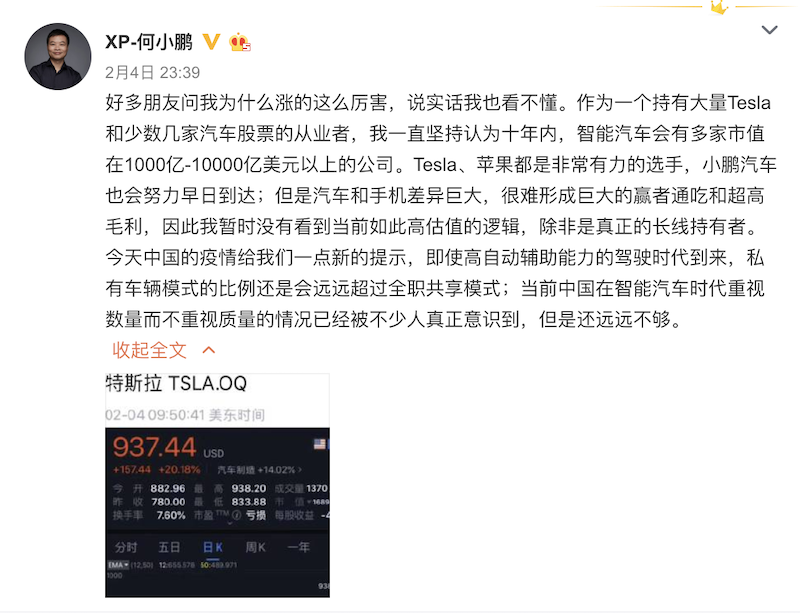

He Xiaopeng, CEO of Xiaopeng Automobile, one of the new power car companies in China, also has a similar point of view, according to which he said that he did not understand the current soaring situation of Tesla. He Xiaopeng believes that in the next 10 years, smart cars will have a number of companies with a market capitalization of more than 100 billion to 1 trillion US dollars, including Tesla, Apple and other enterprises are very powerful contestants, so he also owns some of Tesla's stocks. but he feels that at present, Tesla has not reached the logic of raising his valuation so quickly.

In fact, Tesla's soaring share price is inseparable from its recent good news, including building a factory to production and delivery in China in just one year, discussing cooperation in the era of battery leader Ningde, and the upcoming delivery of its latest model, Model Y. Its Model 3 became the highest-selling electric model in 2019, with cumulative sales of 300885 vehicles for the year.

Although Tesla's latest results for the fourth quarter of 2019 show an increase, the company's revenue in the fourth quarter was $7.38 billion, up 2% from the same period last year; net profit reached $105 million, down 25% from the same period last year; total revenue for the whole year was $24.578 billion, compared with $21.46 billion in the same period last year, an increase of 14.6% The net loss for the whole year was $862 million, compared with a loss of $976 million in the same period last year, narrowing the year-on-year loss, but the company is still in a state of loss, so there are still many institutions that are not optimistic about Tesla, including Buffett.

The current decline may also prove a little bit. When retail investors also begin to chase higher, maybe it is also the day for institutions to ship goods?

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.