In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-24 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)02/11 Report--

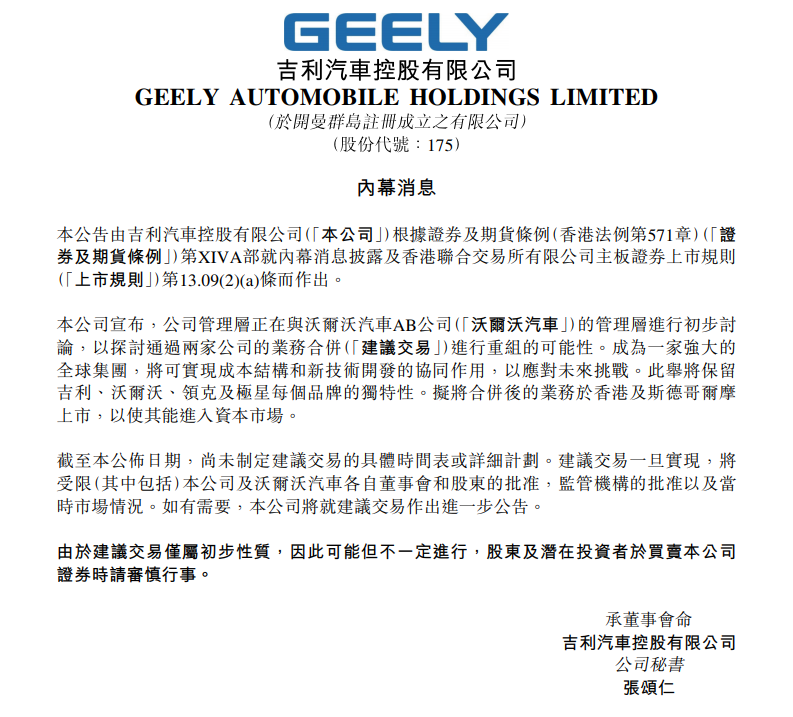

On the evening of Feb. 10, Geely issued an insider announcement that its management was in preliminary discussions with the management of Volvo AB (Volvo) to explore the possibility of restructuring through the merger of the two companies.

Geely said that when the two companies were restructured, they would become a strong global automotive group, achieving synergies between cost structuring and technology development to meet future challenges. After the reorganization, through the main body of Hong Kong Geely Motor listing to achieve docking with the global capital market, the next step will also consider listing in Stockholm, Sweden, but there is no relevant timetable or detailed plan.

Li Shufu, chairman of Geely holding Group, expressed the hope that through restructuring, cooperation and coordination will be further strengthened and greater growth potential will be tapped. Volvo also announced in the evening that the integration is aimed at deepening cooperation between the two sides and more effective coordination in technology research and development, cost control and finance.

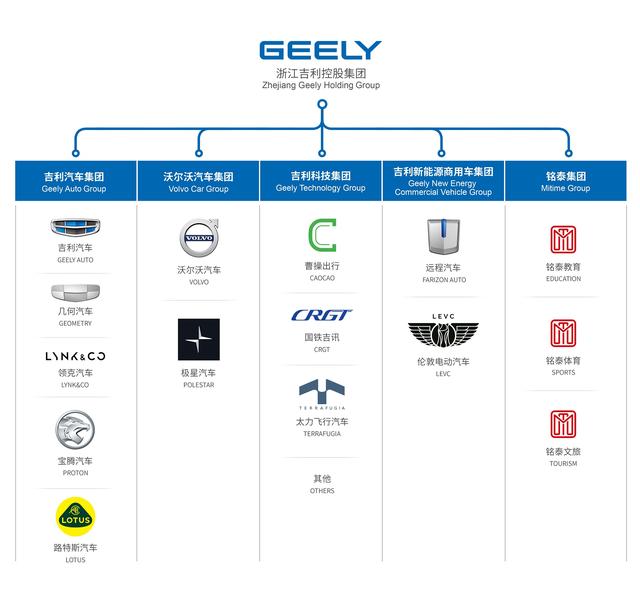

After the merger and reorganization of Geely and Volvo, the new group will maintain the uniqueness of Geely, Volvo, Lecker and Star brands. This means that if Geely and Volvo set up a new group in the future, Geely and Volvo will still develop independently in the areas of brand operation and marketing services.

As a Hong Kong-listed company, Geely had a total market capitalization of 133.8 billion yuan by the end of Feb. 11. Volvo is not yet on the market, and according to previous revelations, Volvo's conservative valuation is between $16 billion and $30 billion. As a result, the market capitalization of the new company after the reorganization is likely to surpass SAIC to become the Chinese automobile group with the highest market capitalization, and is also expected to become one of the top 10 global auto companies by market capitalization.

The relationship between Geely and Volvo:

According to public information, Geely signed an equity acquisition agreement with Ford on March 28, 2010, and Geely acquired a 100% stake in Volvo for $1.8 billion. Since Geely acquired Volvo, the two sides have continuously deepened their cooperation in R & D, production, procurement and other fields.

In March 2012, Geely signed a technology transfer agreement with Volvo, under which Volvo will transfer technology to Geely. At the same time, the two sides also announced that they will jointly develop low-engine, high-performance, green engines and environmentally friendly small car platforms, as well as new energy vehicle assembly system technologies such as electric vehicles and plug-in hybrid vehicles.

In February 2013, Geely Automotive European Research Center was established in Gothenburg to develop the CMA architecture, the next generation modular architecture for medium-sized cars. At present, Geely, Volvo and Lecker brands have launched related models.

In October 2019, Geely Holdings officially announced that it was discussing the possibility of merging its engine business with Volvo.

In the decade since Geely bought Volvo, the two companies have made considerable achievements in terms of sales and revenue, although the car market is becoming more and more competitive.

Volvo sold about 705500 cars worldwide in 2019, up 9.8 per cent from a year earlier, according to sales figures. This is the first time Volvo has sold more than 700000 cars in its 93-year history. Among them, the Chinese market is still Volvo's largest single market, with sales in China of 161000 vehicles in 2019, a record in China.

On the revenue side, Volvo had revenues of SEK 274.1 billion in 2019, up 8.5 per cent from the same period in 2018, while operating profit was SEK 14.3 billion, up 0.8 per cent from SEK 14.2 billion in 2018. Among them, Volvo achieved an operating income of 60.53 billion Swedish kronor in China in 2019, an increase of 10.8 per cent over the same period last year.

At the same time, against the backdrop of the grim Chinese market, Geely's sales fell 9.3 per cent to 1.362 million vehicles in 2019 compared with the same period last year, making it the top seller of China's own brands, and its market share is also growing.

Today, ten years later, Volvo has undergone earth-shaking changes in sales and performance. In a sense, Geely has made a great contribution to the wholly-owned Volvo.

In the face of the severe globalization of the automobile market, many automobile companies strengthen market competition through mergers, such as the merger of Renault-Nissan-Mitsubishi, PSA and FCA or Toyota holding Subaru. At present, neither Geely nor Volvo can deal with the competition of collectivized car companies unilaterally. Perhaps the merger and reorganization of Geely and Volvo is only the beginning of collectivization, and the opportunities and challenges brought by the establishment of the new group are still unknown.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.