In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)03/02 Report--

According to Tianyan survey data, industrial and commercial changes have taken place in Chongqing Xinfan Machinery and equipment Co., Ltd. (hereinafter referred to as Chongqing Xinfan). Its registered capital has been reduced from 1 billion yuan to 290 million yuan, a decrease of more than 700 million yuan, or 71 percent.

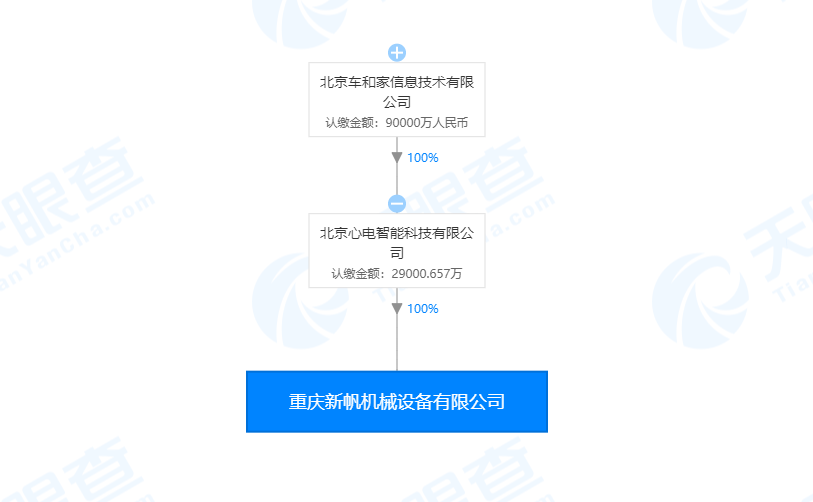

Chongqing Xinfan was established in September 2018, the legal representative is ideal Automobile Co-founder Shen Yanan, and the actual control party behind Chongqing Xinfan is Beijing Automobile Hejia Information Technology Co., Ltd. (referred to as che Hejia). Li Xiang is the ultimate beneficiary and suspected actual controller of the company.

Beijing che Hejia Information Technology Co., Ltd. was established in April 2015 with a registered capital of 915 million yuan. In December 2018, che Hejia spent 650 million yuan to acquire a 100% stake in Lifan Motor, which is also officially qualified for passenger car production. In January 2019, Chongqing Lifan Automobile Co., Ltd. changed its name to Chongqing ideal Intelligence Automobile Co., Ltd.

Chongqing Xinfan has reduced its registered capital by more than 700 million yuan, so that outsiders have to associate it with the IPO of the ideal car, which also shows that the move is to optimize the overall organizational structure.

At the end of last year, it was reported that ideal Automobile secretly applied for IPO in the United States, which was first listed in the first half of this year, raising at least $500m.

Ideal Motors started IPO as early as last summer and hired Goldman Sachs as the underwriting bank to lead the deal, according to people familiar with the matter. In December last year, ideal made a number of investors to withdraw, from the original 42 shareholders to 25 shareholders, including Tianjin Lanchi Xinhe Investment Center (limited partnership), Ningbo Meihua Mingshi investment partnership (limited partnership) and Hubei Meihua Shengshi equity investment partnership (limited partnership). At that time, ideal Automobile CEO Li wanted to admit that the purpose of the company's internal adjustment was to prepare for listing.

If IPO succeeds, ideal Automobile may become the second new car manufacturer to go public with IPO after NIO Automobile. However, even if the new power of car building comes to market, it will still take a long time to break even. Ideal car, as a member of the new power of car-building, is not well funded. As of August last year, after completing its $530 million C round of financing, ideal Motors had raised a cumulative amount of $1.575 billion, valuing it at about $2.93 billion.

In December, ideal officially delivered its first mass-production hybrid car, the ideal ONE, which achieved good results in January despite twists and turns in the delivery process. Ideal ONE ranks second in car-building new power sales, second only to ES6 of Xilai Automobile, with sales of 1180 vehicles, surpassing Xiaopeng G3 and Weima EX5 for the first time.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.