In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)03/13 Report--

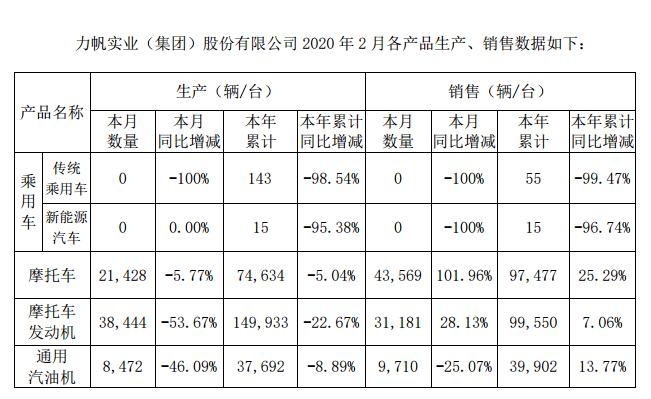

On the evening of March 12, Lifan released its February production and sales KuaiBao. KuaiBao showed that the production and sales of both traditional passenger cars and new energy vehicles were 0 in February this year, down 100% from January to February. The cumulative production and sales of traditional passenger cars from January to February were 143and 55 respectively, down 98.54% and 99.47% from the same period last year. The cumulative production and sales of new energy vehicles were 15, down 95.38% and 96.74% respectively from the same period last year.

It is worth mentioning that in the context of the overall decline in the automotive business, Lifan's old motorcycle business is particularly dazzling, with motorcycle sales of 43569 in February, up 101.96% from January to February, up 25.29% from January to February.

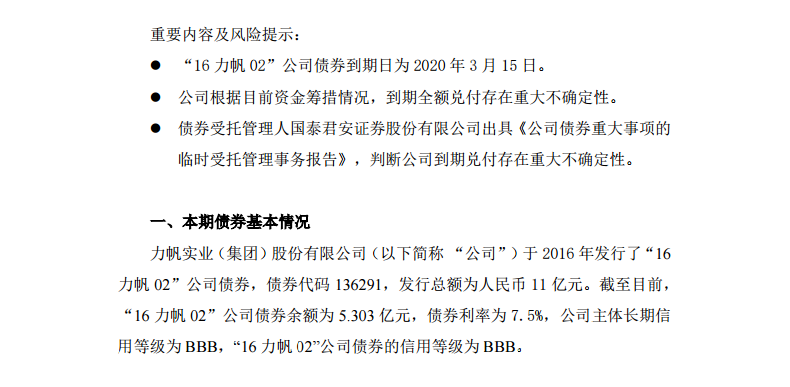

It is worth noting that on the night of the release of production and marketing KuaiBao, Lifan shares also issued a "second risk reminder notice on'16 Lifan 02 'corporate bonds, which shows that the maturity date of" 16 Lifan 02 "corporate bonds is March 15, 2020. according to the current fund-raising situation, there is significant uncertainty in full payment.

Lifan shares issued "16 Lifan 02" corporate bonds in 2016, with a total issue of 1.1 billion yuan, the announcement said. So far, the balance of "16 Lifan 02" corporate bonds is 530.3 million yuan, and the bond interest rate is 7.5%. The long-term credit rating of the main body of the company is BBB, and the credit rating of "16 Lifan 02" corporate bonds is BBB.

In fact, on March 5, Lifan shares issued an announcement on the risk of "16 Lifan 02" corporate bonds. The announcement shows that the company's main long-term credit rating is AA-, and the outlook is "stable", while the credit rating of "16 Lifan 02" corporate bonds is AA-. On March 7, Lifan shares announced again that the long-term credit rating of the main body of the company was adjusted from "AA-" to "BBB", while the credit rating of "16 Lifan 02" corporate bonds was adjusted from "AA-" to "BBB".

Lifan shares said that taking into account the company's 2019 performance losses, large debt scale, facing litigation and other factors, to judge that there is significant uncertainty in due payment.

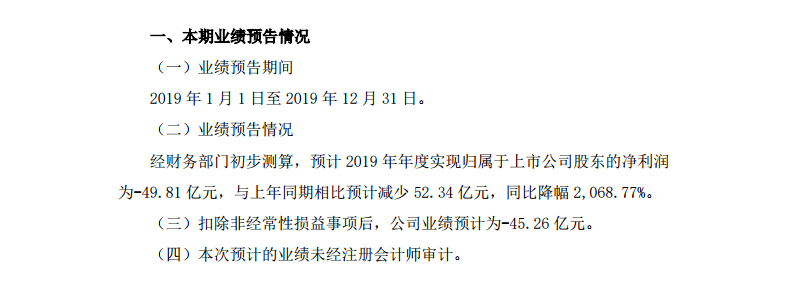

According to the 2019 performance pre-loss announcement previously disclosed by Lifan, the net profit attributable to shareholders of listed companies is expected to be-4.981 billion yuan in 2019, a decrease of 5.234 billion yuan or 2068.77% compared with the same period last year. Production and marketing KuaiBao shows that in 2019, the production and sales of Lifan cars were 18598 and 22536, down 78.62% and 75.52% respectively from the same period last year. The cumulative production and sales of new energy vehicles were 2888 and 3091, down 71.12% and 69.49% from the same period last year.

In the context of the current car market, coupled with the intrusion of the epidemic to the automobile industry, Lifan shares are facing great difficulties, which also leads to the risk of uncertainty in the maturity of its bonds. As for the uncertain factors leading to the maturity and conversion of its bonds, it is mainly due to the decline in the company's performance, the large scale of debt, the accuracy of funds and a number of lawsuits.

In order to ease the debt pressure, Lifan sold its passenger car production base and sold its fuel and new energy vehicle qualification subsidiaries to cars and families in 2018. In terms of automotive business, Lifan Motor has been hovering on the edge of the market. If you can't get back on track after the car market returns to normal, Lifan will probably not be far off the track.

Lifan shares have said that both cars and motorcycles are Lifan's main business and will not give up either side. However, after the car business was hit hard, Lifan said it would increase its R & D investment in the motorcycle industry, and the focus would be on the motorcycle industry in the future. Some netizens said that if they were to concentrate on the operation of the motorcycle industry, it would not be so "miserable" now.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.