In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)03/17 Report--

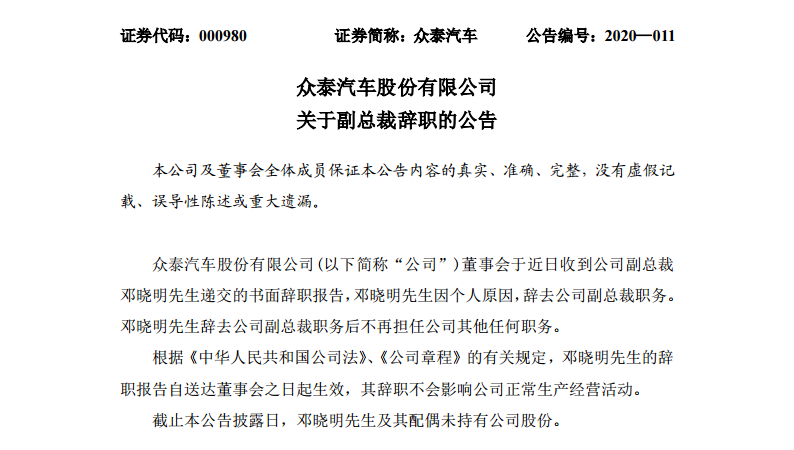

Zhongtai Motors announced on March 17 that the board of directors recently received a written resignation report submitted by Mr. Deng Xiaoming, vice president of the company. Mr. Deng Xiaoming resigned as vice president of the company for personal reasons. After resigning as vice president of the company, Mr. Deng Xiaoming will no longer hold any other positions in the company.

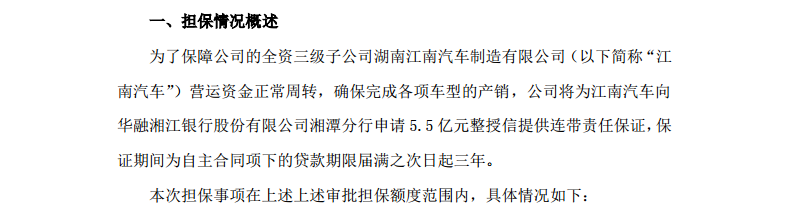

In addition, Zhongtai Automobile also announced on the same day that in order to ensure the normal turnover of working capital of Hunan Jiangnan Automobile Manufacturing Co., Ltd., a wholly-owned third-tier subsidiary of Zhongtai Automobile, and to ensure the completion of the production and marketing of various models, Zhongtai Automobile will provide joint and several liability guarantee for Jiangnan Automobile to apply for 550 million yuan of credit to Xiangtan Branch of Huarong Xiangjiang Bank Co., Ltd. The guarantee period shall be three years from the day following the expiration of the term of the loan under the independent contract.

Zhongtai Automobile said that the company's fourth interim shareholders' meeting in 2019, held on June 19, 2019, all examined and passed the "proposal on the expected amount of guarantee for the financing of wholly-owned subsidiaries in 2019." the board of directors agreed that the guarantee limit for wholly-owned subsidiaries to finance from banks and other financial institutions in 2019 should not exceed 4 billion yuan, including the amount of assets with liabilities exceeding 70 percent of the guaranteed subsidiaries. The term of use of the quota shall be within one year from the date of consideration and adoption of the bill at the fourth interim general meeting of the company in 2019.

Problems such as the departure of senior executives, falling sales and a shortage of funds have become bright spots for the carmaker. In early March, Zhongtai Motors replied to the letter of deep concern, the announcement showed that because Tieniu Group's 100% stake in Zhongtai Motors is restricted, therefore, there is still some difficulty in the realization of Tieniu Group's 2018 performance compensation commitment. However, if necessary, in addition to the compensation shares, Tieniu Group will be compensated in the form of cash such as land deposits and property proceeds.

Tieniu Group, the parent company of Zhongtai Motor, has the right to use a number of industrial land in Yongkang, Zhejiang Province. the local government has planned to collect and store the corresponding land and adjust the regional planning and the nature of the land. In the process of land collection and storage, Tieniu Group is expected to earn about 3.4 billion yuan, which can be used to unpledge 368 million shares. In addition, Zhejiang Zhuochengzhaoye Investment and Development Co., Ltd., a subsidiary of Tieniu Group, has the first-class qualification of real estate development and has successfully developed a number of buildings in Yongkang. At present, the two buildings invested by Zhejiang Zhuocheng Zhaoye Investment and Development Co., Ltd. are about to be completed and delivered, and the investment income obtained by Tieniu Group can also be used to repay stock pledge loans.

According to public data, Jinma shares controlled by Tieniu Group bought Zhongtai Automobile for 11.6 billion yuan in April 2017, injected its assets into the listed company, and completed the restructuring and listing after officially renaming it to "Zhongtai Automobile".

In August 2019, Zhongtai Automobile plans to buy back 468 million shares of Zhongtai Motor held by Tieniu Group for 1 yuan. As Yongkang State is unable to fulfill its promise at the time of merger and acquisition, Tieniu Group needs to pay compensation in accordance with the agreement. However, in November 2019, TieNiu Group's 100% stake in Zhongtai Motor was frozen by the judiciary, the pledge ratio was more than 80%, and Zhongtai Motor's repurchase of 468 million shares was restricted, so the performance promise compensation could not be completed for a long time.

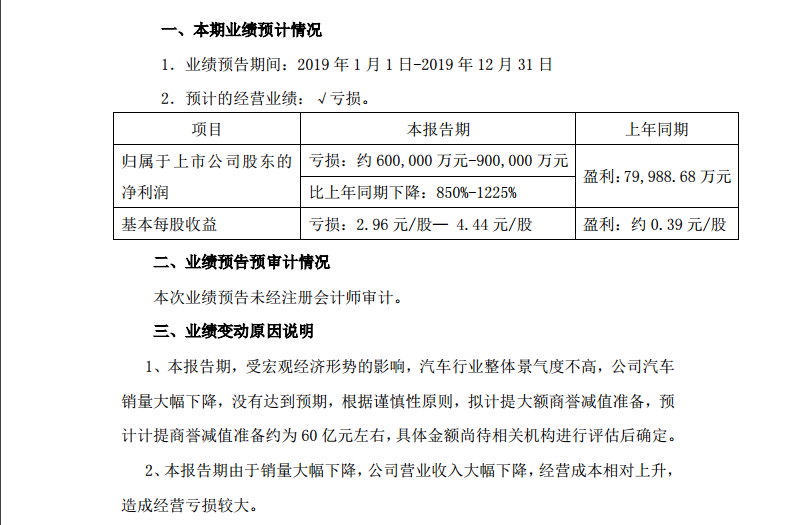

Zhongtai Motors, which was founded in 1998, is still unable to form its own hematopoietic ability. due to the outdated core technology of Zhongtai Automobile and the design can not keep up with the development of the times and other reasons, the operating situation of Zhongtai Automobile continues to be in a tense state. According to Zhongtai Automobile's 2019 performance forecast, it is expected to lose 6 billion-9 billion yuan in 2019, down 85% from a year-on-year profit of nearly 800 million yuan.

Since Zhongtai Motors was exposed to bankruptcy liquidation at the end of last October, Zhongtai Motors' drawbacks have gradually emerged in the market and have been sued by a number of upstream suppliers, and its Junma Motor has also repeatedly exposed the news of bankruptcy. Zhongtai Motors has faded out of sight since the outbreak in January, and sales in January and February have not yet been disclosed because Zhongtai Motors has no national six models for sale.

The operating condition of Zhongtai Automobile is not very optimistic, not to mention whether it can form the ability of self-hematopoiesis, and whether it can survive has become a difficult problem for this car company.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.