In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-18 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)03/23 Report--

According to just released the fourth quarter of 2019 and full-year results show that still in the loss of the car, recently by the court as the subject of enforcement, which in many people's opinion whether the car encountered difficulties again.

Shanghai Lulai Automobile Co., Ltd., the main body of operation of Lulai Motor, has been listed as the subject of execution by the Shanghai Jiading District people's Court, with a target of 1.1 million yuan, according to the China Executive Information publicity Network. To say that this 1.1 million yuan is obviously "negligible" compared with the loss made by Xilai Motor over the past year, is it possible that the recent loss made by Xilai Motors can not even be repaid?

In response to this, Xilai Motor responded today: this is a normal business dispute between NIO and real estate agents. The two sides failed to reach an agreement on the results of their work and the standard of fees, and took the judicial approach. The court made a judgment on this, and NIO fully respected the court's decision and cooperated with the enforcement in accordance with the law.

Shanghai Lai Automobile Co., Ltd. was established in May 2015, with a registered capital of US $2.5 billion, the legal representative is Qin Lihong, co-founder of Lai Automobile, and the type of company is a limited liability company (wholly owned by a legal person from Taiwan, Hong Kong and Macao).

The company's business scope includes investment in areas where foreign investment is allowed by the state; technology development, technology transfer and technology consultation of new energy vehicles and related parts and components, wholesale and commission agents of auto parts, etc., which is wholly owned by NIO NEXTEV LIMITED.

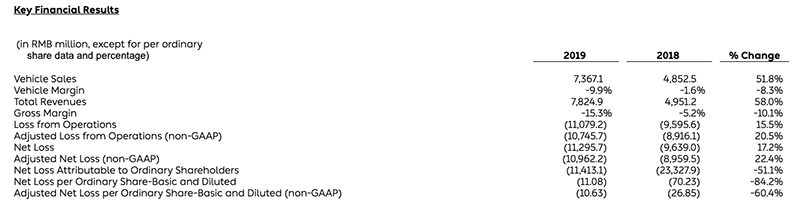

In the past year, Xilai has been under great pressure and has even been touted as one of the car companies that are about to collapse in the environment of public opinion. According to the results of the fourth quarter and full year of 2019 released by Xilai Automobile, the operating income in the fourth quarter was 2.85 billion yuan, compared with 3.436 billion yuan in the same period last year, down 17.1% from the same period last year; the net profit and loss in the fourth quarter was 2.865 billion yuan, down 18.2% from the same period last year; obviously, under the trend of gradual increase in sales volume in the fourth quarter, revenue is still lower than in the past. However, judging from the full-year operation of Xilai Automobile, its revenue reached 7.825 billion yuan, an increase of 58.0% over the same period last year.

It was thought that such a figure would be very beautiful for Xilai, but the net profit and loss for 2019 reached 11.3 billion yuan, an increase of 17.2% compared with the net loss of 9.6 billion for the whole of 2018, which undoubtedly left the market unable to find the value of Xilai. As a result, the share price fell as much as 20% at one point in the financial report.

According to the sales data of Xilai Automobile in 2019, a total of 20565 vehicles were delivered in the whole year, an increase of 81.2% over the same period last year. It can be seen that the sales volume is very good, and it has even become the only new power brand in China with an annual delivery volume of more than 20, 000 units. However, due to the decline in gross profit margin, the current Xilai is basically in the situation of "losing one car at a time".

According to the data, the gross profit margin of Lulai Motor for the whole year of 2019 was-15.3%, down more than 10.1% from 5.2% in 2018. Qu Yu, vice president of finance at Lailai, explained that due to the price difference between ES6 and ES8 in the fourth quarter, the overall average price of bicycles has a downward trend. In addition to the manufacturing costs of raw materials and amortization, the quality insurance service provided by Xilai to car owners in the past year has also greatly increased the consumption of labor costs and further lowered the gross profit margin of vehicle sales.

Gross profit margin is linked to profits, and only by achieving sufficient profits can we maintain the normal operation of the enterprise. How to increase the gross profit margin has also become one of the core goals in 2020. According to Li Bin, in 2020, Ulai will improve the optimization of the supply chain, continuously reduce the cost of battery packages, and reduce the manufacturing costs of cars brought about by the increase in production scale and management optimization. therefore, Ulai is confident that the gross profit margin will become positive in the second quarter and achieve the goal of double-digit gross profit margin at the end of the year.

Although NIO Autobots is in a situation of increasing losses in 2019, it has ushered in a number of financing since 2020, and three financing progress has been announced in three months. On March 5th, February 14th and February 6th, it announced the completion of convertible bond financing of US $235 million, US $100m and US $100m respectively. In addition, it was announced in February that the Hefei municipal government would invest 10 billion yuan in NIO to establish the NIO China headquarters project.

Even if it succeeds in raising $400 million, the coming of huge losses will not help it get rid of its liquidity problems, but it can still save its life in the short term. So why can NIO, who knows he is still at a huge loss, get financing? It is understood that compared with most listed companies, Ulai convertible bonds can achieve private placement of convertible bonds within one year, which is shorter than that of most listed companies for more than five years, which means that creditors have the right to choose to repay their debts or convert them into company shares after a year.

Due to the fact that before the outbreak of COVID-19 and before the breakout of US stocks, the share price of Xilai was about 5 yuan, and the convertible bond-to-equity price of Lulai was 3.07 US dollars and 3.50 US dollars respectively, which was obviously lower, but because of the current repeated circuit breakers of US stocks, the stock price of Xilai fell to about 2.40 US dollars, which is much lower than the conversion price. If the company's share price can not rise within a year, it is likely to cause rigid payment on the maturity date of convertible bonds, which will face great pressure to repay the debt.

As for the establishment of the China headquarters of Lulai Automobile in Hefei, in fact, the project plans to raise more than 10 billion yuan, which means that the government invests jointly through the local designated investment platform, combined with local financial institutions and private capital. According to a previous announcement issued by Jianghuai Automobile, the 14th Board of Directors of the Seventh session was convened to examine and approve the "motion on applying for mortgage loans to the Anhui Branch of the Export-Import Bank of China with its own assets."

Provide the maximum mortgage guarantee for real estate and land with an estimated value of not less than 2.7 billion yuan in the name of the company. Apply to the Anhui Branch of the Export-Import Bank of China for credit business up to 1.6 billion yuan in local and foreign currencies. Some analysts believe that this is because Jianghuai Automobile and Xilai Automobile are used as advance payments in the early stages of the establishment of "Wei to China".

In any case, in the face of the current lossmaking Xilai, there are still many goals that need to be achieved, including an increase in sales in 2020, a rise in gross profit margin and a stabilization of the share price. According to Li Bin, the cash balance is insufficient to provide the working capital and liquidity needed for continued operations for the next 12 months, which means that during this time, Ulai will overcome various difficulties and continue to raise funds.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.