In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)04/29 Report--

In the face of the market environment shrouded by COVID-19 's epidemic in 2020, most car companies will face signs of declining sales and profits, especially for BYDA, which has been in a continuous decline in the new energy vehicle market for 11 months. However, a few days ago, as BYDA reported an 85% drop in profits in the first quarter, it was still "bullish" by a number of institutions.

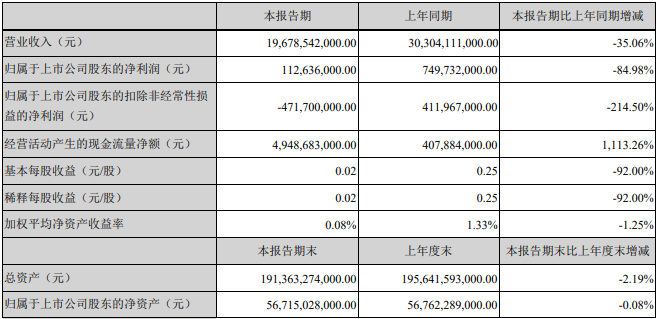

According to the "first quarter 2020 report" released by BYD, in the first quarter, BYD's revenue was 19.68 billion yuan, down 35.06% from the same period last year; the net profit was 110 million yuan, down 84.98% from the same period last year, while the net profit after deducting non-recurring profit and loss was-471.7 million, that is, a loss of more than 400 million yuan. In this regard, BYDA said that it was mainly due to the COVID-19 epidemic and macroeconomic decline, leading to changes in operating income. In addition, non-operating expenses in the first quarter increased by 271.42% year-on-year to 39.72 million yuan, which BYD said was caused by an increase in donation expenditure or another reason for the decline in net profit.

This is also true in terms of cumulative sales in the first quarter. Data show that BYD's cumulative sales in March this year were 30599, down 34.7% from the same period last year, of which 12256 were new energy vehicles, down 59.2% from the same period last year. The cumulative sales from January to March were 61273, down 47.9% from the same period last year, including 22192 new energy vehicles, down 69.7% from the same period last year. So neither fuel models nor new energy models have helped BYD make a profit.

However, according to BYD's financial report, the net profit attributed to shareholders of listed companies in the first quarter was profitable, because BYD received 533 million yuan in car-related government subsidies in the first quarter, which means that without relevant government subsidies, BYD is still in a state of loss.

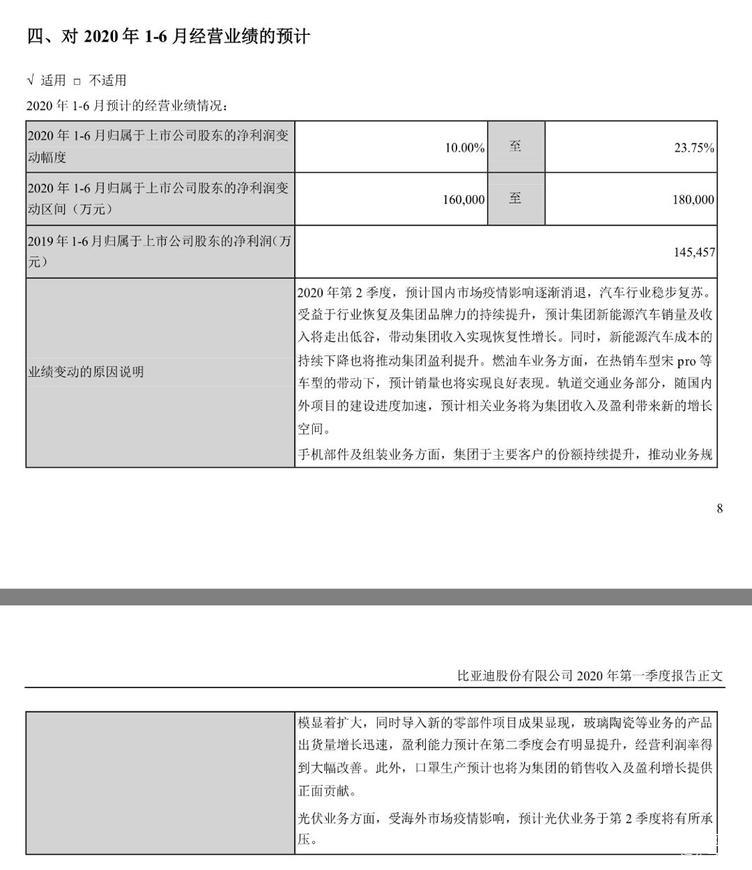

But there is clearly no sign that many institutions are "optimistic" about the continued decline in the BYD auto sector. after all, no institution is willing to invest in a company that cannot be profitable only by subsidies, because this is an investment that cannot achieve long-term benefits. However, while BYD released its first-quarter results, it also pointed out that BYD expects its net profit to reach 16 to 1.8 billion yuan in the first half of this year, up 10% from a year earlier.

This is not only due to the expected recovery in the auto market in the second quarter, but also because BYD has made mask production a major aspect of the group's sales and profit growth. Although BYD's sales in the automotive sector are facing an impact, since the outbreak of COVID-19, BYD has unexpectedly become one of the "largest mask manufacturers in the world".

BYD Electronics reported a profit of 657 million yuan in the first quarter, up 69.44 percent from a year earlier, according to the results released on the evening of April 28. The first-half profit is expected to increase 2.8 times compared with the same period last year (575 million yuan in the same period last year). It means that BYD's electronic profit in the second quarter will not be less than 1.528 billion, or even close to 1.6 billion yuan of BYD's annual profit last year.

In addition, according to ABC and the Los Angeles Times, BYD has received nearly $1 billion orders for masks in California, equivalent to about 7 billion yuan.

In this regard, many investors believe that "the mask business plays an important role", and some investors even said that BYD can survive without subsidies. Of course, for the recent BYD, the mask business has become one of its main income, and the COVID-19 epidemic has not been effectively controlled, the mask business has been able to help BYD achieve a certain source of income.

To this end, including Citigroup, Morgan Stanley and Jeffery and other institutions have been optimistic about BYD semi-annual report investment. But for BYD, it is the automotive sector that needs more attention. After all, BYD is at a very disadvantage in the declining new energy market. Once the mask cannot become one of BYD's main businesses, it will face a big profit challenge.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.