In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)05/02 Report--

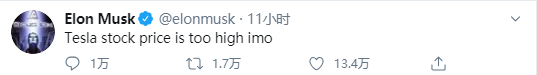

In the past six months, Tesla's stock price has increased frantically, and Tesla's market capitalization has even surpassed that of GM, Ford, Volkswagen and other traditional car companies, becoming the world's second-largest car company after Toyota. However, on May 1, US Eastern time, Tesla CEO Musk tweeted that "Tesla's share price is too high", a remark that caused Tesla's share price to close down 10.3%, the biggest drop since March 18, and the market value lost $14.8 billion (104.5 billion yuan) that day.

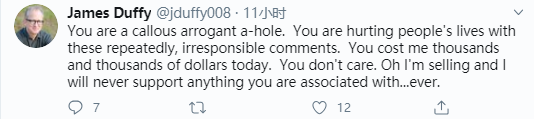

Some netizens commented that "Musk is an arrogant bastard", while another netizen said, "Musk actually shorted Tesla's stock price and thought his stock price was too high. Is this still an entrepreneur?" So hack your own business. "

Musk's tweets not only led to a sharp fall in Tesla's share price, but could also lead him to violate an agreement he reached with the Securities and Exchange Commission that any tweets made by Musk that might affect Tesla's share price will be reviewed prior to release. It is not clear whether Musk's release of "Tesla's share price is too high" has been reviewed by internal lawyers.

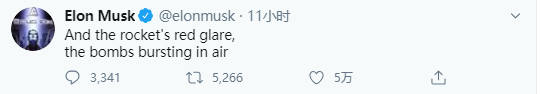

In addition, Musk also announced that he would sell all his properties, fall out with his girlfriend and extract the lyrics of the US national anthem, making investors wonder if his account had been stolen. Tesla and Musk have not responded so far.

It is worth mentioning that Musk has "paid" for posting unreasonable tweets more than once. In August 2018, Musk tweeted that "he is considering privatizing Tesla at a price of $420 per share." In fact, Musk did not receive funds for privatisation and was accused of violating US securities law after his remarks were attacked by outsiders. Mr Musk then withdrew his talk of privatisation, but was investigated by the Securities and Exchange Commission.

In September 2018, the Securities and Exchange Commission filed a lawsuit against Musk, accusing him of making "false and misleading statements" on Twitter about the privatization of Tesla. In the end, Musk reached a settlement with the SEC. Musk and Tesla were each fined $20 million. Musk was forced to resign as chairman of Tesla (barely keeping his position as CEO), and agreed that future public statements on Tesla's financial and other topics would be submitted to his legal adviser for review.

However, the lawsuit between Musk and investors is not over. It is understood that the US court ruled in mid-April that Tesla must accept shareholder litigation because of Musk's privatization remarks, because investors thought Musk intended to deceive them.

Mr Musk did not learn his lesson. In February 2019, Musk tweeted that "Tesla expects to produce 500000 electric cars in 2019," while in a 2018 earnings conference call, Tesla officially estimated that 36-400000 electric cars would be delivered in 2019.

The SEC accused Mr Musk of misleading investors about production and that the posts were not internally vetted, violated the SEC agreement and once again filed a lawsuit in court. However, Tesla's share price plummeted as a result of Mr Musk's insistence that the information he released was public during the earnings call. Subsequently, Musk posted that "production capacity will increase in 2019, and if this capacity is maintained for a whole year, it will reach 500000 vehicles."

Musk's remarks in 2020 did not stop there, and Musk's remarks became more active in the context of the COVID-19 epidemic in the United States. On March 17, Musk posted that "panic about novel coronavirus is stupid". While promoting chloroquine as an effective treatment, Musk posted that "the danger of panic still far outweighs that of novel coronavirus." Musk even predicted that "by the end of April, there will be almost no new confirmed cases of novel coronavirus in the United States."

There is nothing wrong with holding your own views on certain things, but as an entrepreneur and as Tesla's CEO, inappropriate remarks may cause investors to suffer huge losses. after all, Tesla's investors also invest in Musk's ability. At present, Tesla's share price has gone through a wave of decline, and it is unknown whether it will continue to fall. In addition, once Musk's remarks are not reviewed by legal advisers, Musk may face a new round of litigation by the Securities and Exchange Commission.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.