In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)05/16 Report--

Since the establishment of Ulai, sales have gradually increased, reaching a record high in 2019. However, according to the data that Xilai submitted its annual report to the US SEC a few days ago, the company's revenue loss expanded again, which means that the pace of loss has not been stopped.

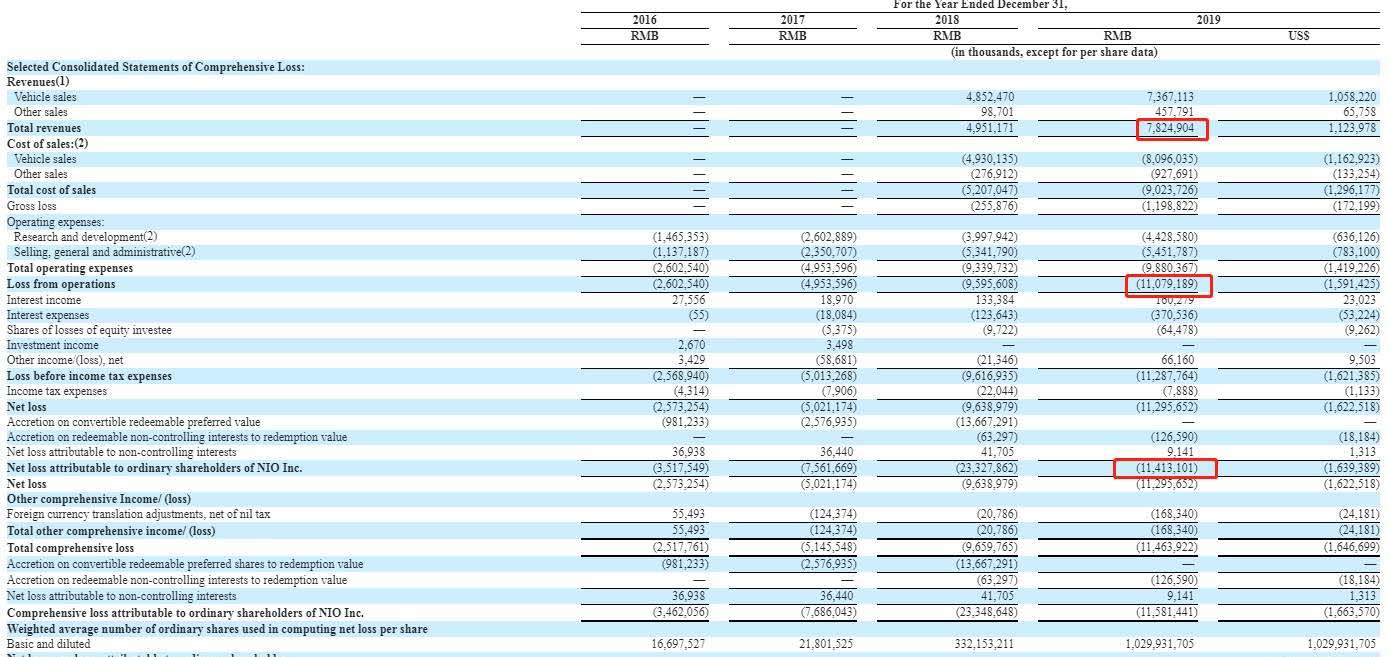

According to the financial report, the net loss of the company in fiscal year 2019 was 11.296 billion yuan, an increase of 17.2% over the same period last year; the net loss of ownership was 11.413 billion yuan, down 51.1% from the same period last year; and the net profit of common shareholders belonging to the parent company was-11.287 billion yuan, an increase of 51.62% over the same period last year. According to the revenue data of the previous two years, the net loss was 5.0122 billion yuan in 2017 and 9.639 billion yuan in 2018.

At the same time, the annual report also shows that as of December 31, 2019, NIO had paid 604 million yuan to Jianghuai Motor (including 333 million yuan in compensation for losses and 271 million yuan in manufacturing and processing fees paid in 2018 and 2019).

Of the 333 million yuan in compensation for losses, 120 million yuan in 2018 and 210 million yuan in 2019. This is also due to the view that the more it sells, the more it loses money. According to data, it delivered 11348 vehicles in 2018 and sold 20565 in 2019, showing a significant increase in sales.

In response, NIO also responded that NIO's compensation for Jianghuai was not due to an increase in factory operating losses due to the increase in the number of cars built, but from the start of the loss-making agreement between the two sides, which actually covered losses for less than one year. Since April 2018, the two sides have signed a production ES8 agreement that if any operation loss occurs in the Hefei manufacturing plant, Xilai will bear the operation loss of Jianghuai Automobile Company. So from the date of signing, it is less than a year by the end of 2018, and it is normal to lose more than 2019, which is calculated on the basis of a full year.

In addition, NIO also signed ES6 and EC6 manufacturing cooperation agreements with Jianghuai in April 2019 and March 2020 respectively, the situation is the same as the previous ES8, Hefei manufacturing plant has to bear any operating losses.

It is undeniable that while NIO's losses have expanded, the gross profit margin and the gross profit margin of car sales in 2019 are also falling further, falling by 15.3% and 9.9% respectively. In this regard, NIO also said that the main reason for the deterioration of the gross profit margin index is the increase in production costs.

Although there are statistics that the loss of each unit sold is 800000 yuan per unit sold in 2018, it has shrunk to a loss of 500000 yuan per unit sold, but for the current situation, it should speed up the solution found, otherwise it will be in a state of loss all the time, or it will be very difficult to encounter more challenges if it is still "losing more and more money".

According to the sales performance of new forces in the first quarter of this year, it is slightly better than traditional car companies, and the market share of domestic new energy vehicles has also risen from about 5% in 2019 to 14.6%, with a marked increase in market share, which has been achieved against the current during the epidemic. Among them, the accumulated insurance volume of Xilai reached 3819 in the first quarter, which is still the car company with the highest sales of new forces in China, far exceeding ideal, Xiaopeng and Weimar, but better sales are also an arduous task for the current NIO.

To this end, at the results call meeting in the fourth quarter of this year, Li Bin also said that he was confident of achieving the 2020 sales target, and that the gross profit margin of Xilai in the second quarter would become a regular one and a double-digit gross profit margin would be achieved by the end of the year. In addition, Li Bin also revealed that in 2020, Ulai will improve the optimization of the supply chain, continuously reduce the cost of battery packages, and reduce the average manufacturing costs of vehicles brought about by the increase in production scale and management optimization, so as to achieve a reduction in gross profit margin.

Although after all kinds of public opinion pressure over the past year, the car company that cannot make a profit is still very difficult to get the favor of capital, so while improving the competitiveness of its products, it should also realize that the company has the ability to make a profit, otherwise it will be empty talk for consumers.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.