In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)05/28 Report--

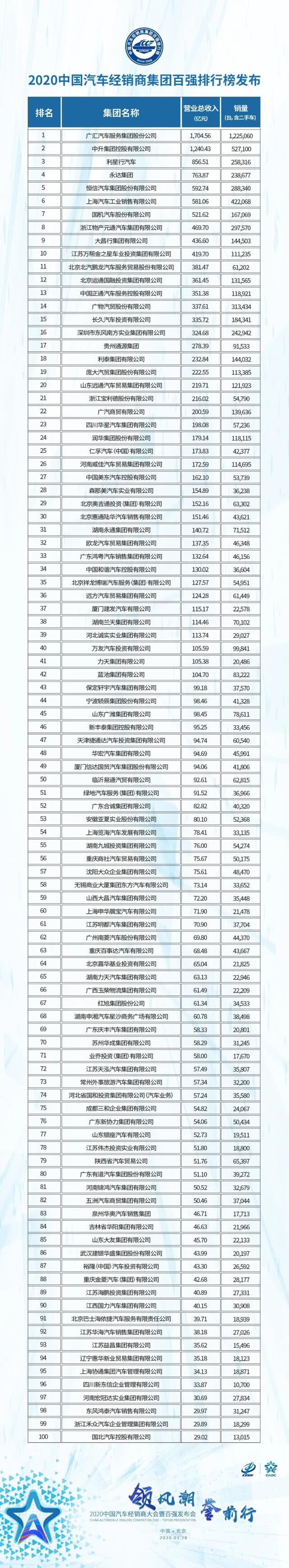

With the launch of the annual China Automobile Dealers Conference and Top 100 Conference, it means that the results of the "most profitable" car dealer groups in 2020 will be announced. According to the newly released ranking list, the most profitable group is still Guanghui Automobile.

Specifically, compared with the 2019 ranking, there is no significant change in the top three of the 2020 ranking, which is still won by Guanghui Motor, Zhongsheng Group and Lixing Group. Although there have been some changes in the rankings of the top 10 dealer groups, only one dealer group has missed the top 10, the huge group that ranked ninth last year.

For the revenue of the dealer group announced this time, it is the revenue situation of 2019, and the top ten dealer groups all showed significant revenue growth compared with the previous year. Among them, as the largest automobile dealer group in China, its operating income reached 170.456 billion yuan in 2019, an increase of 4.283 billion yuan. Although it only achieved single-digit year-on-year growth, it was far away from the second place of nearly 50 billion yuan. This also shows that in the domestic car market for two consecutive years of decline in the market, Guanghui Group is still the strongest performance of car companies. However, the net profit belonging to shareholders of listed companies fell 20.16% to 2.6 billion yuan compared with the same period last year.

Zhongsheng Group and Lexing Group also showed an obvious growth trend in 2019, but Zhongsheng Group achieved revenue of 124.043 billion yuan in 2019, an increase of 16.307 billion yuan over the previous year, and became one of the few dealer groups to achieve soaring growth. this also keeps it at more than 100 billion in revenue. On the other hand, due to the various rights protection and quality of Beijing Mercedes-Benz in recent years, Lixing Motor has also been affected to a certain extent, achieving only a small increase of 2.655 billion yuan. However, it still benefits from its mostly luxury brands, which helps it maintain a relatively stable performance.

As for Shanghai Yongda, which ranked fourth last year, Dachang Bank, which ranked sixth, and the giant group, which ranked ninth, showed signs of decline to varying degrees. Among them, Shanghai Yongda's operating income fell from 65.918 billion yuan to 46.97 billion yuan in 2019, dropping its ranking by two places. Dachang, which ranked sixth last year, dropped to ninth place from 44.579 billion yuan in revenue in 2019 to 43.66 billion yuan. It is also because the two groups have failed to have stronger brands, including Shanghai Yongda, which has a number of second-tier luxury brands, while Dachang Bank is mostly a joint venture brand.

It is worth noting that the giant group changed the most in the ranking, from ninth in 2019 to 19th in 2020, and its total revenue decreased to 22.255 billion yuan from 42.034 billion yuan in 2019.

But on the contrary, Yongda Group, with the advantage of its main luxury brands, leapt to the fourth place in the top 10 in 2019, achieving operating income of 76.387 billion yuan in 2019, and net profit of 1.569 billion yuan, an increase of 18.4 percent over the same period last year, making it the most outstanding group.

On the whole, although passenger car sales in China continued to decline, the total revenue output value of the top 100 dealers in 2019 was 1.73 trillion yuan, an increase of 6.3% over the same period last year.

Specifically, Japanese brands have the highest gross profit margin and sales profit margin for new cars, while European brands rank second, showing a higher level of zero service absorption (the ratio of profits generated by after-sales service to dealer operating costs) and sales profit margins; compared with independent brands, the new car gross profit margin is only higher.

In fact, the declining market for two consecutive years has turned China's automobile market from incremental competition to stock competition, and the automobile circulation industry will face more and more pressure, as well as losses in the industry.

In this regard, Shen Jinjun, president of the China Automobile Circulation Association, also said that for brands and dealers with weak service ability in the future market, they are bound to withdraw from this market. After all, there are so many automobile brands and secret sales and service outlets in China that they are unique in the world. However, throughout the development of China's automobile industry, there is still a lot of room for sustainable development.

Affected by the epidemic, domestic automobile production and sales in April 2020 were 2.102 million and 2.07 million respectively, up 2.3% and 4.4% respectively from the same period last year, ending 21 consecutive months of year-on-year decline. In the first four months, domestic car production and sales were 5.596 million and 5.761 million respectively, down 33.4% and 31.1% respectively. Although the market has picked up slightly, it is still not optimistic about the overall performance this year.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.