In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)06/03 Report--

Although Geely had previously been affected by the market, Geely had made a plan to place 7.85% of its shares and raised HK $6.447 billion to ensure sufficient cash, but the rhythm of its "buy buy" has not stopped. A few days ago, there is news that Geely will acquire commercial vehicle listed company Lingxing Ma shares. In this regard, Geely Automobile also responded that it is still in the process of understanding.

For the above specific situation, According to Geely Group relevant personage response said, Geely really and Valin Xingma contact, But because the other party is listed company also has corresponding letter approval system, So specific news can only wait for the announcement release. If the acquisition plan is realized, it means that Geely Automobile will deepen in the commercial vehicle market.

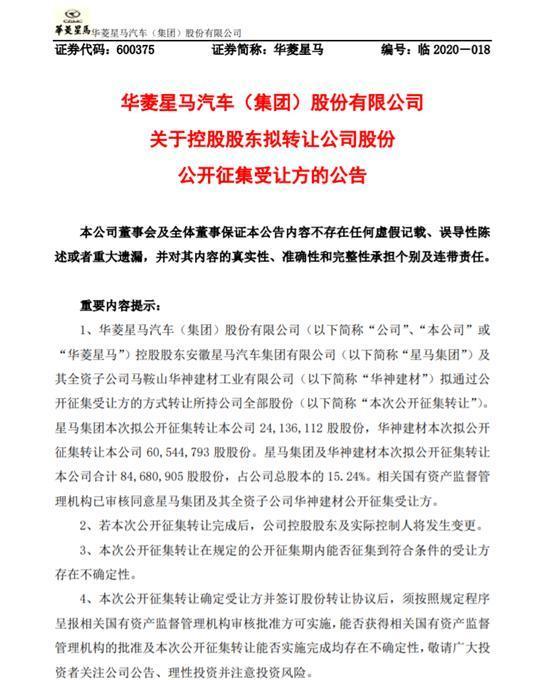

In fact, as early as the end of May this year, there were rumors in the industry that Geely would buy Valin Xingma. On May 23, Valin Xingma issued an announcement saying that Xingma Group, the controlling shareholder of the company, and its wholly-owned subsidiary Huashen Building Materials, planned to transfer 85.68 million shares of the company by means of public solicitation of transferees, accounting for 15.24% of the total share capital of the company. If the transfer price is not lower than RMB 5.14 yuan/share, the acquirer needs to pay at least RMB 435 million yuan.

A few days later, Valin Xingma issued a risk announcement again, because its stock price has risen by about 90% in the past month, and the latest static P/E ratio is 110, far exceeding the industry average. However, in recent years, the performance and profit performance of Valin Xingma is only general. According to the financial report, from 2016 to 2019, the net profit attributable to shareholders of listed companies hovers around RMB 50 million yuan. In the first quarter of this year, the net profit attributable to shareholders of listed companies was about 110 million yuan from profit to loss, and the operating income was 1.07 billion yuan, down 44.1% year-on-year; the profit fell sharply by 1941.73% year-on-year from 5.96 million yuan.

However, Valin Xingma is still very strict with the conditions for acceptance, including total assets of no less than 200 billion yuan in 2019, net assets of no less than 50 billion yuan, production qualification for passenger cars and commercial vehicles, and profits for three consecutive years, with annual total profits of no less than 5 billion yuan, etc., while Geely Automobile basically meets the conditions, so that many industry rumors say Geely will be the final delist.

Perhaps from Geely's various "buy", we can see its ambition to become a real "big car enterprise", after all, like some major multinational car enterprises have their own commercial models, including Toyota's Hino, Renault Nissan has its own commercial vehicle model of the same name, and Daimler has Mercedes-Benz commercial vehicles. Geely Commercial Vehicle Group currently only owns two major electric commercial brands, such as London Electric Vehicle Company (LEVC) and Long-range New Energy Commercial Vehicle, which do not involve fuel commercial vehicle models.

If you take over Valin Star Horse, it means Geely will complete the matrix layout of traditional fuel vehicles and new energy vehicles in the commercial vehicle field. However, in the view of Cui Dongshu, secretary-general of the association, Valin Xingma is relatively small in size and basically belongs to a third-tier automobile enterprise. Even if Geely really completes the acquisition, it may not have too much impact on the current commercial vehicle market.

According to public information, Valin Xingma was formerly known as Maanshan City Building Materials Factory founded in 1970. It was listed on the Shanghai Stock Exchange in April 2003. In 2004, Mitsubishi Technology of Japan was introduced into the truck field. The leading products are chassis and whole vehicle, powertrain, axle, heavy special vehicle, new energy commercial vehicle, bus, other automobile parts and assemblies, etc. Over the years, Valin Xingma has also been one of the top ten enterprises in the field of heavy trucks in China.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.