In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)06/20 Report--

In 2020, the Chinese car company Geely Group continued its mergers and acquisitions. After hosting the Changfeng Cheetah car factory and confirming its ownership of the commercial vehicle Valin Star Horse, Geely said that Geely was interested in acquiring a Chinese car company and a foreign car company. They are Lifan shares and South Korea Ssangyong Motor. Geely has denied the matter.

Rumors of Geely and Lifan

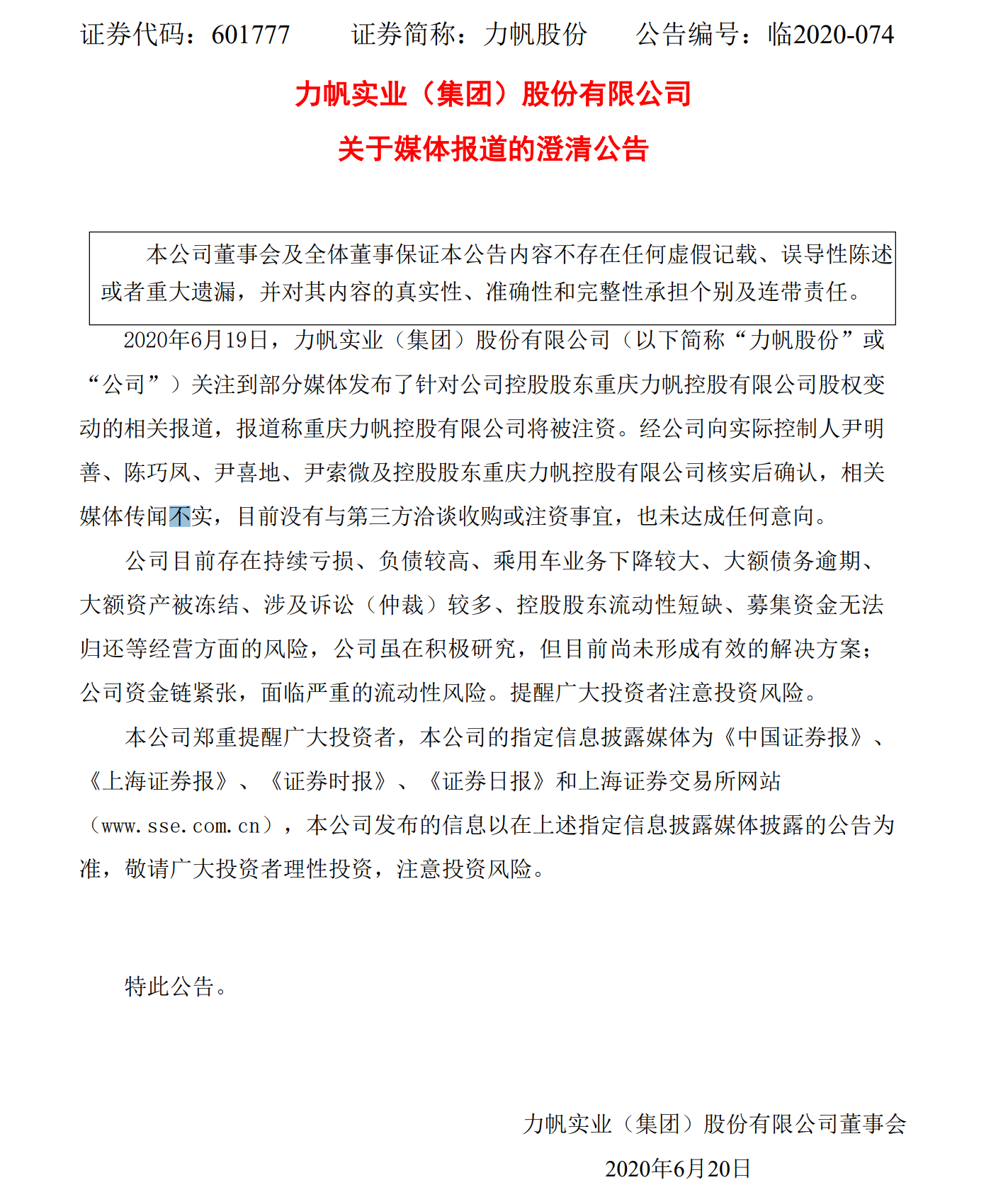

Recently, it has been pointed out that Zhejiang Geely holding Group Co., Ltd. plans to inject capital into Chongqing Lifan holding Co., Ltd., becoming its largest shareholder, the price and scale of the shares are not clear. Affected by the news, Lifan shares once rose in a straight line by the limit.

Subsequently, in response to this rumor, Yang Xueliang, vice president of Geely Automobile Group, said: "there is no such thing."

On June 20, Lifan Industrial (Group) Co., Ltd. issued a clarification announcement on media reports. The announcement said that after verifying with the actual controllers Yin Mingshan, Chen Qiaofeng, Yin Xidi, Yin Suowei and controlling shareholder Chongqing Lifan Holdings Co., Ltd., the relevant media rumors are not true and there are no acquisitions or capital injection talks with third parties, and no intention has been reached.

Lifan also stressed that at present, the company has sustained losses, high liabilities, a large decline in passenger car business, large debts overdue, large assets frozen, more litigation (arbitration), lack of liquidity of controlling shareholders, unable to return the funds raised, and other operational risks, although the company is actively studying, but has not yet formed an effective solution; the company's capital chain is tight and faces serious liquidity risks. Remind investors to pay attention to investment risks.

Lifan's rumored acquisition is also related to its continued loss-making performance. In 2019, Lifan realized operating income of 7.4 billion yuan, down 32.35% from the same period last year, and the net profit attributed to shareholders of listed companies was a loss of 4.68 billion yuan. According to the report of the first quarter of 2020, Lifan realized revenue of 560 million yuan in the first quarter, down 74.88% from the same period last year. The net profit belonging to shareholders of listed companies was 197 million yuan, down 103.06% from the same period last year.

On the evening of June 18, Lifan shares disclosed the company's cumulative supplementary announcement involving litigation (arbitration) matters. The announcement shows that the company has been involved in 392 lawsuits (arbitration), involving a total amount of 2.906 billion yuan. Of the 392 cases, 221 have been adjudicated (arbitration). Lifan is all defendants and needs to compensate the other party a total of 1.836 billion yuan. There were 82 unheard cases, involving a total amount of 580 million yuan. In addition, the amount of undisclosed litigation (arbitration) reached 268 million yuan in the past 12 months. There are also 181 lawsuits (arbitration), the total amount of which is 164 million yuan due to the small amount of individual cases.

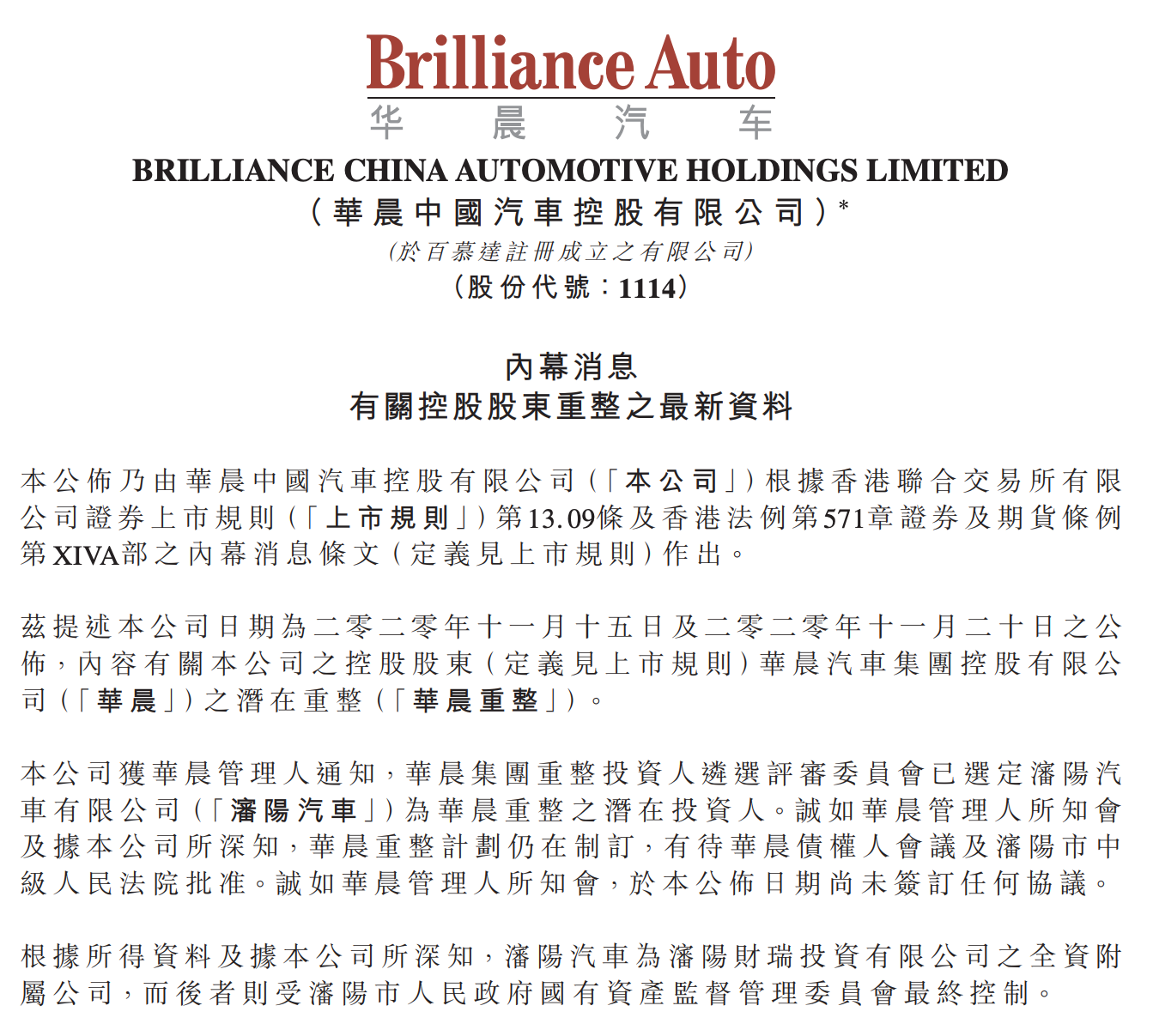

Rumors about Geely and the cars of both sides

Geely may take part in a bid for Ssangyong, a South Korean subsidiary of Indian carmaker Mahindra, Bloomberg reported. According to South Korean media reports, Ssangyong Motor, which is in trouble, is looking for new investors and has chosen Samsung Securities to cooperate with Rothschild, a well-known global financial family, to attract market interest.

In response to this matter, Yang Xueliang, vice president of Geely Automobile Group, also said publicly, "there is no such plan."

According to public information, Mahindra, founded in 1945, is one of the largest car companies in India and one of the largest tractor manufacturers in the world. Ssangyong Motors, founded in 1954, is a well-known car company in South Korea, its main model is SUV. In March 2011, Mahindra announced that it would buy a 70 per cent stake in Ssangyong Motor for 523 billion won (3.024 billion yuan), making it the company's largest shareholder. Since 2013, Ssangyong has conducted two rounds of rights issues worth 130 billion won (752 million yuan), and Maheng's stake in Ssangyong currently stands at 74.65%.

Due to sluggish product sales, lack of R & D funds, the epidemic exacerbated the company's operating crisis and other factors, Ssangyong Motor is in trouble. So far, Ssangyong has suffered losses for 13 consecutive quarters. Recently, Mahindra has decided to cancel a new round of capital injection into Ssangyong Motor.

Geely, which is constantly expanding, is considered to emulate the successful model of Volkswagen Group and build into an omni-directional, multi-brand global automobile group. Geely had already participated in the capital injection plan of Aston Martin, a sports car maker, and held talks with investors and management of Aston Martin, but it backfired and Canadian billionaire Lawrence Stroll bought 16.7 per cent of Aston Martin for £182 million.

At present, Geely Group has five business segments, including Geely, Geometry, Lecker, Proton and Lutes, while Volvo has Volvo and Polar. At the same time, Geely Holdings is the single largest shareholder in Daimler and a shareholder in the global joint venture of the smart brand.

Li Shufu has said that Geely must compete in the global auto market and become an international and global enterprise.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.