In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-24 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)06/21 Report--

After a variety of negative blows in 2019, it seems to have undergone a significant change since 2020, attracting investment despite continuing losses in an environment of rising sales.

A few days ago, according to documents filed by the Securities and Exchange Commission, Tencent, through its wholly-owned subsidiary Yellow River, invested $10 million (70.7 million yuan) to buy 1.68 million American depositary shares (ADS) of Lulai Motor in June, meaning that after the increase, Tencent, as a veteran shareholder, has held about 159 million common shares, or 15.1%, making it the second largest shareholder.

In early June, Xilai announced that it would issue 60 million shares of ADS at a proposed price of $5.97, with an estimated net income of $344.2 million. Under the previous plan, NIO would raise $358.2 million, which, including additional placement rights, could raise up to $411.93 million. But in the end, NIO issued 72 million new shares at $5.95 per share, 20% more than planned, raising a total of $428 million (3.026 billion yuan).

According to NIO, the proceeds from this fund-raising are mainly used to provide cash investment to NIO China and other necessary working capital. The company expects that NIO China will use cash to invest in research and development of products, services and technologies, develop production facilities, and expand its supply chain, operations and sales and service networks, as well as for general business purposes.

Obviously, each and every new financing reflects the positive performance of NIO, and this financing has also alleviated the shortage of funds for Lulai. Although after all kinds of vehicle spontaneous combustion and recall in 2019, senior management turnover, personnel layoffs and huge losses of 40 billion, it is felt that Ulai will not make it through 2019, and even let its share price fall as low as around $1, which is at risk of delisting.

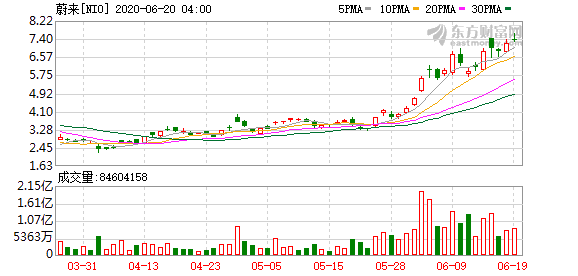

However, with the launch of the new model, in an environment where sales continue to rise, it has gradually attracted more new financing to help ease the capital of Lulai, so that its share price has risen above $7. Since June, Xilai has risen 84.42% and now has a market capitalization of $9 billion.

Although Xilai is now increasingly favored by outside capital, it has yet to turn a profit. According to the financial results of the first quarter of 2020 released by Xilai, the total income was 1.37 billion yuan, down 15.9% from the same period last year, and the operating loss was 1.57 billion yuan, 44% lower than the previous year, and 40% lower than the same period last year.

In this regard, good sales of Ulai still need to increase gross profit margin as one of its core goals in 2020. According to Ulai data, in May 2020, the cumulative delivery volume reached 3436 vehicles, an increase of 215.5% over the same period last year. A total of 10429 new cars were delivered in the first five months, which is also the brand with the largest sales among the new power car companies, but it has been in a state of "more and more losses".

In any case, Tencent has played a positive role in increasing its investment in Lulai over the past year. Data show that in 2019 alone, Tencent has invested more than $140 million.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.