In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-21 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)06/23 Report--

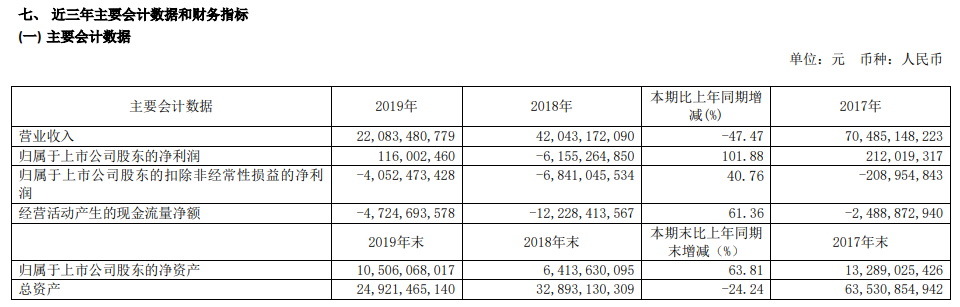

On the evening of June 22nd, ST released its 2019 performance report, showing that its operating income reached 22.083 billion yuan in 2019, down 47.47% from the same period last year; the net profit of shareholders belonging to listed companies was 116 million yuan, an increase of 101.88% over the same period last year. In addition, the net profit attributable to non-deduction was-4.05 billion yuan, an increase of 40.76% over the same period last year.

The huge group said in its financial report that in 2019, due to a serious shortage of funds, property could not be realized and other reasons, it was unable to pay off maturing debts, and the serious shortage of funds led to a continuous downturn in 2019, resulting in the shutdown of a large number of distribution outlets, and the operation could not operate normally.

Giant Group was founded on March 3, 2003, and in 2010, the company was the largest car dealer in China. Statistics show that the giant group once had 1035 outlets across the country, including 834 specialty stores, 134 auto supermarkets and 69 shopping malls.

Due to the huge pressure of cash flow in recent years, large groups frequently sell stores to ease the financial pressure. In May 2018, the giant group announced the transfer of 100% equity in five subsidiaries, and in August 2018, it announced the transfer of 100% equity in nine subsidiaries. As of December 31, 2019, Giant Group has 402 outlets in 29 provinces, municipalities, autonomous regions and Mongolia, including 308 specialty stores (including 288 4S stores), 20 auto supermarkets and 74 integrated markets. The number of outlets continues to shrink significantly.

In May 2019, the giant group borrowed 17 million yuan from Beijing Jidongfeng, which was eventually appealed to the court by Beijing Jidongfeng because it was unable to repay it within the time limit. In September 2019, the Tangshan Intermediate people's Court ruled to accept the company's application for restructuring on the grounds that the company could not repay its due debts and that it might lose its ability to repay. According to the relevant provisions of the Enterprise bankruptcy Law, if the reorganization of the company fails, the company will be declared bankrupt by the court. In the same month, Shenshang Holdings, Yuanwei assets and National Transport capacity announced that they would form a consortium to become investors in the restructuring intention of a huge group. In December 2019, the court ruled that the implementation of the large group restructuring plan had been completed.

In addition, according to the giant group's previous announcement, in order to withdraw funds, the giant group will rent and sell idle storefronts. According to the plan, the giant group will sell 21 car parks or other projects across the country in three years, involving a real estate area of 361900 square meters. Among them, six projects including Zhengzhou Zhongmou Automobile Park, Shiyun Old passenger Station, Zhangjiakou Phase I Automobile Park, Qingdao Huangdao Automobile Park, Tangshan Huaxing Park and Jixian Automobile Park will be sold in 2020.

Benefiting from the completion of the restructuring plan, the debt pressure of the large group has dropped significantly. As of December 31, 2019, the total assets of the giant group were 24.921 billion yuan, down 24.24% from the same period last year; the total liability was 14.336 billion yuan, down 45.72% from the same period last year, and the asset-liability ratio was 57.52%, compared with 84.26% at the end of the third quarter of 2019.

The giant group said in the financial report that with the completion of bankruptcy restructuring, the company will set sail again in 2020, and the debt will be greatly reduced to reduce the pressure on the company's operation; at the same time, the company intends to optimize and adjust the company's store line and brand grade structure in the light of market consumer demand, and concentrate superior forces to vigorously develop Japanese, German and other joint venture brands to improve the company's overall anti-risk ability.

However, the large group also admitted that if the future market environment, market consumer demand changes dramatically, the effect of incremental business integration may not be as expected. The epidemic has led to a lot of uncertainty in the car market, and it is hard to escape the impact of being a car dealer. In the first quarter of 2020, the operating income of large groups in the first quarter was 3.617 billion yuan, down 19.31% from the same period last year; the net profit of shareholders belonging to listed companies was-156 million yuan, down 68.04% from the same period last year.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.