In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)06/30 Report--

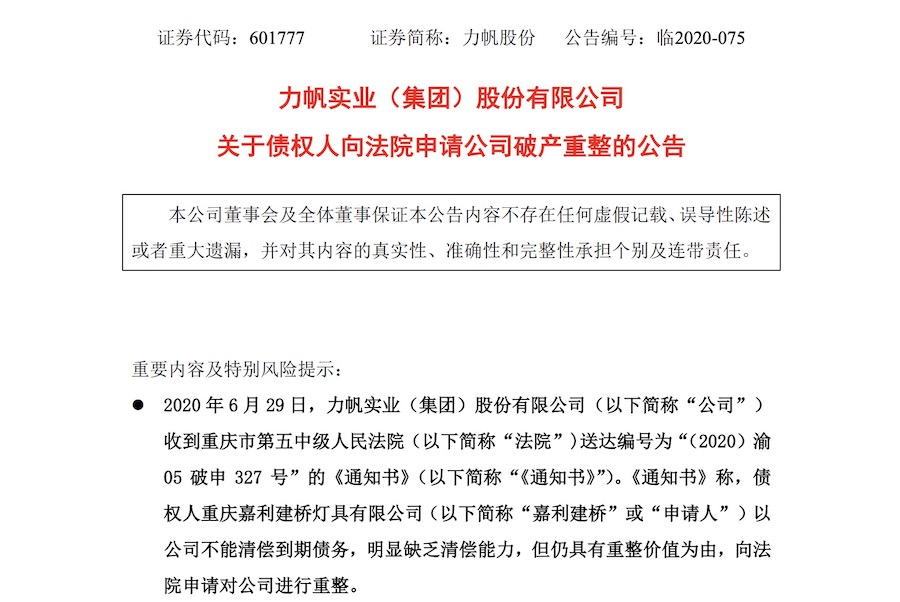

Nowadays, under the accelerated changing market environment of domestic automobile market, many marginal automobile enterprises feel difficult. A few days ago, Lifan shares issued "on creditors to the court to apply for bankruptcy reorganization of the company" announcement, saying that the company received the court served "notice," creditor Jiali Jianqiao on the grounds that the company can not pay off due debts, obviously lack of solvency, but still has reorganization value, to the court to apply for reorganization of the company.

The creditor who applied to the court for reorganization of the company is Chongqing Jiali Jianqiao, and the debt scale related to Lifan shares is not large. The announcement shows that Lifan shares owe 563,100 yuan to Jiali Jianqiao, which has been overdue so far. Lifan shares said that so far, the court has not received the decision on the applicant's application for reorganization of the company, whether the applicant's application can be accepted by the court, whether the company can enter the reorganization procedure and when there is significant uncertainty. Lifan said that regardless of whether it enters the reorganization process, it will do its best to do a good job in daily production and operation management on the existing basis.

The announcement also mentioned that, according to relevant regulations, if the court accepts the applicant's application for reorganization of the company according to law, the company will be declared bankrupt due to the failure of reorganization. If the company is declared bankrupt, the company will be subject to bankruptcy liquidation, and according to regulations, the company's shares will face the risk of being delisted.

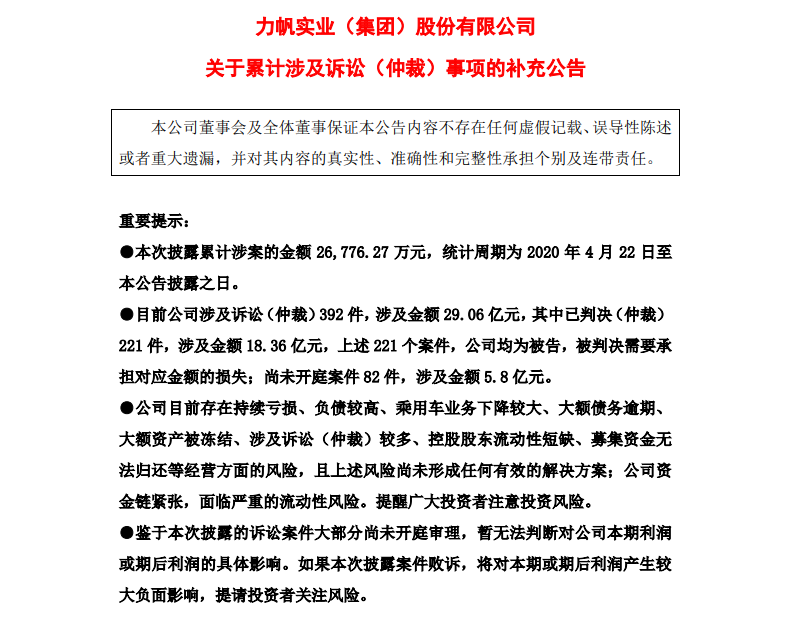

It has to be said that Lifan shares are now in deep debt crisis. According to the announcement issued by Lifan shares on the evening of June 18, the company has been involved in 392 lawsuits (arbitration) involving 2.906 billion yuan.

Of the 392 cases, 221 have been adjudicated (arbitrated), and Lifan is all the defendant, with a total compensation of 1.836 billion yuan. There were 82 unheard cases involving a total amount of 580 million yuan. In addition, undisclosed litigation (arbitration) in the past 12 months reached 268 million yuan. There were also 181 lawsuits (arbitrations), which were not disclosed due to the small amount of individual cases, with a total amount of 164 million yuan.

Lifan sales volume and performance declined significantly. According to the sales data, from January to May 2020, the sales volume of Lifan traditional passenger cars fell by 95.5% to 887 vehicles, and the sales volume of new energy vehicles fell by 54.5% to 460 vehicles, undoubtedly becoming the most marginal automobile enterprise in the domestic market at present. In this regard, Lifan also said in the announcement, Lifan automobile business has faced stagnation, the domestic market basically lost, at present only a small number of export orders, passenger car brand existence is marginalized risk.

In order to revitalize the company's business and realize a turnaround, Lifan also considered returning to the motorcycle industry. However, according to Chongqing Jiali Jianqiao Lamps Co., Ltd., the creditor who applied to the court for reorganization of the company, it is the company that supplies motorcycle parts and process materials to Lifan shares. Lifan involved 563,100 yuan of settlement amount of relevant parts and components, which means that Lifan shares rely on the motorcycle main business to survive. It has also been affected by financial problems.

According to the performance report, Lifan realized revenue of 7.4 billion yuan in 2019, down 32.35% year-on-year; net profit loss attributable to shareholders of listed companies was 4.68 billion yuan, down 1950.83% year-on-year; revenue in the first quarter of 2020 was 560 million yuan, down 74.88% year-on-year; net profit loss attributable to shareholders of listed companies was 197 million yuan, down 103.06% year-on-year.

Now it seems that in the industry environment downturn, the market normal survival of the fittest, the structural adjustment of the automobile market, towards high-quality development road is the industry law. However, whether Lifan Group can successfully reorganize has become the focus of everyone's attention. Once the reorganization fails, Lifan Group will also have the risk of bankruptcy, or even the result of bankruptcy liquidation. Now Lifan is under pressure.

Under the stock competition environment of automobile industry, Lifan Group, which is in the marginal state, faces serious crisis. The company's continuous operation problems and huge debts make Lifan "overwhelmed". The elimination competition of automobile industry accelerates, and more and more automobile enterprises will fall down.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.