In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)08/06 Report--

According to media reports, Geely Motor's acquisition of Lifan shares may be a foregone conclusion, when Lifan will only retain the motorcycle sector, and the rest will be taken over by Geely Motor, "including shell resources of listed companies, production qualifications, financial licenses, and so on." In addition, after Geely takes over Lifan, it will get the local mandarin duck plot in Chongqing.

With regard to Geely's acquisition of Lifan, some media have sought confirmation from Yang Xueliang, vice president of Geely Automobile Group, but it has not been confirmed as of press time. At the same time, some relevant officials of Geely Holdings Group responded to the media: "I don't know about this."

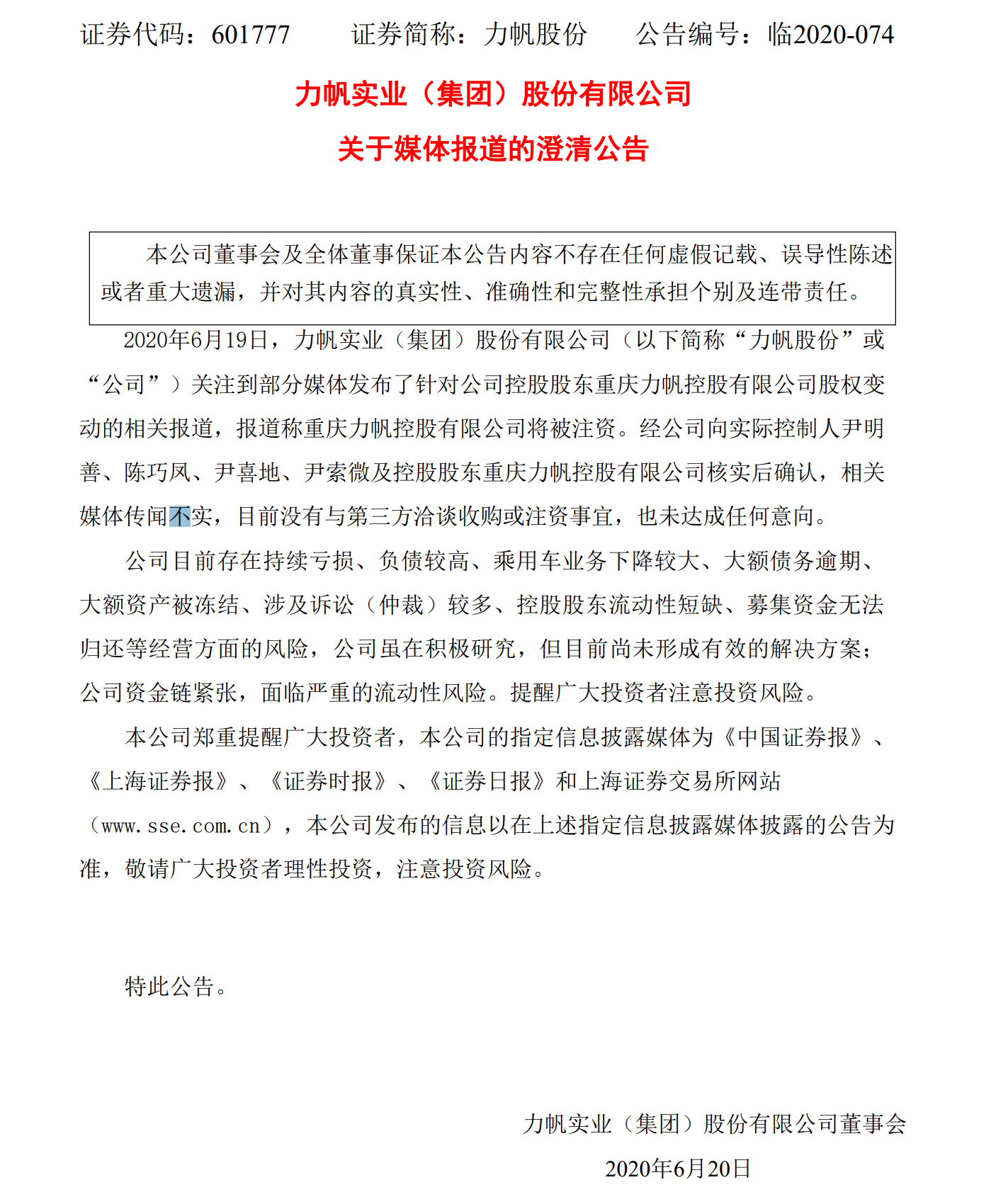

In fact, rumors of Geely's acquisition of Lifan were already rumored as early as June, when there were media reports that Geely Holdings planned to inject capital into Lifan Holdings to become its largest shareholder. Both Geely and Lifan denied the rumor. "there is no such thing", Yang Xueliang said on Weibo, while Lifan issued a clarification notice denying it.

It is an indisputable fact that China's automobile industry is in recession in 2020, especially under the influence of the epidemic, there are not a small number of enterprises that do not have enough funds to maintain operation and eventually lead to delisting, and Lifan is not one of the car companies that are "in danger".

In terms of performance, Lifan's revenue fell by 32.35% to 7.4 billion yuan in 2019, and net profit plummeted by 1950.83% to-4.682 billion yuan. In the first quarter of 2020, Lifan's revenue fell by 74.88% to 560 million yuan, and net profit fell by 103.06% to-197 million yuan. In terms of sales, Lifan sold 22536 traditional passenger cars, 3091 new energy vehicles and 608500 motorcycles in 2019, and 978,549 and 213536 Lifan passenger cars and motorcycles in the first half of this year, respectively, down 95.29%, 56.32% and 29.03% from a year earlier. No matter from which point of view, Lifan will not be very likely to support it.

Under the influence of sales, Lifan is mired in a debt crisis. On July 10, Lifan shares announced that 10 wholly-owned subsidiaries were applied to the court for judicial restructuring by creditors because they were unable to pay off their maturing debts, and the company would risk being declared bankrupt due to the failure of the restructuring. Lifan is heavily in debt, and it is an indisputable fact that it is difficult to operate.

To sum up, if the news of Geely's acquisition of Lifan is true, it will be the best result for Lifan. After Geely takes over Lifan, Lifan will return to the motorcycle plate to "restructure the mountains and rivers". Although the sales volume of Lifan motorcycle plate has also declined sharply, it is not impossible to peel off the automobile plate that continues to lose money. It is not impossible for the motorcycle plate to usher in growth.

For Geely, it has been taking a "buy" attitude to increase its market share in recent years. On July 23, Geely Commercial vehicle Group signed an agreement with Anhui Xingma Automobile Group and Maanshan Huashen Building Materials Industry, a wholly-owned subsidiary, to hold 15.24% of the company's shares with 435 million yuan as the company's controlling shareholder.

In fact, whether the news of Geely's acquisition of Lifan is true or not, it only reflects the "survival principle" of the current Chinese auto market. At this stage, the survival and development of weak brands is difficult, a number of joint venture car companies have announced their withdrawal under the stock competition, and some marginal independent car enterprises will also face elimination, so the merger and reorganization of China's automobile industry is imperative.

Quoting previous industry insiders: "Market elimination is fair, which is also conducive to the merger and reorganization of China's automobile industry." Car companies without brands, core technology and capital will collapse one after another. " At present, joint venture brands such as Changan Suzuki and Dongfeng Renault are delisted, while independent brands Huatai Automobile, Zhongtai Automobile and Haima Motor are in market difficulties, speeding up the growth and decline of brands under the survival principle of survival of the fittest.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.