In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-24 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)08/07 Report--

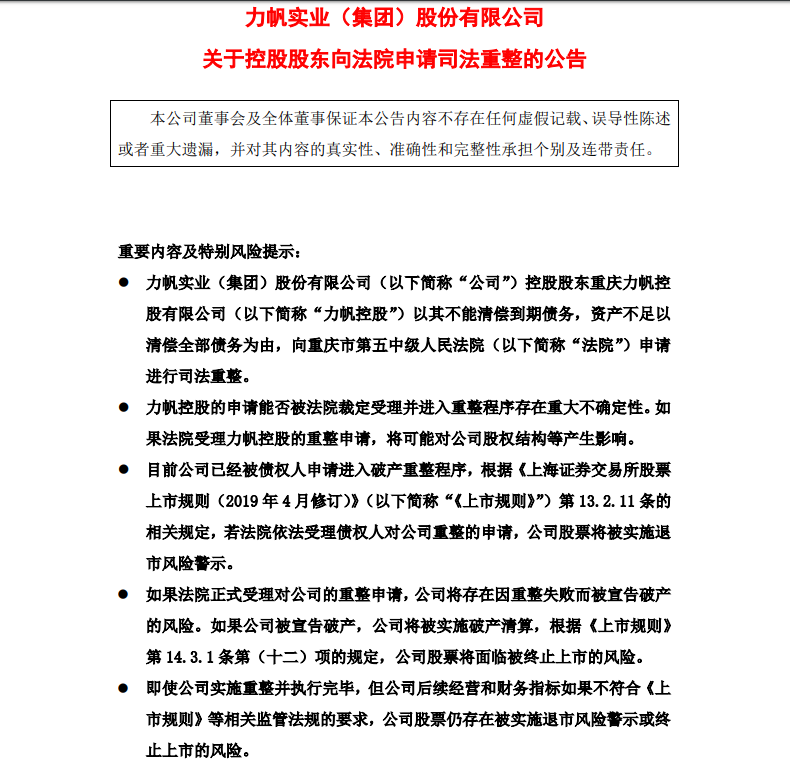

On the evening of August 6, Lifan shares announced that the controlling shareholder, Chongqing Lifan Holdings Co., Ltd. (hereinafter referred to as "Lifan Holdings"), on the grounds that it was unable to pay off its maturing debts and its assets were insufficient to pay off all its debts, apply to the Fifth Intermediate people's Court of Chongqing (hereinafter referred to as "the Court") for judicial reorganization. At present, Lifan Holdings has submitted an application for restructuring to the court, which may have an impact on the company's ownership structure.

According to the announcement, Lifan Holdings has been facing debt risks since 2017. although it has tried its best to formulate relevant plans and resolve related problems through a variety of ways, it has not been able to completely get rid of its liquidity crisis. In order to properly solve the debt problem of Lifan Holdings and protect the interests of the broad masses of creditors and investors, Lifan Holdings considered that it had restructuring value and applied to the court for judicial reorganization on August 6, 2020, on the grounds that it could not pay off its maturing debts and its assets were insufficient to pay off all its debts.

Lifan shares said that at present, the company has been applied by creditors to enter the bankruptcy reorganization procedure, and if the court accepts the creditor's application for company reorganization in accordance with the law, the company's shares will be delisted risk warning; if the court formally accepts the company's reorganization application, the company will be declared bankrupt due to restructuring failure. If the company is declared bankrupt, the company will be liquidated and its shares will face the risk of being terminated. In addition, even if the company implements the reorganization and the implementation is completed, if the company's subsequent business and financial indicators do not meet the requirements of the relevant regulatory regulations such as the listing rules, the company's shares are still at risk of being delisted or terminated.

It is worth mentioning that just yesterday, there were media reports that Geely Motor's acquisition of Lifan has become a foregone conclusion. At that time, Lifan will only retain the motorcycle plate, and the rest will be taken over by Geely, including listed company shell resources, production qualifications, financial licenses and so on. In other words, Lifan may no longer exist after being acquired by Geely, but it will also be "reborn" in another way, but so far both sides have not responded to the news.

Data show that at first Lifan shares are mainly engaged in the production and sales of motorcycles, and then they are involved in passenger cars, new energy vehicles, shared cars and other fields. It can be said that Lifan spent a lot of energy on the way to building cars. However, the process of building Lifan has not been smooth. It has been going downhill since 2017 and lost money for the first time in 2019. According to the data, the net profit of Lifan shares fell from 171 million yuan in 2017 to-4.682 billion yuan in 2019, with a net loss of 191 million yuan in the first quarter of 2020.

In addition, according to the cumulative litigation announcement announced by Lifan shares on June 18, the company has involved 392 lawsuits (arbitration), involving an amount of 2.906 billion yuan. In the announcement, Lifan shares said that the actual operation of the passenger car business of listed companies is facing stagnation, the passenger car business, especially the new energy vehicle business, has declined significantly, the domestic market has basically lost, there are only a small number of export orders, and the progress of technology research and development projects is slow. Passenger car brands are at risk of being marginalized.

Restructuring may be the last "lifesaver" of Lifan shares, but this does not have much effect on "lifesaver". Industry insiders said that Lifan shares restructuring value is small. In the past five years, the growth rate of Lifan's brand and technology level is far behind that of its peers, such as new energy vehicles, intelligent network couplings, etc., so even if the restructuring is completed, it is still not favored by the market. In response to the recent media reports that Geely will buy Lifan, industry insiders think that it is just a rumor. Today's automobile industry not only has overcapacity, but also has excess production qualification, and Lifan's production qualification is no longer valuable. other assets do not play a greater role for Geely, and there will be many legacy problems after the acquisition of Lifan. Geely does not need to "set himself on fire" at all.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.