In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-18 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)08/08 Report--

After Lulai Automobile and ideal Automobile, another new domestic car-building power plans to be listed in the United States, becoming the third Chinese car-making company to be listed on the stock market in the United States.

In the early morning of August 8, Beijing time, Xiaopeng formally submitted a prospectus to the Securities and Exchange Commission (SEC) and applied for listing on the New York Stock Exchange. Xiaopeng is listed under the symbol "XPEV", according to the documents, and this time the IPO is underwritten by Credit Suisse, JPMorgan Chase and Bank of America Securities. However, Xiaopeng's IPO price range and the number of shares to be issued are uncertain, and the $100m listed in the prospectus is only a placeholder disclosed routinely and does not represent the actual financing of the IPO.

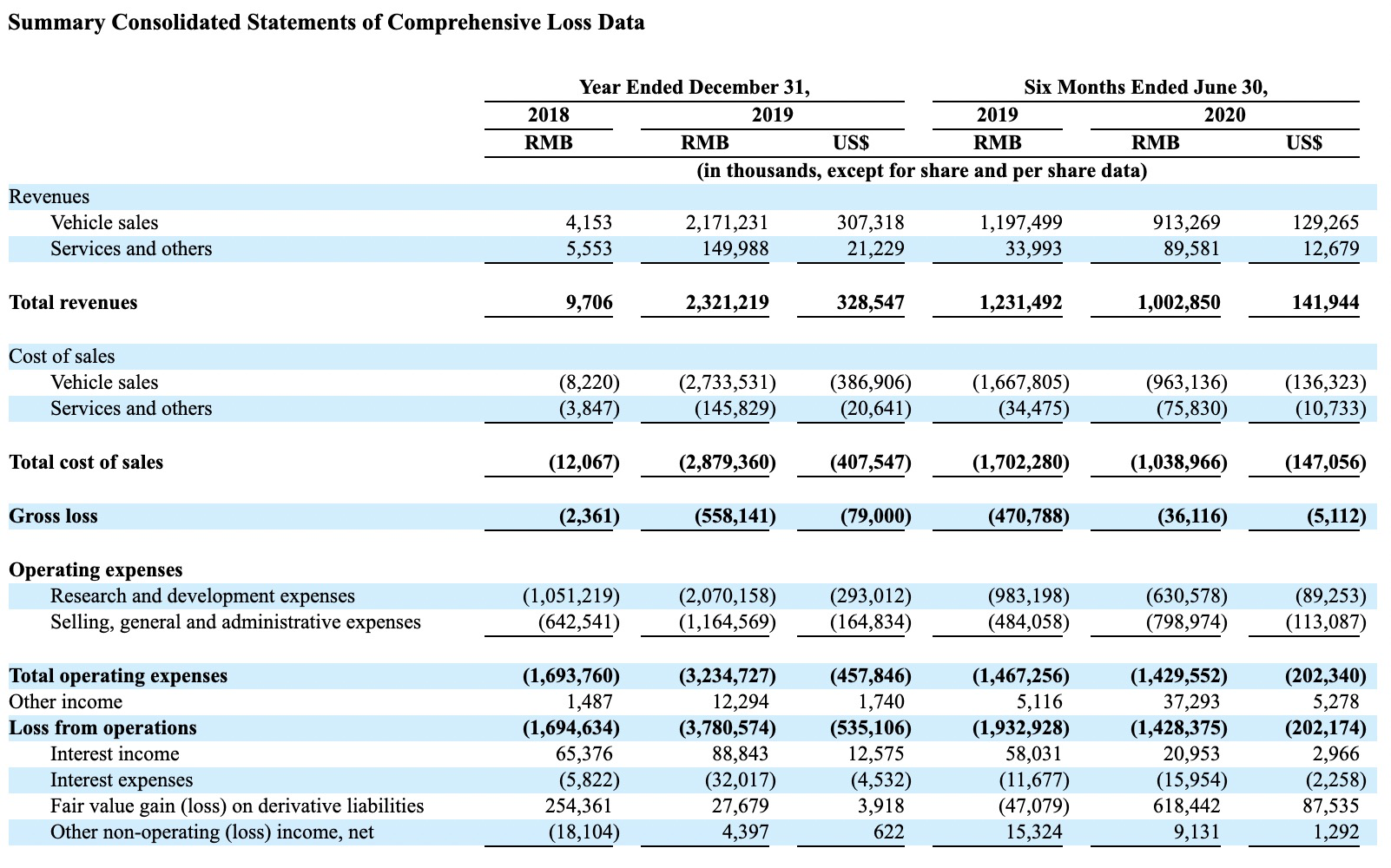

According to the prospectus, Xiaopeng CEO he Xiaopeng holds 31.6%, while other directors and executives, including he Xiaopeng, hold 40.9%. Among other shareholders, Taobao China Holdings (Taobao China Holding Limited) holds 14.4% as the largest external shareholder, while Xiaomi, GGV GGV Capital and Morningside Capital hold 12%. However, in terms of performance, Xiaopeng has not performed well and has been in a state of loss since its inception. According to the prospectus, Xiaopeng's net losses in the first half of 2018-2020 were 1.399 billion yuan, 3.692 billion yuan and 796 million yuan, with a cumulative loss of 5.887 billion yuan since 2018.

According to the data, Xiaopeng Motor, founded in 2014, is the Internet electric vehicle brand of Guangzhou Orange Bank Intelligent Automotive Technology Co., Ltd. since its inception, it has completed 10 times of financing, with investors including IDG Capital, CICC Capital, Morningside Capital and Alibaba Group participating.

At present, Xiaopeng has two models on sale, namely Xiaopeng G3 and Xiaopeng P7. Among them, Xiaopeng G3 began to be delivered in December 2018 and Xiaopeng P7 began to be delivered in May 2020. According to the data, the cumulative delivery volume of Xiaopeng is 20707, including 18741 for Xiaopeng G3 and 1966 for Xiaopeng P7.

It is worth mentioning that before Xiaopeng IPO, Xilai Motor and ideal Motor were the first to be listed in the United States, and the share prices of these two companies have also risen sharply recently. at present, the total market capitalization of Xilai Automobile is 15.9 billion US dollars, while that of ideal Motor is 14.3 billion US dollars. If Xiaopeng's plan to list in the United States comes true, the "three hardships" of car building will also further expand the market.

In addition to NIO, ideal and Xiaopeng, which has submitted a prospectus, more car manufacturers also plan to go public. Recently, there are media reports that Weimar is working with the finance company and plans to land on the Kechuang board as soon as this year. Weimar responded with "no comment" to the report. Earlier, the official announced that the third production model will go on sale in the third quarter of 2020 and is scheduled to go on sale in Science and Technology Innovation Board in 2021.

In 2020, many car manufacturers eventually quit the market because of financing difficulties, mass production failure and other reasons. For car manufacturers still in the market, there are all players with stories who can survive the first round of knockout, but the era of storytelling and PPT car building has passed. Desperately listing at the same time, if you can not maintain the core competitiveness of the products, as soon as possible to achieve positive cash flow, then the real pain may just begin.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.