In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)08/13 Report--

On August 12, a number of bonds owned by brilliance Automobile Group continued to plummet. 19 Huaqi 01 and 18 Huaqi 01 both fell more than 20%, 19 Huaqi 02 fell more than 14%, 17 Huaqi 01 fell more than 9%. For the continued decline in its bonds, brilliance said that it had set up a debt committee, which mainly took the lead in Everbright Bank, mainly coordinating relevant creditors not to draw loans, suppress loans, break loans, and continue to give financial and financial support to the company.

According to a rating report released by Oriental Jincheng, at the end of March 2020, brilliance Holdings had total assets of 175.437 billion yuan, total liabilities of 122.675 billion yuan, net assets of 52.762 billion yuan, and asset-liability ratio of 69.93%. By the end of April to December 2020, the scale of the company's interest-bearing debt was 43.267 billion yuan, accounting for 63.87% of the total interest-bearing debt. Oriental Jincheng further pointed out that brilliance Holdings' profits mainly come from brilliance BMW, its own brand passenger car production and sales continue to decline, business revenue capacity decline, profitability is still weak.

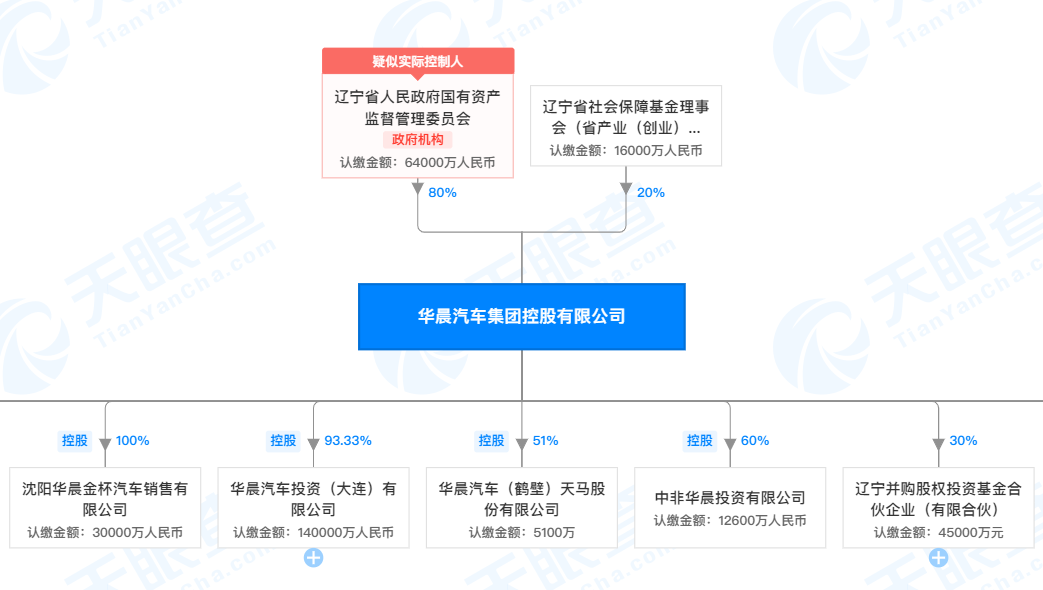

Tianyan investigation shows that brilliance has a registered capital of 800 million yuan, which is 80% and 20% respectively owned by the State-owned assets Supervision and Administration Commission of the Liaoning Provincial people's Government and the Liaoning Provincial Social Security Fund Council, and the actual control is the State-owned assets Supervision and Administration Commission of the Liaoning Provincial people's Government. The company is mainly engaged in vehicle manufacturing business, including brilliance BMW and brilliance China, at the same time, the company also has some spare parts and other business. Among them, the company's revenue and gross profit mainly come from brilliance BMW vehicle series products.

In recent years, due to the continued downturn in the domestic market, coupled with the low competitiveness and slow renewal of brilliance's own brand products, brilliance does not have a high status in China and can only rely on the joint venture brand brilliance BMW to make a living. According to data released by brilliance China, brilliance BMW made a net profit of 7.62 billion yuan in 2019. Excluding its net profit, brilliance China posted a net profit loss of 1.064 billion yuan.

It can be said that brilliance's performance is basically maintained by BMW, and the days of "lying down to make money" may come to an abrupt end in 2020. In October 2018, brilliance reached an agreement with BMW to transfer 25 per cent of brilliance to BMW for 3.6 billion euros and extend the joint venture until 2040. Brilliance Holdings will lose control of brilliance BMW, brilliance BMW's hematopoietic capacity will also be greatly reduced, the operating risk will be further deepened.

For current consumers, brilliance is over-dependent on the hematopoietic capacity of brilliance BMW, resulting in a lack of motivation for the development of its own brands, which not only makes brilliance Chinese brands gradually marginalized, but also makes itself into a state of continuous losses. At present, the decline of brilliance's own brand has become a microcosm of brilliance's current situation. Brilliance Holdings, which is heavily dependent on brilliance BMW and has a debt ceiling, is in a development dilemma.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.