In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-21 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)08/23 Report--

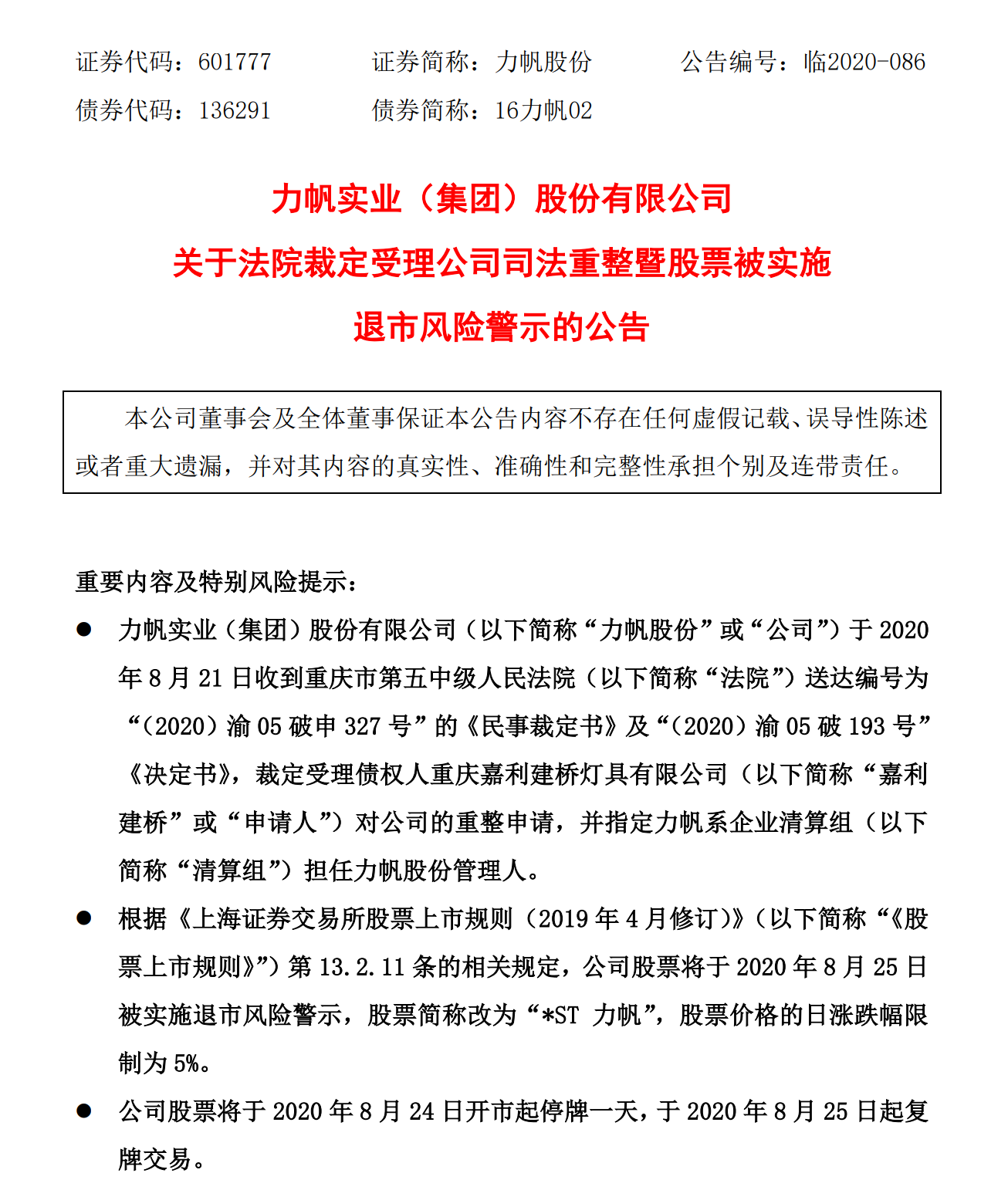

Lifan shares were applied to the court for bankruptcy reorganization by the supplier because they were unable to pay off their maturing debts. Today, Lifan shares announced that the court had ruled to accept the restructuring and that the company was at risk of being declared bankrupt due to the failure of the restructuring. At the same time, the company's stock was delisted risk warning, the stock abbreviation was changed to "* ST Lifan".

The person who applied to the court for bankruptcy reorganization of Lifan shares was "Chongqing Jiali Jianqiao Lighting Co., Ltd.". The court held that, judging from the facts ascertained in this case, Lifan Co., Ltd. has been unable to pay off its maturing debts, and the current monetary capital is 43 million yuan. Due debt 1.196 billion yuan, other property liquidity is poor, can not be realized, it should be determined in accordance with the law that it obviously lacks the ability to repay. Therefore, Lifan Co., Ltd. has the reason for bankruptcy.

At the same time, the court held that due to the bankruptcy reasons of Lifan Co., Ltd., if it is not rescued in time, it will bring great losses to the interests of creditors, shareholders, employees and other stakeholders, and its reorganization is necessary. Lifan Co., Ltd. has been engaged in the automobile and motorcycle industry for many years, has relatively complete production qualifications and mature production technology, and has established a relatively complete industrial chain system with many sales channels and restructuring value. it intends to achieve restructuring by means of equity restructuring, debt restructuring, asset restructuring and operation restructuring, and the restructuring plan is feasible.

To sum up, the court accepted the applicant Chongqing Jiali Jiaqiao Lighting Co., Ltd. for the reorganization of the applicant's Lifan shares.

According to the stock listing rules, Lifan shares will be delisted risk warning on August 25, the stock abbreviation will be changed to "* ST Lifan".

In terms of risk warning, Lifan shares were ruled by the court to accept restructuring, and there is a risk of being declared bankrupt because of the failure of restructuring. If the company is declared bankrupt, the company will be liquidated, and the company's shares will face the risk of being terminated. Even if the company has completed the restructuring and implementation, the company's follow-up business and financial indicators do not meet the requirements of relevant regulatory regulations, and the company's shares are still at risk of being delisted or terminated.

On the same day, Lifan also disclosed the company's cumulative litigation (arbitration) cases, as well as the progress of its subsidiaries, including Lifan passenger cars, which were ruled by the court to accept judicial reorganization.

Lifan shares have a large number of litigation risks and face huge debts. The announcement shows that at present, the company is involved in 1178 lawsuits (arbitration), involving an amount of 5.037 billion yuan. The litigation will have a significant impact on the follow-up production and operation of the company, and the company reminds investors to pay attention to the risks.

Lifan previously said, at present, the company has persistent losses, high liabilities, a large decline in passenger car business, large debts overdue, large assets frozen, more litigation (arbitration), lack of liquidity of controlling shareholders, unable to return the funds raised, and other operational risks, and the above risks have not yet formed any effective solutions; the company's capital chain is tight and faces serious liquidity risks.

Lifan shares lost 4.682 billion yuan in 2019 and 197 million yuan in the first quarter of this year. The company's continuing operational problems and huge debts have made Lifan face a serious crisis.

The sales report shows that from January to July, Lifan sold only 1168 fuel vehicles, 612 new energy vehicles, 287549 motorcycles and 415085 motorcycle engines.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.