In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)08/29 Report--

Entering 2020, China's automobile market continues to be in the doldrums further, coupled with the irreparable losses caused by the COVID-19 epidemic, the sales volume of domestic car companies has dropped sharply compared with the same period last year, and the decline in operating income and net profit has become a common phenomenon. however, with the improvement of consumption level after the epidemic, the performance of car companies has also begun to pick up.

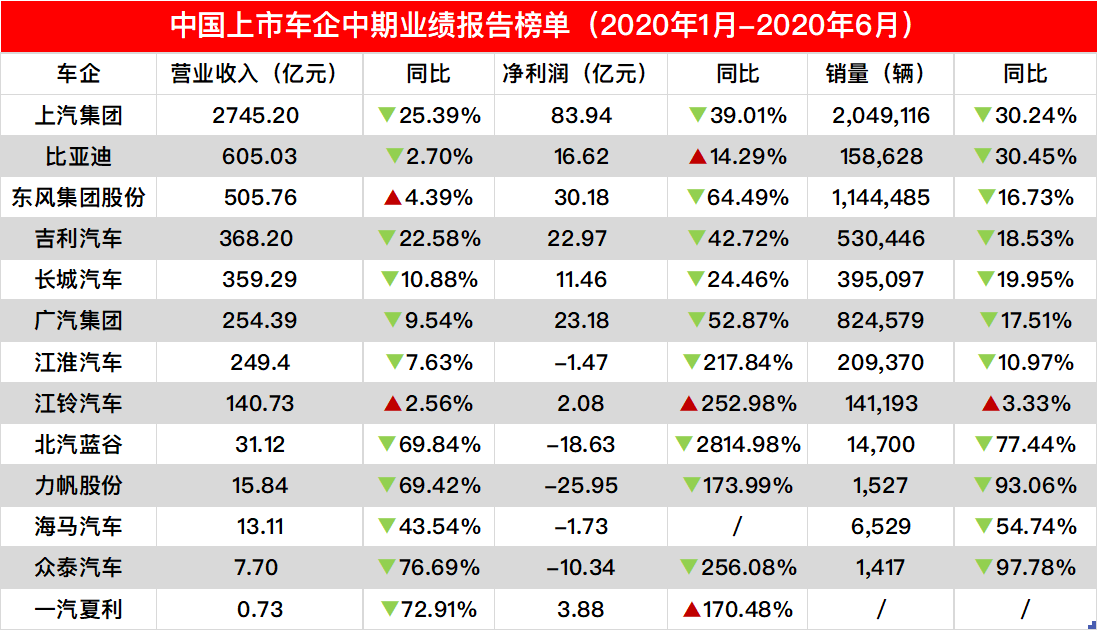

According to a number of listed car companies disclosed in the 2020 interim results summary statistics (ranked according to the level of operating income), more than 90% of car companies have a double decline in revenue and profit, even SAIC is inevitable.

Judging from the list, the top five car companies are SAIC, BYD, Dongfeng Group, Geely Motor and Great Wall Motor, of which BYD achieved an increase in net profit compared with the same period last year, while Dongfeng Group achieved an increase in operating income compared with the same period last year.

SAIC is still the largest automobile company in China, with revenues and profits in the forefront of the industry. On August 27, SAIC disclosed its results for the first half of 2020. According to the report, SAIC's operating income in the first half of the year was 274.52 billion yuan, down 25.39% from the same period last year; the net profit belonging to shareholders of listed companies was 8.394 billion yuan, down 39.01% from the same period last year.

As the leading enterprise in the domestic automobile industry, SAIC showed great performance pressure in 2020, and its profits mainly came from three joint venture brands: SAIC-Volkswagen, SAIC-GM and SAIC-GM Wuling. But the performance of these three brands this year has been disappointing. According to the data, SAIC's cumulative sales in the first half of the year fell by 30.24% to 2049116 vehicles, while SAIC-Volkswagen, SAIC-GM and SAIC-GM Wuling sold 577385, 556206 and 531040 vehicles respectively in the first half of the year, down 37.18%, 33.31% and 28.69%, exceeding the market average.

In order to make up for the market disadvantage, SAIC has implemented a number of rescue policies, including SAIC's five major enterprises offering 50% discount on cars, car price concessions, cost subsidies, exemption from purchase tax, zero down payment, etc., SAIC Volkswagen Skoda all series of models have been reduced, SAIC GM models have returned to the four-cylinder market, SAIC GM Wuling "ground stall economy" seeks sales recovery, and so on.

BYD is one of the few car companies to achieve net profit growth. According to the financial report, BYD achieved operating income of 60.503 billion yuan in the first half of the year, down 2.70 percent from the same period last year. The net profit belonging to shareholders of listed companies was 1.662 billion yuan, up 14.29 percent from the same period last year, of which 716 million yuan came from government subsidies, and the net profit after deducting non-recurrent profits and losses was 916 million yuan.

BYD said in the financial report that affected by the COVID-19 epidemic, sales of new energy vehicles fell sharply compared with the same period last year. BYD's cumulative sales fell 30.45 per cent to 158628 vehicles in the first half, with new energy vehicles falling 58.34 per cent to 60677 and fuel vehicles down 18.85 per cent to 97951, according to the data.

Dongfeng Group achieved sales revenue of 50.576 billion yuan in the first half of the year, an increase of 4.39% over the same period last year, and the profit attributable to equity holders of the parent company was 3.018 billion yuan, down 64.49% from the same period last year. Dongfeng Group's shares rely mainly on Dongfeng Nissan and Dongfeng Honda for revenue and profits, and the epidemic in the first half of the year caused factories at Dongfeng Nissan and Dongfeng Honda to fail to open normally and sales fell sharply. Cumulative sales of Dongfeng Group shares fell 16.73 per cent to 1144485 vehicles, with daily production and sales falling 17.32 per cent to 437241 and 16.95 per cent to 302425 respectively, according to the data.

Geely Motor and Great Wall Motor are the representatives of domestic independent brands. According to the financial report, the operating income of Great Wall fell 10.88 per cent to 35.929 billion yuan in the first half of the year, and the net profit of shareholders of listed companies fell 24.46 per cent to 1.146 billion. Geely Motor's operating income fell 22.58 per cent to 36.82 billion yuan, and the profit attributable to equity holders fell 42.72 per cent to 2.297 billion yuan.

GAC GROUP owns subsidiaries such as GAC MOTOR, Guangzhou Automobile Honda, Guangzhou Automobile Toyota, Guangzhou Automobile Mitsubishi, Guangzhou Automobile Fick and so on. According to the interim report, GAC GROUP achieved operating income of 25.439 billion yuan, down 9.54% from the same period last year, while the net profit belonging to the owner of the parent company was 2.318 billion yuan, down 52.87% from the same period last year.

GAC GROUP's cumulative sales in the first half of the year were 824579, down 17.51 per cent from a year earlier. Of this total, GAC Honda fell 20.58 per cent to 318451, GAC Toyota increased 3.11 per cent to 320888, GAC Fick fell 50.97 per cent to 17577, and GAC-Mitsubishi fell 54.56 per cent to 28673. Zeng Qinghong, chairman of GAC GROUP, has said that due to the impact of the pneumonia epidemic, the company will lower its forecast for car sales this year from 8 per cent to about 3 per cent, or about 2.12 million vehicles.

BAIC Langu, a car company committed to the development of new energy, was surprised by its performance in the first half of this year. BAIC Langu achieved operating income of 3.112 billion yuan in the first half of the year, down 68.94% from the same period last year. The net loss attributed to shareholders of listed companies was 1.863 billion yuan, a year-on-year drop of 2,814.98 percent. BAIC Blue Valley said that affected by the COVID-19 epidemic, BAIC's new energy sales fell sharply, resulting in a sharp drop in revenue and net profit.

According to the latest data released by BAIC Blue Valley, BAIC's cumulative new energy sales in the first half of this year were 14700, down 77.44 per cent from the same period last year. Prior to this, BAIC New Energy won the title of new energy vehicle sales for many years in a row, but since the decline of new energy subsidies, BAIC's sales of new energy have declined for a time, and showed tremendous sales pressure during the epidemic. BAIC New Energy has been surpassed by Tesla, BYD, GAC NE and other car companies in the first half of the year.

Zhongtai Automobile, Lifan Automobile, Haima Automobile and FAW Xiali have also disclosed their performance one after another, as domestic marginal car companies, revenue and profit slumped year-on-year is also expected. Of this total, Zhongtai Automobile's operating income fell 76.69 percent to 770 million yuan, with a net loss of 1.034 billion; Lifan Motor's operating income decreased by 69.42 percent to 1.584 billion yuan, with a net loss of 2.595 billion yuan; Haima Motor's operating income fell 43.54 percent to 1.311 billion yuan, with a net loss of 173 million yuan; FAW Xiali's operating income fell 72.91 percent to 726.96 million yuan, with a net profit of 388 million yuan.

For other car companies, in the first half of the year, Jianghuai Motor's business income fell 7.63% to 24.94 billion yuan, and its net loss fell 217.84% to 147 million yuan. Jiangling Motor's operating income increased by 2.56% to 14.073 billion yuan, and net profit increased by 252.98% to 208 million yuan. It has become the only car company on the list to achieve double growth in revenue and net profit.

The cold winter in the car market continues, and the epidemic has made the whole industry even worse. In the first half of the year, Changan PSA and Dongfeng Renault delisted one after another, and a number of independent brands also had operational difficulties, accelerating the reshuffle of the automobile industry, as well as the integration and merger and reorganization of the automobile industry. In the second half of the year, with the holding of mainstream auto shows, the implementation of gold, silver and market policies, will help car companies to achieve steady sales growth, for many car companies, sales growth performance recovery is still the main goal.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.