In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)09/02 Report--

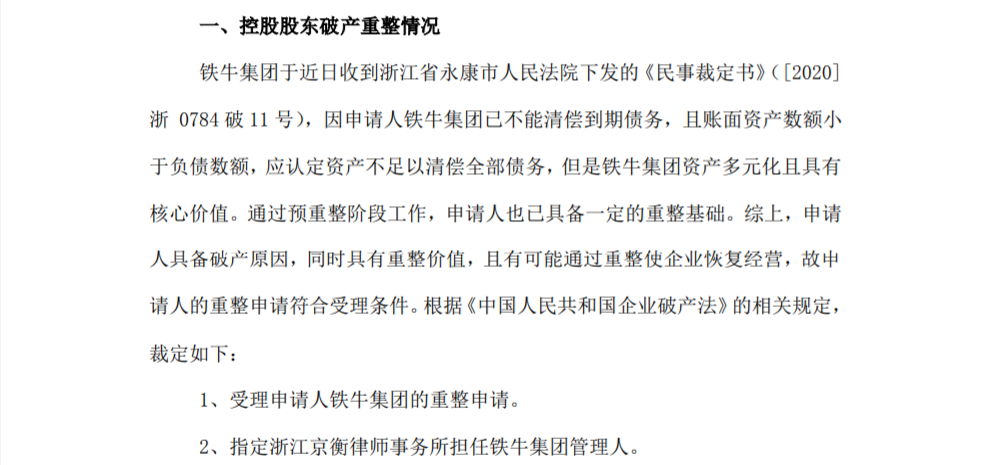

On the evening of September 1, Zhongtai Automobile announced that its controlling shareholder Tieniu Group Co., Ltd. (hereinafter referred to as "Tieniu Group") recently received a "civil order" issued by the people's Court of Yongkang City, Zhejiang Province. the court has accepted Tieniu's application for reorganization.

The announcement shows that because Tieniu Group is no longer able to pay off its maturing debts, and the amount of book assets is less than the amount of liabilities, it should be determined that assets are not sufficient to pay off all debts, but Tieniu Group's assets are diversified and have core value. Through the pre-restructuring phase of work, Tieniu Group also has a certain restructuring basis. According to the relevant provisions of the Enterprise bankruptcy Law of the people's Republic of China, the court accepted the applicant's application for reorganization of Tieniu Group. In addition, Zhejiang Jingheng Law firm was appointed as the manager of Tieniu Group.

Zhongtai Automobile said that at present, the bankruptcy reorganization of Tieniu Group is only a preliminary arrangement, the company does not know the specific plan and plan, and there is still uncertainty about whether the bankruptcy reorganization can be successful.

According to the data, Tieniu Group was first established in 1992, and its main business includes automobile manufacturing and sales, key automotive parts, new energy vehicles, electronics and electrical appliances, real estate development and investment management, and so on. Anhui Tongfeng Electronics and Zhongtai Automobile are two listed companies. According to Tianyanchu data, Tieniu Group is currently the largest shareholder of Zhongtai Automobile, holding 38.78% of Zhongtai shares.

Tieniu Group has promised that if the non-net profit deducted by Zhongtai Automobile from 2016 to 2019 is less than 1.21 billion yuan, 1.41 billion yuan, 1.61 billion yuan and 1.61 billion yuan respectively, Tieniu Group will make performance compensation. According to the financial report, Zhongtai Automobile deducts non-return net profit of-491 million yuan in 2018 and-9.3 billion yuan in 2019. According to the compensation agreement previously signed by the two sides, Tieniu Group should compensate about 468 million shares to Zhongtai Automobile, but the performance promise compensation has not been completed for a long time because the shares held by Tieniu Group have been judicially frozen and pledged.

In March this year, Tieniu Group proposed a performance compensation solution, which will be compensated through the sale of land collection and real estate income if necessary; in May this year, Tieniu Group plans to carry out performance compensation by writing off shares or repaying cash. Cash comes from the revitalization and disposal of the enterprise's assets, it says it will do its best to solve the problem of performance compensation and gambling, but there are still a number of risks that cannot be fulfilled in the near future.

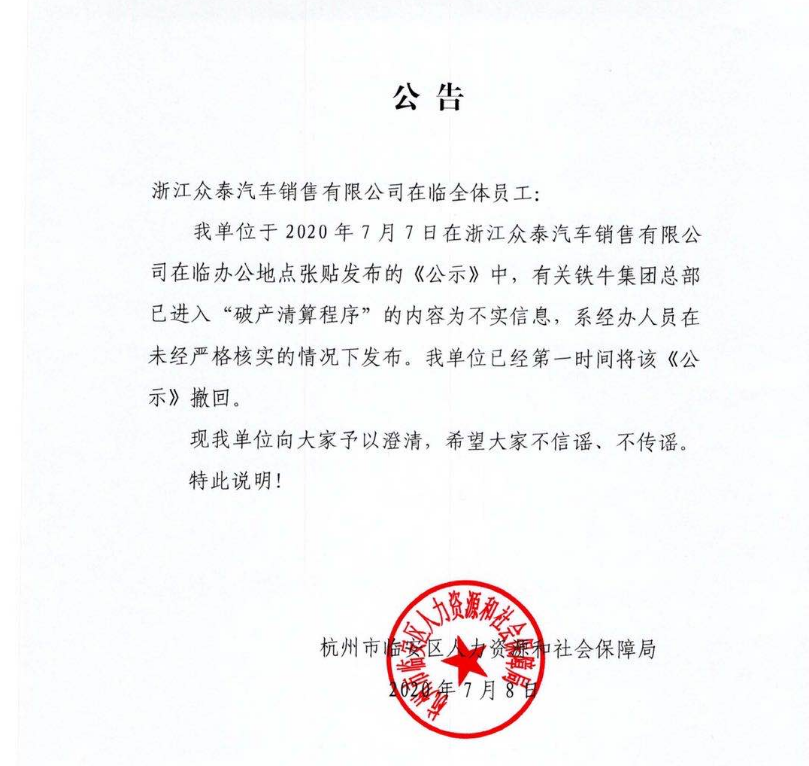

In addition, in July this year, a document about Tieniu Group entering bankruptcy liquidation was circulated online, signed by the Human Resources and Social Security Bureau of Lin'an District of Hangzhou City. According to the document, Zhongtai Automobile and the Group headquarters have not paid their employees for seven consecutive months because Tieniu Group headquarters has confirmed that it has entered the bankruptcy liquidation process. However, the news was quickly denied, and the Hangzhou Linan District Human Resources and Social Security Bureau issued a notice to clarify that "the content that Tieniu Group headquarters (Zhongtai Motor's major shareholder) has entered the" bankruptcy liquidation procedure "is false news.

The controlling shareholder is going bankrupt, and the operating condition of Zhongtai Motor, whose stock is also capped, is not optimistic. Data show that in 2019, Zhongtai Motor's revenue fell by 79.78% to 2.986 billion yuan, net profit by 1498.98% to-11.19 billion yuan, operating income by 76.69% to 770 million yuan in the first half of 2020, and net profit by 256.08% to-1.034 billion yuan.

Zhongtai Automobile can also be regarded as a veteran automobile manufacturer in China, which has been established for more than 20 years and has witnessed the whole stage of the development of China's automobile industry. However, in these 17 years, Zhongtai Automobile did not pay attention to the research and development technology reserve, but focused on the appearance design, resulting in its terminal competitiveness in the domestic brand is getting weaker and weaker, facing the situation of delisting.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.