In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)09/02 Report--

According to the latest announcement, the controlling shareholders of the two companies were ruled by the court to go bankrupt and reorganized because they were insolvent.

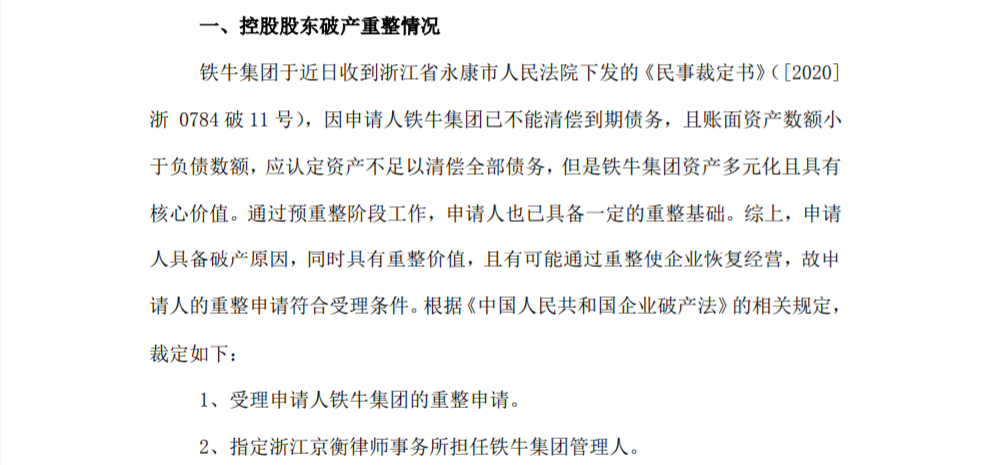

Bankruptcy reorganization of controlling shareholders of Zhongtai Automobile

On the evening of September 1, Zhongtai Automobile announced that its controlling shareholder Tieniu Group Co., Ltd. (hereinafter referred to as "Tieniu Group") recently received a "civil order" issued by the people's Court of Yongkang City, Zhejiang Province. the court has accepted Tieniu's application for reorganization.

The announcement shows that because Tieniu Group is no longer able to pay off its maturing debts, and the amount of book assets is less than the amount of liabilities, it should be determined that assets are not sufficient to pay off all debts, but Tieniu Group's assets are diversified and have core value. Through the pre-restructuring phase of work, Tieniu Group also has a certain restructuring basis. According to the relevant provisions of the Enterprise bankruptcy Law of the people's Republic of China, the court accepted the applicant's application for reorganization of Tieniu Group. In addition, Zhejiang Jingheng Law firm was appointed as the manager of Tieniu Group.

Zhongtai Automobile said in the announcement that the company and Tieniu Group are different subjects, have independent and complete business and independent management capabilities, and are independent of the controlling shareholders in terms of business, personnel, assets, institutions, finance and so on. Tieniu Group's entry into bankruptcy proceedings will not affect the production and operation of the company for the time being.

According to the data, Tieniu Group was first established in 1992, and its main business includes automobile manufacturing and sales, key automotive parts, new energy vehicles, electronics and electrical appliances, real estate development and investment management, and so on. Anhui Tongfeng Electronics and Zhongtai Automobile are two listed companies. According to Tianyanchu data, Tieniu Group is currently the largest shareholder of Zhongtai Automobile, holding 38.78% of Zhongtai shares.

The controlling shareholder went bankrupt, and the operating condition of Zhongtai Motors, whose shares were wearing stars and hats, also had a glorious moment. In 2016, Zhongtai launched a number of models, such as the T600 sports version, the SR9 and the Damai X5, among which SR9 became Zhongtai's "star" products after its launch. Thanks to this, Zhongtai Motor's cumulative sales reached 333100 vehicles in 2016, an increase of 50% over the same period last year, which is also the highest since Zhongtai was founded.

However, product quality problems have led to a decline in brand reputation, and Zhongtai's sales have been declining. After a decline in 2017, sales fell to 154800 in 2018 and only 116600 in 2019. Zhongtai has stopped disclosing sales figures. Whether Zhongtai, which is becoming more and more difficult, can survive 2020 is also a topic of great concern to the industry.

Lifan Automobile Holdings was ruled to merge and restructure

On August 31, Lifan shares announced that 11 companies, including controlling shareholder Lifan Holdings and shares, were ruled by the Chongqing Fifth Intermediate people's Court for substantive merger and restructuring.

Lifan shares pointed out in the announcement that although the reorganization and the completion of the implementation of the reorganization plan will help to optimize the company's asset-liability structure and improve the company's operating conditions, Lifan shares still face the risk of bankruptcy due to restructuring failure.

According to the relevant announcement, under the background that the existing assets are no longer sufficient to pay off the existing debts, and the controlling shareholders have been unable to pay off their maturing debts, even if the bankruptcy restructuring of Lifan Holdings is successful, the company's follow-up business and financial indicators still need to meet the regulatory requirements, otherwise, the company's shares are still at risk of being delisted or terminated.

According to the latest results released by Lifan shares on Aug. 28, operating income fell 69.42% to 1.584 billion yuan in the first half of 2020, while net profit plunged 173.99% to-2.595 billion yuan. As of the current period, the net assets of Lifan shares were only 106 million yuan, down 96.12% from the same period last year.

In addition, Lifan shares have a large number of litigation risks and face huge debts. The announcement shows that at present, the company is involved in 1178 lawsuits (arbitration), involving an amount of 5.037 billion yuan. The litigation will have a significant impact on the follow-up production and operation of the company, and the company reminds investors to pay attention to the risks.

With the impact of COVID-19 's epidemic on the domestic automobile market, including Zhongtai Automobile, Lifan Automobile, Cheetah Automobile and other car companies have fallen into a "dead end" one after another, and may become the first Chinese car companies to be "eliminated" in 2020. From the point of view of Zhongtai and Lifan, even if the controlling shareholders successfully pass the judicial reorganization, there is still a lot of uncertainty in the later development, and perhaps only time can give the answer.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.