In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)09/03 Report--

After two consecutive years of decline, the domestic automobile market has shown fatigue. In 2020, coupled with the impact of the COVID-19 epidemic, the automobile market is further depressed, making it more and more difficult to sell domestic cars. This has led to varying degrees of decline in the performance of car companies or dealer groups.

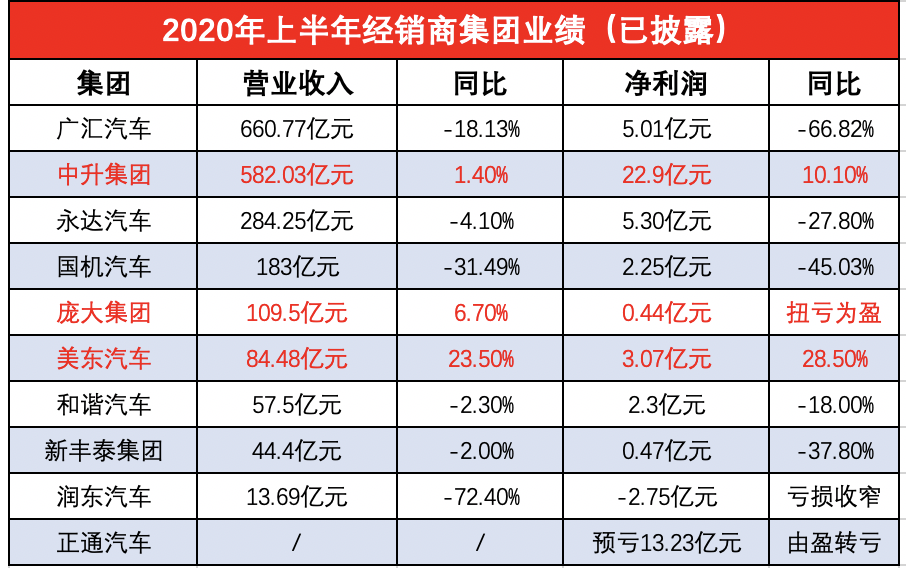

According to the mid-year results disclosed by 10 mainstream car dealer groups in China a few days ago, seven groups have seen a year-on-year decline in revenue and net profit, while only three have bucked the trend. Whether it is Guanghui Automobile, which is the largest in China, there has also been an obvious decline in performance, with profits falling by more than 60%, and it has also become the group with the largest decline; on the contrary, the huge group that has achieved restructuring has achieved growth against the trend, which shows that the market is really difficult.

Specifically, the revenue of Guanghui Automobile, the largest in China, reached 66.077 billion yuan in the first half of the year, down 18.13 percent from the same period last year, and the net profit was 501 million yuan, down 66.82 percent from the same period last year. In terms of sales, the group's cumulative new car sales in the first half of the year were 314200, down 26.7% from the same period in 2019.

According to industry analysis, its performance is similar to that of SAIC. Although it has the largest volume, it is difficult to adjust in time under the impact of the epidemic because of its numerous layout, so that the overall performance in the first half of the year failed to reflect the first level of the industry and became one of the worst performing groups.

Although Zhongsheng Group, which is not as large as Guanghui Motor, became the most outstanding car company in the first half of this year. According to the report, the company achieved 58.203 billion yuan in revenue in the first half of the year, up 1.4% from the same period last year, while the profit attributable to the owner of the parent company was 2.29 billion yuan, up 10.1% from the same period last year. Sales showed that the group sold 197188 new cars in the first half, down 7.8 per cent from the same period in 2019. Despite a slight decline in sales, Zhongsheng's sales revenue and profits have both achieved positive growth.

The expert committee of the China Automobile Circulation Association said that thanks to the fact that the sales and profits of Mercedes-Benz, Lexus, BMW and Toyota in Zhongsheng's brand portfolio were better than those of other brands in the first half of the year, it was even said that "the interim results released by Zhongsheng can be regarded as a weather vane for luxury car dealers in the first half of the year." It means that the "successful" performance of Zhongsheng Group in the first half of the year is mainly due to the luxury brand market.

Like Zhongsheng Group, Meidong Motor and large groups were able to reverse the trend, with first-half earnings of 8.448 billion yuan, up 23.5% from the same period last year, and after-tax profit of 307 million yuan, up 28.5% from the same period last year. This is also due to the fact that luxury brands continue to be the group's core source of sales revenue, accounting for about 84.3% of passenger car sales revenue.

Data show that Meidong Automobile Group currently has 60 4S stores, including 7 Porsche, 24 BMW, 15 Lexus, 12 Toyota, 1 Hyundai and 1 Audi. The combination of mainstream luxury brands and Japanese brands, which have made money this year, has allowed Meidong Automobile Group to continue to make money.

As for large groups, the company achieved operating income of 10.95 billion yuan in the first half of the year, an increase of 6.72% over the same period last year, and the net profit belonging to shareholders of listed companies was 44 million yuan, which eventually rebounded to turn losses into profits.

In contrast, Yongda Automobile and Harmony Automobile, which are also focused on luxury brands, are a little gloomy, although their performance outperformed the market, but they were still hit by the epidemic. The worst performance was Zhengtong Motor and Rundong Motors, which were greatly affected by the epidemic and were deeply confused by the group's funds, resulting in a number of 4S stores being exposed that they could not deliver their vehicles on time, and consumer complaints about rights protection occurred frequently.

There is even news that the group has defaulted on an installment loan of about $100 million. According to the official document, 30% of the loan principal and interest will be repaid in two installments, the installment loan will be extended until January 2021, and the financial difficulties are being solved by selling shares. Including Rundong Motor is also in financial difficulties, due to a debt of 1.66 million creditors filed for bankruptcy restructuring.

Although Yongda Automobile, Harmony Automobile and Xinfengtai Group, which are in the second echelon, also experienced varying degrees of decline in performance in the first half of this year, the overall decline was caused by the market affected by the epidemic. Yongda Motors, which has the biggest decline, said that as the market recovery group's business gradually returned to normal in the second half of the year, it would continue to increase the proportion of luxury car sales in the second half of the year. Yongda currently has an asset-liability ratio of 67.72% in the first half of 2020, an increase of 10.2% over the same period in 2019.

Looking at the performance of a number of mainstream dealer groups in the first half of this year, it can be said that it is "even worse". After all, the current domestic market continues to malaise, coupled with the impact of the epidemic is bound to bring no small impact. According to the latest dealer survey report released by the China Automobile Circulation Association, only 21.5% of the dealers in the country achieved positive sales growth in the first half of 2020, that is, 80% of the car dealers' sales declined.

However, for dealer groups, owning more luxury brands has become an "anti-fall artifact", so that more and more dealers are increasing the proportion of luxury brands. As for those marginal luxury brands will be eliminated, which means that some luxury brands may be even more difficult, while the sales of the more advantageous first-tier luxury brands may continue to be popular in the market.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.