In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-21 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)09/11 Report--

Learned from the official website of the Bancassurance Regulatory Commission, in order to implement the "guidance on the implementation of comprehensive vehicle insurance reform" on improving the level of traffic insurance insurance requirements. The China Banking and Insurance Regulatory Commission recently issued a notice on adjusting the limit of liability and the floating coefficient of premium rates for compulsory insurance.

According to the announcement, it is divided into three parts:

First, the content of the new liability limit scheme, which clearly defines the death and disability compensation limit of 180000 yuan for traffic insurance, 18000 yuan for medical expenses, and 2000 yuan for property loss compensation.

When the insured has no liability, the compensation limit for death and disability is 18000 yuan, the compensation limit for medical expenses is 1800 yuan, and the compensation limit for property loss is 1800 yuan.

Compared with the original liability limit, except for the property loss compensation limit, the death and disability compensation limit and the medical expense compensation limit have been greatly increased.

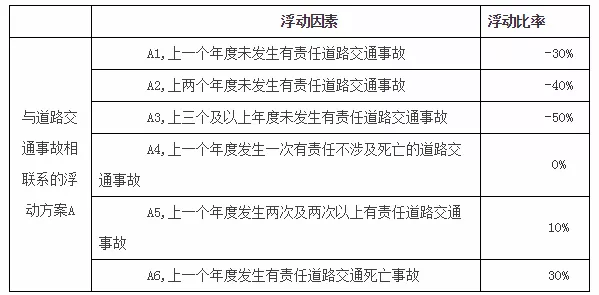

The second is the content of the new rate floating coefficient scheme, which makes it clear that the rate floating coefficient scheme in all regions of the country is subdivided from the original category 1 into five categories, the upper limit of the floating ratio remains unchanged at 30%, and the floating rate is expanded from the original lowest-30% to-50%. Increase the preferential rate for consumers without compensation.

By introducing five kinds of rate floating coefficients, the problem that the compensation rates of traffic compulsory insurance vary greatly among different places is alleviated to a certain extent, and the lower level of compensation rates of strong traffic insurance in some areas is improved.

There are six rate fluctuation factors in these five types of schemes, which are: no responsible road traffic accidents occurred in the previous year; no responsible road traffic accidents occurred in the previous two years; no responsible road traffic accidents occurred in the previous three or more years; there was a road traffic accident in the previous year that did not involve death; two or more responsible road traffic accidents occurred in the previous year. A responsible road traffic accident occurred last year.

Among them, Plan An of rate adjustment is implemented in Inner Mongolia, Hainan, Qinghai and Xizang, with a floating ratio of up to 50% to 30%, and Plan B is implemented in Shaanxi, Yunnan and Guangxi. the floating ratio ranges from 45% to 30%, and so on.

Third, the switching time and transition arrangements are stipulated, and it is clear that if a road traffic accident occurs after 00:00 on September 19, 2020, the new and old compulsory insurance policies will be carried out in accordance with the new liability limit.

If a road traffic accident occurs under the traffic insurance policy under the compulsory traffic insurance policy that has not ended as of 00:00 on September 19, 2020, the new liability limit shall be followed; if a road traffic accident occurs before 00:00 on September 19, 2020, the original liability limit shall remain the same.

In addition, the announcement will be formally implemented on September 19, 2020. In the next step, the Bancassurance Regulatory Commission will guide all bancassurance supervision bureaus, property insurance companies and relevant units to do a good job in the work of compulsory traffic insurance to ensure that the reform of compulsory traffic insurance is carried out in a steady and orderly manner.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.