In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)09/15 Report--

Affected by the trend of accelerated decline in the market in the past two years and the superimposed epidemic situation, car companies that do not have an advantage have become even worse, not only in the overall, Lifan and other car companies that are facing "bankruptcy." even brilliance, as a veteran car company, has come to the brink of delisting.

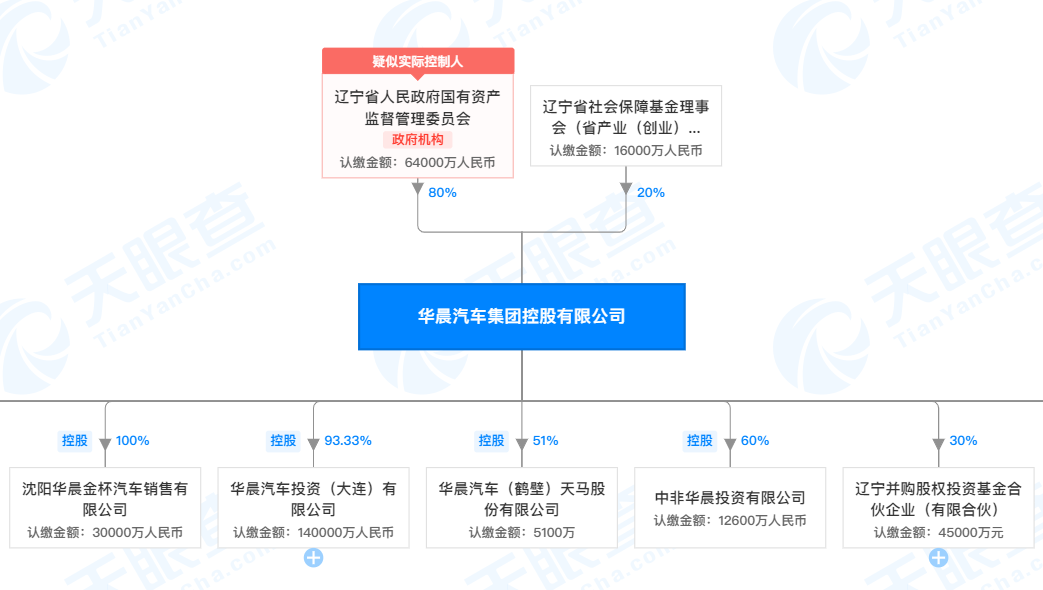

As of September 15, brilliance Automobile Group holding Co., Ltd. had been executed 15 times in September, with a total amount of 246 million yuan, according to APP.

As we all know, brilliance, as an established domestic car company, has been the main force of China's automobile industry since it was founded in 2002, and it has been developed for 17 years. Brilliance is the only partner of BMW in China, making it have the label of "BMW" all the time.

And BMW as a best-selling luxury brand, with the upgrading of the consumer market in the past two years, brilliance also relies on brilliance BMW to achieve a lot of revenue. According to brilliance Automobile recently released the first half of 2020 results report. Brilliance China's revenue in the first half of this year was 1.45 billion yuan, down 23.85% from a year earlier, while net profit was 4.045 billion yuan, up 25.24% from a year earlier, according to the report.

It can be seen that brilliance China in the case of a sharp decline in operating revenue, still benefit from the profit contribution of brilliance BMW, so that its net profit is not falling but rising, bringing good revenue for the company.

However, since July, brilliance has been caught in a "stock debt" storm, with hundreds of billions of yuan in debt, and a number of equity shares have been frozen. what is more serious is that brilliance's three independent brands lack the ability to make a hematopoiesis, unable to provide the possibility for brilliance to turn around. Its two independent brands, China and Huasong, all sold zero cars in July. In other words, excluding the profit share from brilliance BMW, brilliance China's other sectors lost 338 million yuan in the first half of this year.

According to public financial data, by the end of March 2020, brilliance had total assets of 175.437 billion yuan, net assets of 52.762 billion yuan, total liabilities of 122.675 billion yuan and short-term interest-bearing debt of 48.4 billion yuan.

Although brilliance has four listed companies, including brilliance China (01114.HK), Golden Cup Motor (600609.SH), Shenhua Holdings (600653.SH) and Xinchen Power (01148.HK), with 47000 employees, its performance depends on the joint venture brilliance BMW, which can be called the "profit cow" of brilliance.

In addition to the debt problem, brilliance is also caught in a whirlpool of equity freezes and legal disputes. Public data show that since July this year, brilliance Automobile Group held at least 10 shares in five companies, have been frozen by the relevant courts, the amount is as high as 1.5 billion yuan, for up to three years. At the same time, brilliance is also involved in large legal proceedings, as well as a number of companies applying for property preservation.

As a result, hundreds of billions of dollars in debt and 10 shares have been frozen, which has left brilliance with a big funding gap, which obviously cannot be reversed by relying solely on its own brand, even with the support of BMW, which is a "profit cow". Probably not for long.

According to the announcement agreement agreed between brilliance and BMW in 2018, brilliance's 25 per cent stake in BMW is proposed to be sold to BMW for 29 billion yuan, and the deal is expected to be completed no later than 2022. It means that brilliance's share of profits from the joint venture will be halved after the completion of the contract. At that time, brilliance will be able to achieve even less profit revenue, which may lead to an even greater crisis for the company.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.