In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)09/17 Report--

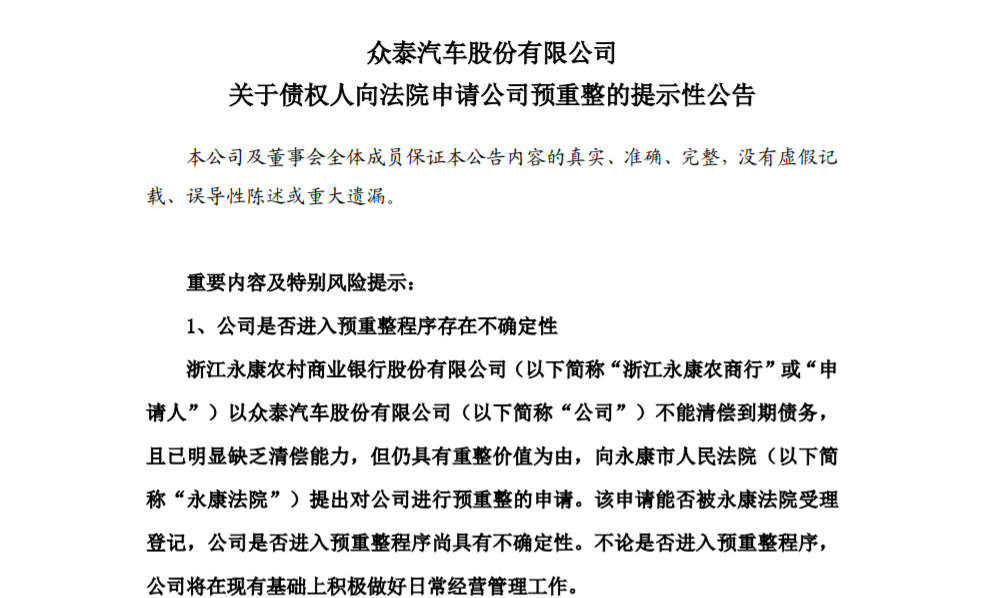

On the evening of September 16th, * ST Zhongtai issued an indicative announcement on creditors applying to the court for company pre-restructuring. The announcement shows that Zhejiang Yongkang Rural Commercial Bank Co., Ltd. (hereinafter referred to as "Zhejiang Yongkang Agricultural Commercial Bank"), on the grounds that Zhongtai Motor is unable to pay off its due debts and obviously lacks solvency, but still has restructuring value, apply to the people's Court of Yongkang City for pre-restructuring of the company, but whether the application of Zhejiang Yongkang Agricultural Bank can be accepted and registered by the court. There is still uncertainty about whether Zhongtai Motor will enter the pre-restructuring process.

According to the announcement, in August 2019, Zhejiang Yongkang Nong Commercial Bank and other four banks, as initial lenders and Zhongtai Motor as borrowers, signed the "RMB 3 billion liquidity syndicated loan contract." after signing the contract, Zhejiang Yongkang Nong Commercial Bank issued a loan principal of 150 million yuan to Zhongtai. After issuing the loan, Zhongtai Motor paid interest until March 20, 2020, and the loan matured on August 14, 2020. Zhongtai Motor is unable to repay the principal of the loan due at 150 million yuan and the interest after March 20, 2020.

Zhongtai Automobile, which was founded in 1998, can be regarded as an established domestic brand. Due to a high degree of imitation of luxury brand models, Zhongtai car sales have been soaring, with a market capitalization of up to 38.6 billion yuan, and then due to product problems leading to a decline in performance and dealer rights protection, the current market capitalization of Zhongtai Automobile is only 2.8 billion yuan.

On June 22, Zhongtai Automobile released results showing that revenue in 2019 was 2.986 billion yuan, down 79.78 percent from the same period last year, while the net loss was 11.19 billion yuan, down 1498.98 percent from the same period last year. Subsequently, the shares of Zhongtai Automobile Company were treated with "delisting risk warning", and the stock abbreviation was changed from "Zhongtai Automobile" to "* ST Zhongtai".

Zhongtai Automobile released its semi-annual report on Aug. 29, showing that revenue in the first half of the year was 770 million yuan, down 76.69% from the same period last year, while the net loss was 1.034 billion yuan, down 256.08% from the same period last year.

This also attracted regulatory attention, and the Shenzhen Stock Exchange quickly issued an inquiry letter to Zhongtai Motor, opening the "Soul 17 questions." The Shenzhen Stock Exchange requires Zhongtai Automobile to explain the reasons for the sharp decline in revenue and net profit in the light of changes in industry conditions and gross profit margin. It also requires Zhongtai Automobile to explain whether vehicle sales and sales revenue match.

The technical strength of Zhongtai Automobile is weak, the old models have been slow to upgrade the national six standards, and the development of new models has been slow, and now it has been applied for restructuring by creditors. In the current environment of intensified reshuffle in the automobile industry, Zhongtai Automobile is teetering in the market. according to the current performance of Zhongtai Automobile in the market, it is only a matter of time before it collapses completely.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.