In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-21 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)09/17 Report--

Xiali, once one of the representatives of the national sedan chair, encountered the rapid development of the domestic car market, but now it is about to bid farewell to the whole vehicle business. On the evening of September 16, Tianjin FAW Xiali Automobile Co., Ltd. (issued the "report on Major Asset Sale and issuing shares to purchase assets and raise matching funds and related transactions", defining the specific plan of the latest restructuring.

It is understood that this plan will involve four parts: the free transfer of FAW Xiali shares held by FAW shares, the sale of major assets, the issuance of shares to purchase assets and the raising of supporting funds. As of the date of signing of the summary of this report, FAW shares hold 761427612 shares of FAW Xiali, with a shareholding ratio of 47.73%, and it is proposed that all the shares held will be transferred to Iron shares free of charge.

In addition, FAW Xiali plans to issue shares from China Iron, Iron shares, Wuhu Changmao, structural Adjustment Fund, ICBC Investment, Agricultural Bank of China Investment, Runnong Ruihang Bank and Eaton Fund to buy its combined 100% equity in China Railway Wusheng Technology and iron shares in Tianjin Company and 100% equity in total trade. The total amount of matching funds to be raised by FAW Xiali will not exceed 1.6 billion yuan.

At the same time, after FAW Xiali transferred all its assets and liabilities except 17.5% equity of Xinan Insurance and remaining input tax to Xiali operation as of the evaluation base date, FAW Xiali intends to sell 100% equity of Xiali Operation and 17.5% equity of Xinan Insurance to FAW shares. FAW designated FAW assets as the receiver. FAW Xiali will directly transfer 100% equity in Xiali operation and 17.5% equity in Xin'an Insurance to FAW assets.

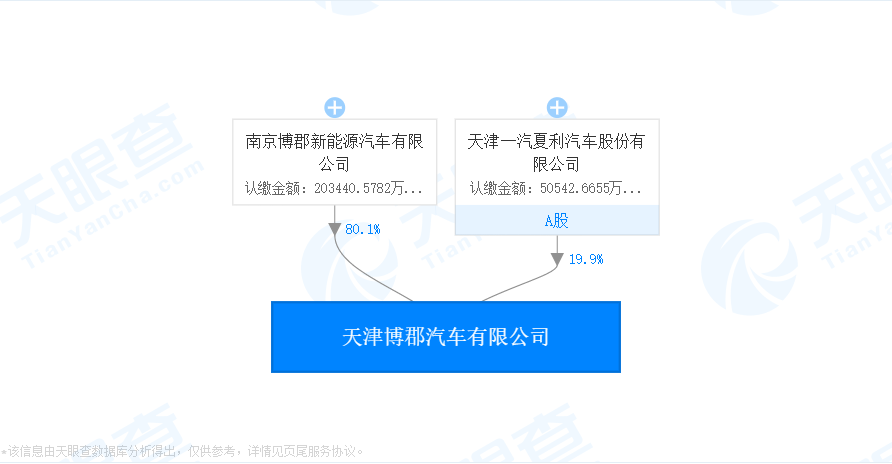

Although FAW Xiali declined several years ago, in May this year, FAW Xiali officially signed a downward move in Nanjing Zhixing, Huali Company, and Xiali Operation Company in Tianjin to transfer Huali's equity at a symbolic price of "1 yuan". At the same time, put aside Huali's debt of about 850 million yuan. It is precisely in order to enable Tianjin Bojun to win the production qualification and start to build cars, and the enterprise name has been changed to "Tianjin Bojun Automobile Co., Ltd." from then on.

However, the restructured Tianjin Boxun is also bumpy. Due to the delay in starting construction, Tianjin Boxun employees have only been paid twice, namely in December last year and April this year, and the wages owed in the rest of the month have not yet been paid. Since August 1, the company has been out of business for a period of three months. at the same time, it has also begun to seek potential investors. if it fails to find investors at the expiration of the closure period, it means that Tianjin Boxun will enter the process of dissolution and liquidation.

In April this year, it was revealed that more than 200 employees from FAW Xiali went to Bo County and reported to the Central Commission for discipline Inspection that there were violations of discipline and law in the process of mixed reform of FAW Xiali and Boxun cars, because their superiors were well aware that Boxian cars were still reorganized, causing many employees to stop work.

Although FAW Xiali has been hovering on the edge of delisting for many years, it has been repeatedly warned of delisting. However, because the high probability of delisting means it is difficult to turn around, it has to obtain additional income through evaluation and asset transfer to eliminate the risk of delisting. Data show that FAW Xiali made a cumulative loss of more than 7.5 billion yuan from 2014 to 2018. According to the 2019 results forecast issued by FAW Xiali on January 22, FAW Xiali made a pre-loss of 1.25 billion yuan to 1.39 billion yuan in 2019, compared with a profit of 37.31 million yuan in the same period last year, down 3450.31% from a year earlier. 3825.54%.

In the five years of losses, FAW Xiali had to sell its property in order to ease the financial pressure. FAW Xiali sold the internal combustion engine manufacturing branch, transmission branch, product development center and automobile research center. In addition, FAW Xiali will transfer 15% of its shares in FAW Toyota to FAW twice at a price of 2.56 billion yuan and 2.923 billion yuan.

In the first half of this year, FAW Xiali's operating income was 100.1 million yuan, down 65.25% from the same period last year, and the net profit after deducting non-return was-243 million yuan. According to FAW Xiali's latest restructuring plan, the successful completion of the reorganization means that FAW Xiali will also bid farewell to A shares. At the same time, FAW Xiali will actively promote the major asset restructuring with China Iron, and its business will be transformed into material supply services and productive services oriented to the railway rail transit industry. From then on, FAW Xiali will also bid farewell to the whole vehicle business.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.