In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)09/28 Report--

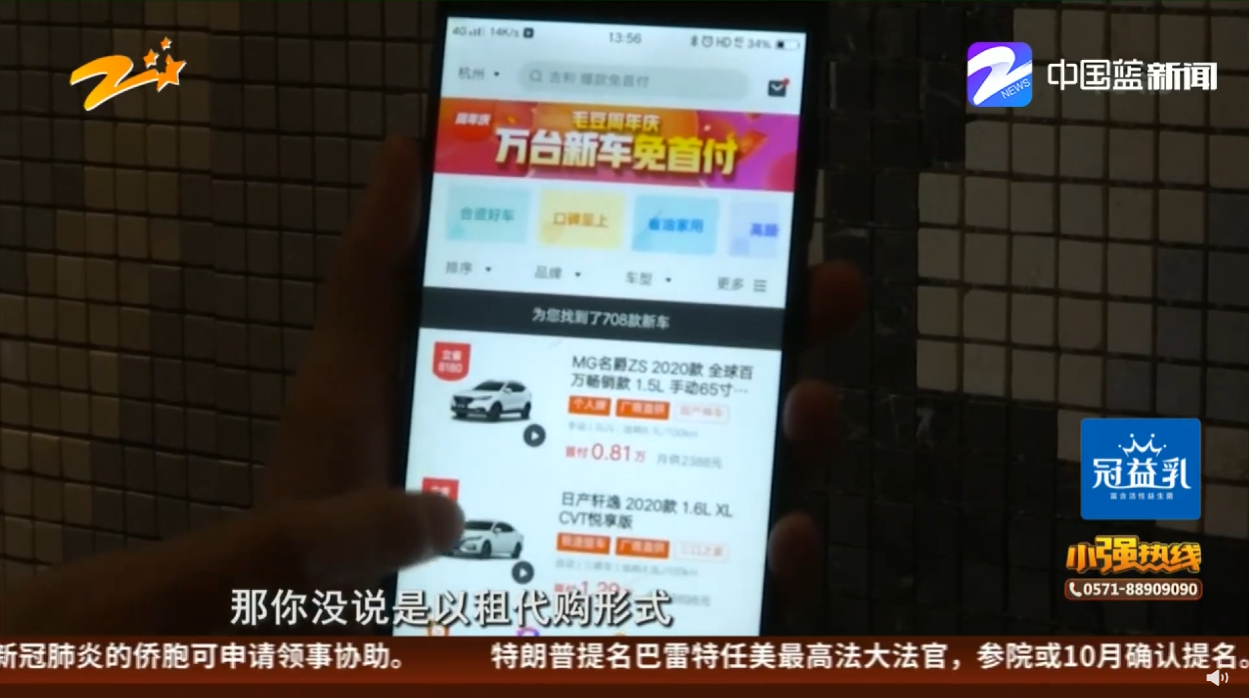

Mr. Chen bought a new car online through edou, but unknowingly signed a financial lease contract, and the car was finally rented, and the loan interest rate was ridiculously high. What happened during that time?

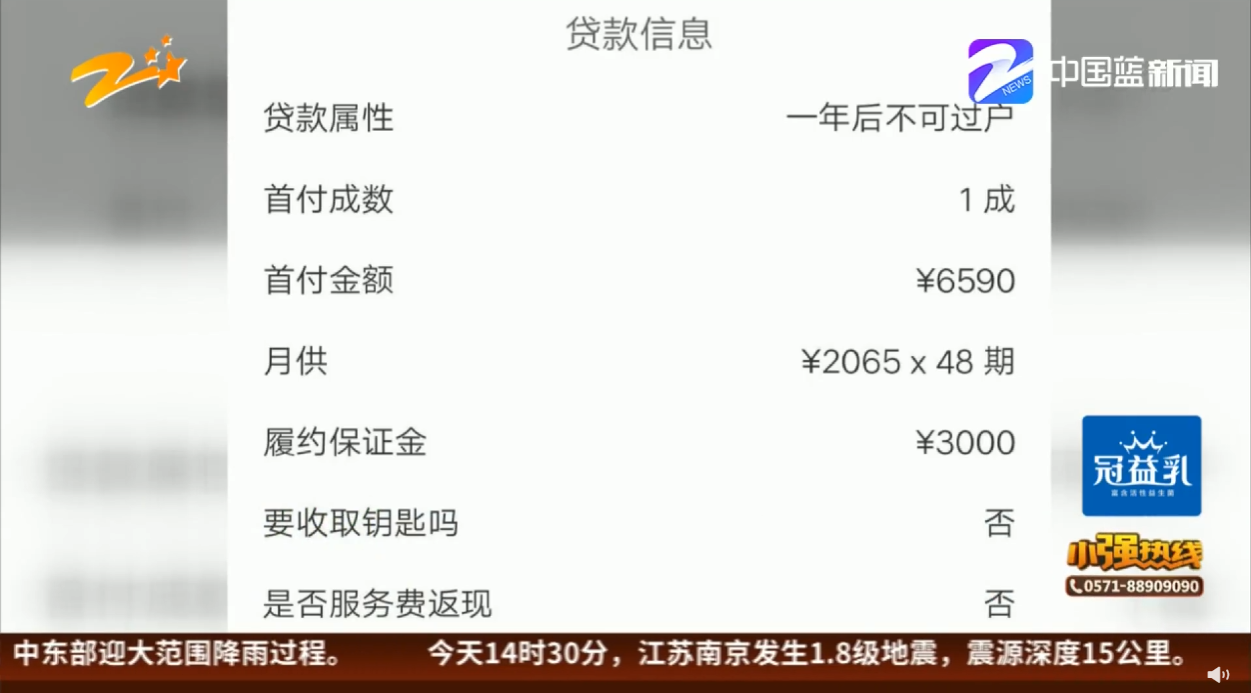

Mr. Chen took a fancy to a Kia Huanchi in the new car network of edou. The price of the platform was 65900 yuan. Mr. Chen planned to make a loan to buy it, so a salesman contacted him. At that time, the salesperson and Mr. Chen decided on a loan plan, 10% of the down payment for the car is 6590 yuan, the monthly payment is 2065 yuan, a total of 48 installments. On the same day, Mr. Chen made a down payment of 6590 yuan and a deposit of 3000 yuan. When he went back, Mr. Chen found the problem.

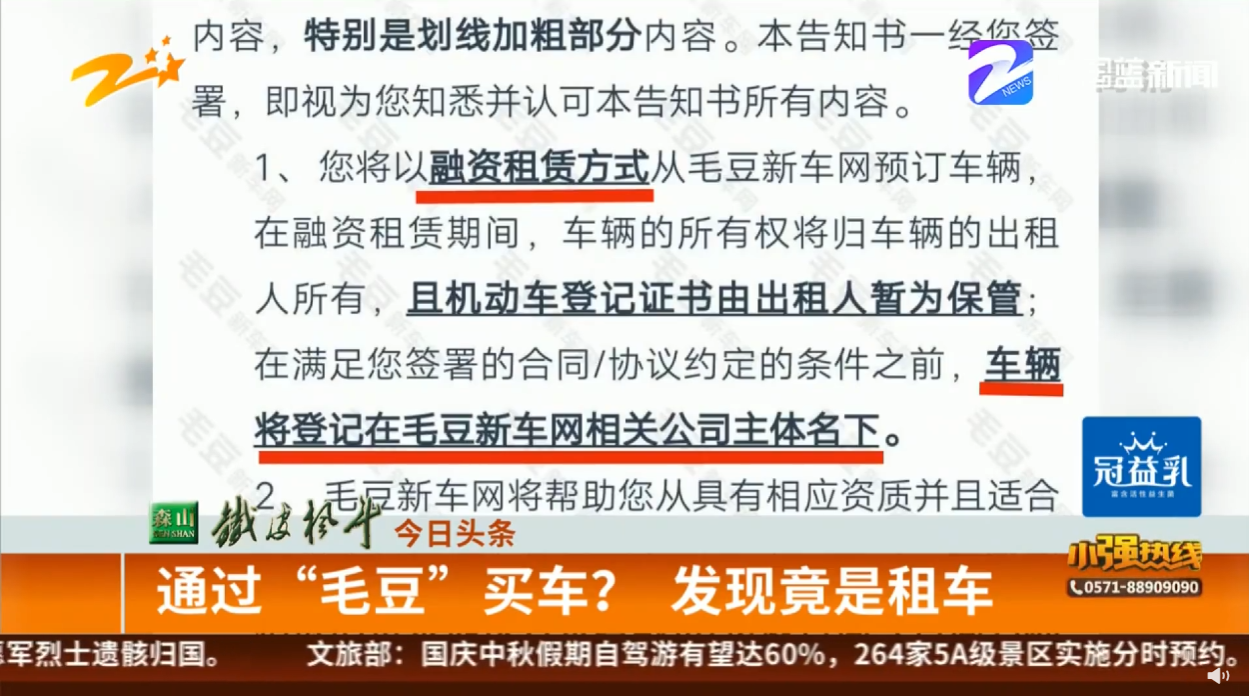

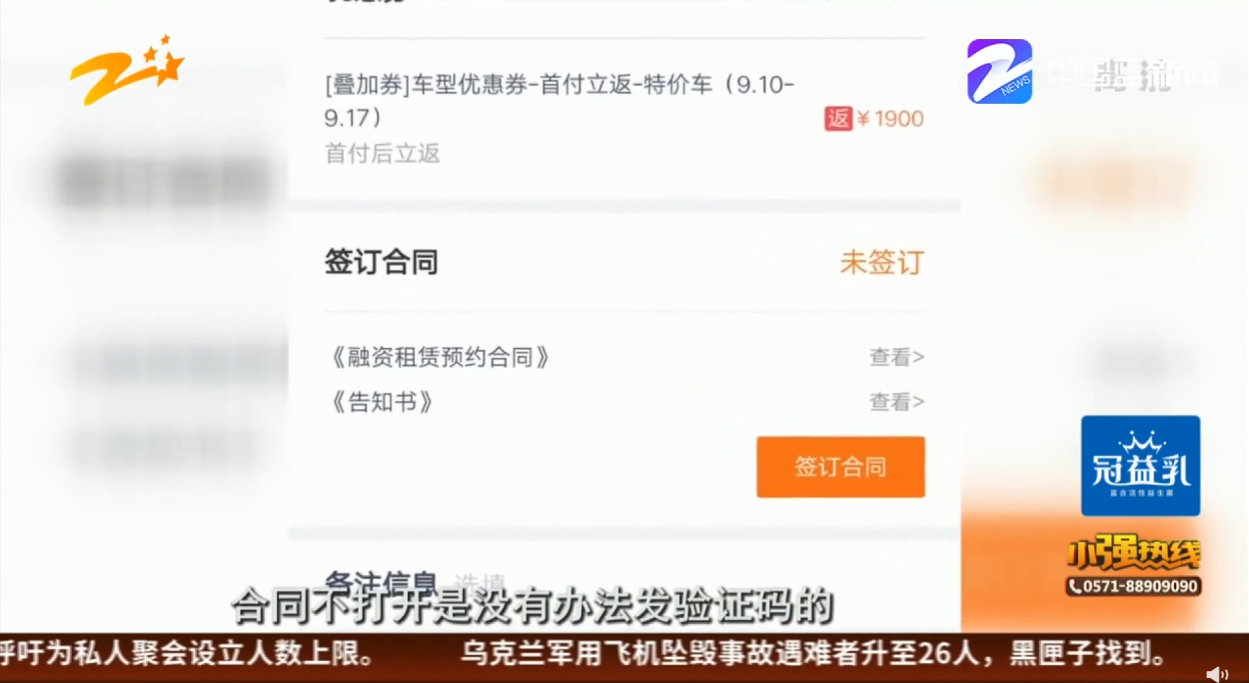

After Mr. Chen went back, he saw an electronic contract on the mobile platform of the new car network, with his own name on it. Upon careful examination, he found that he was using the car in the way of financial leasing, and the vehicle was registered in the name of the company related to the new car network. The ownership does not belong to him.

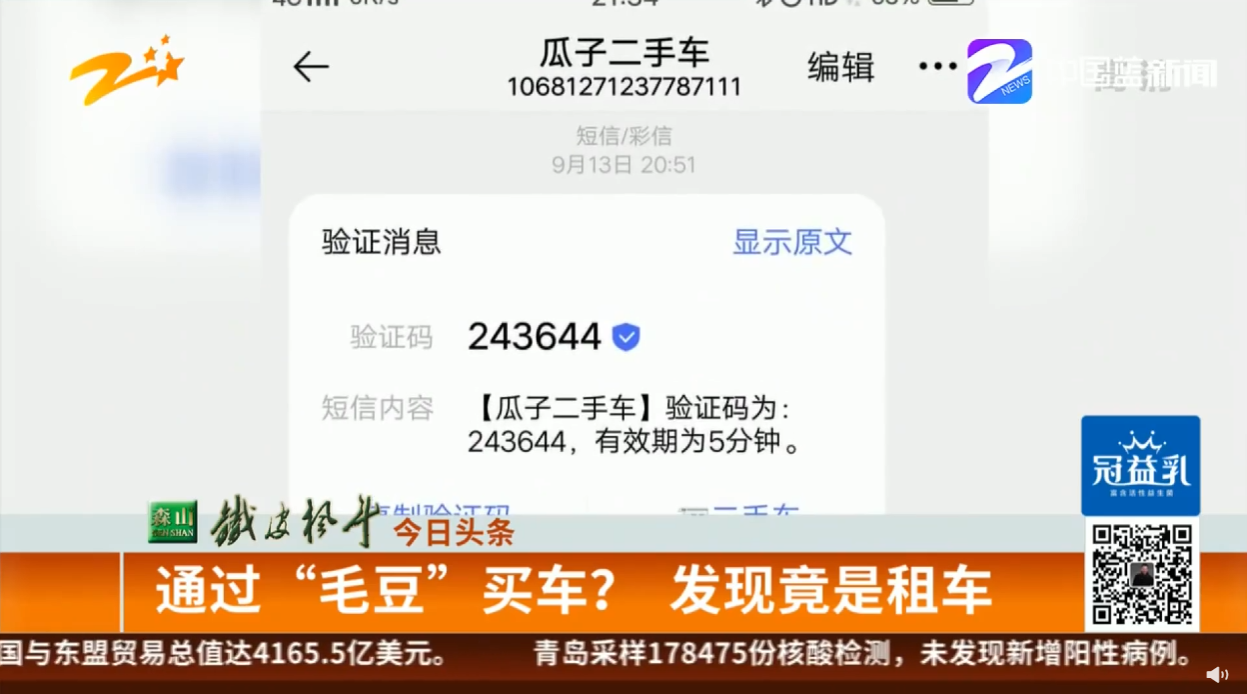

Mr. Chen said that during the interview with him, the salesperson never mentioned that the so-called "buy" was essentially a "lease." what made him even more angry was that at that time, the salesperson asked him to send a CAPTCHA, which was used to sign an electronic contract. but he didn't know.

I wanted to buy a car, but in the end, I rented a car. In this case, Mr. Chen said that he would rather default than borrow in this way.

Hangzhou edou new car Xiaoshan store salesperson denied that this thing must be clear, at that time told customers about the company brand company households, the contract is "rent instead of purchase." Mr. Chen stressed that at that time, he only said that the package tax should be paid by the company, but he did not understand that the meaning of the package tax by the company meant that the ownership of the vehicle belonged to the company.

In view of the situation that sending a CAPTCHA is to sign a contract, the manager of the Xiaoshan store said that the CAPTCHA can only be issued if the contract is opened, but Mr. Chen said, "I didn't know that sending the CAPTCHA was to sign the contract."

Now Mr. Chen proposes that he would rather pay liquidated damages than use the car again. After negotiation between the two sides, the manager of Xiaoshan store said that Mr. Chen needs to pay 5% of the liquidated damages in accordance with the contract, and can help Mr. Chen with a refund. The company will first go to the bank to cancel the loan, and after the cancellation, the company will initiate a refund. The money can be transferred to Mr. Chen's account within about 10 working days.

In addition, Mr. Chen calculated and repaid the price. The total price of the car is 65900 yuan. Although the down payment is only 6590 yuan, the four-year loan plus principal can only be repaid with a total of more than 100,000 yuan. The loan interest rate is ridiculously high, and the annual interest rate is as high as 25%.

Searching for keywords such as "edou" and "renting and purchasing" on a consumer rights protection platform, we learned that most consumers complained that after they bought a car on edou new car network, the problem of buying a car became renting instead of purchasing and the loan interest rate was too high.

The original intention of car financial leasing is to break the high threshold of car purchase and let consumers realize their car dream with lower expenditure. However, behind the hot market, there is a bit of a change in "rent instead of purchasing", and even some behavior has something to do with fraud.

The car is not in his name, and coupled with the exorbitant loan interest rate, Mr. Chen would rather default than continue the loan in this way. Through this incident, Mr. Chen also reminded consumers to listen carefully to the salesperson when buying a car, which may be different from the contract, and to measure the way such loans buy cars.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.