In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)10/03 Report--

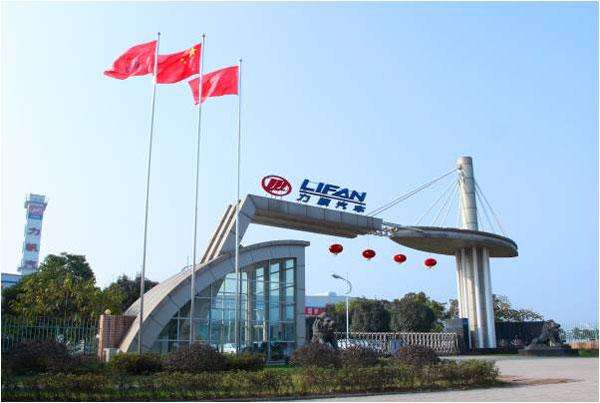

According to Lifan's latest announcement, Geely confirmed its participation in the judicial restructuring of Lifan.

A few days ago, Lifan issued a "Progress notice on recruiting restructuring investors", saying that Chongqing Liangjiang Equity Investment Fund Management Co., Ltd. and Geely Maijie Investment Co., Ltd. as a consortium, the application materials for investors with intention to restructure were submitted to the manager in accordance with the provisions of the recruitment announcement. For the application materials, the manager conducted a strict examination; within the time limit specified by the manager, Liangjiang Fund and Maijie Investment paid a deposit and signed a confidentiality agreement. It has been confirmed by the manager that the application of Liangjiang Fund and Maijie Investment is valid and is now participating in the restructuring of the company as an intended restructuring investor.

![1601721108938111.png F1{@0]KUZUF4[T693M6U[AB.png](https://www.autochat.com.cn/uploadfile/ueditor/image/20201003/1601721108938111.png)

Data show that Geely Maijie Investment Co., Ltd. was established on October 27, 2015, the legal representative is Xu Zhihao, the scope of business includes industrial investment; investment consulting, fiduciary enterprise asset management. In the company's shareholder information, Geely Technology Group Co., Ltd. holds 99% of the shares, while Hangzhou Geely Technology Co., Ltd. holds 1%. Therefore, the actual control is Li Shufu.

It means that Geely has begun to participate in the restructuring of Lifan.

On August 21, 2020, the court decided to accept the judicial reorganization of Lifan shares and appointed the Lifan enterprise liquidation group as the manager.

The court held that Lifan shares have been unable to pay off the maturing debt, and the current monetary capital is 43 million yuan, the maturing debt is 1.196 billion yuan, and other property is illiquid and cannot be realized, so it should be determined in accordance with the law that it obviously lacks the ability to repay. Therefore, Lifan shares have reasons for bankruptcy. Because Lifan shares have the reason of bankruptcy, if it is not rescued in time, it will bring great losses to the interests of creditors, shareholders, employees and other stakeholders, and its reorganization is necessary. Lifan shares have been engaged in the automobile and motorcycle industry for many years, have relatively complete production qualifications and mature production technology, and have established a relatively complete industrial chain system with many sales channels and restructuring value. it is proposed to achieve restructuring through equity restructuring, debt restructuring, asset restructuring, operation restructuring, the restructuring plan is feasible. To sum up, the court accepted the applicant Chongqing Jiali Jiaqiao Lighting Co., Ltd. for the reorganization of the applicant's Lifan shares.

Lifan also reminded investors that the company was ruled by the court to accept the restructuring, there is a risk of bankruptcy due to the failure of the restructuring. If the company is declared bankrupt, the company will be liquidated and its shares will face the risk of being terminated.

Lifan shares in the passenger car business continued to decline, resulting in large losses, high debt, large debt overdue and other situations, and finally embarked on the road of bankruptcy reorganization. Geely as a restructuring investor into the Lifan restructuring project, is expected to achieve Geely's further expansion plan, but the details of Geely's move are not known yet. Prior to this, Geely Holdings Group officially hosted Changfeng Cheetah Changsha factory, after which Geely will introduce new energy vehicle products and technologies to promote resource integration.

The suspension of the automobile business and the huge losses caused by operating problems have made Lifan face a serious crisis. In 2019, Lifan recorded a loss of 4.682 billion yuan; in the first quarter of 2020, Lifan recorded a loss of 197 million yuan.

The production and marketing report shows that from January to August, Lifan sold a total of 1183 traditional passenger cars, down 94.5 percent from the same period last year; 661 new energy vehicles, down 60.5 percent from the same period last year; and 342175 motorcycles, down 15.6 percent from the same period last year.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.