In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)10/16 Report--

Mid-October has passed, a number of domestic car companies have released the latest performance forecasts for the first quarter, with the introduction and landing of the government and the rapid recovery of the domestic macro-economy, a number of head car companies showed varying degrees of profit growth in the third quarter, but it is still difficult for marginal car companies to recover the declining situation.

The net profit of Changan and BYD both soared, and the profit of the main business was weak.

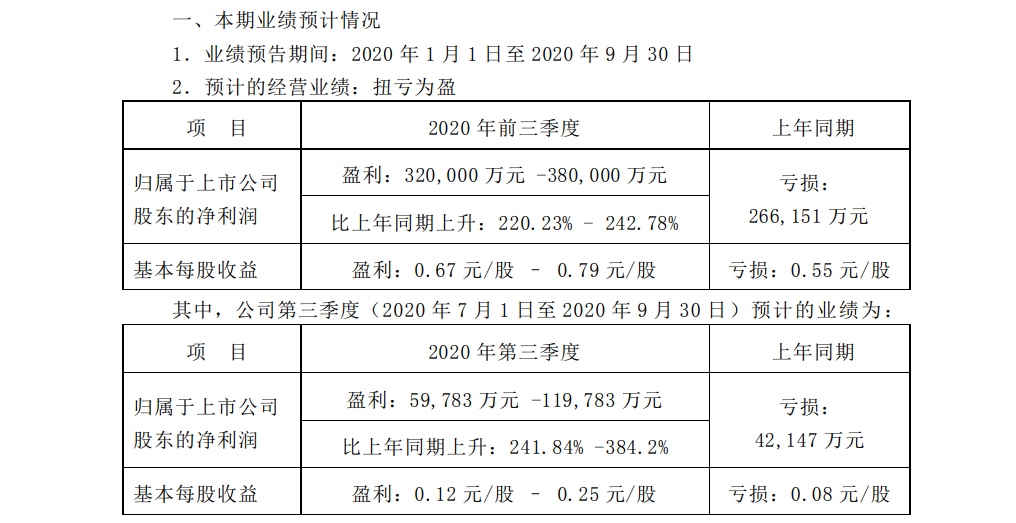

On October 15, Changan Automobile issued a forecast for its third performance, showing a profit of 5.98 to 1.198 billion yuan in the third quarter of 2020, an increase of 241.84 percent to 384.2 percent over the same period last year, and a profit of 32.0 to 3.8 billion yuan in the first three quarters, an increase of 220.23 percent and 242.78 percent over the same period last year. Changan Automobile said in the performance forecast that the sharp increase in net profit in the first three quarters was mainly due to the increase in sales volume, the optimization of product structure, the substantial improvement in the profitability of its independent business and the steady improvement in the profitability of the joint venture business.

In terms of sales volume, Changan Automobile has indeed achieved a large growth, with cumulative sales of 1370881 vehicles in the first three quarters, an increase of 12.01% over the same period last year. In terms of specific brands, Changan Ford's cumulative sales increased by 29.65% to 167133 vehicles in the first three quarters, Changan Mazda's cumulative sales increased by 1.58% to 94332 vehicles, and Changan independent brand sales increased by 20.94% to 706559 vehicles.

In addition to the return of the market to make the company profitable, Changan Automobile also said that the increase in non-operating profit and loss in the first three quarters was about 5.6 billion yuan to shareholders of listed companies, and the increase in net profit of 5.6 billion yuan mainly came from three projects:

1. Chongqing Changan New Energy Automotive Technology Co., Ltd., a wholly-owned subsidiary, introduced four strategic investors, and the company gave up the priority to increase capital. Increase the net profit belonging to the shareholders of the listed company by about 2.1 billion yuan; 2. The 50% equity held by Changan Peugeot Citroen Automobile Co., Ltd. was transferred to Qianhai Ruizhi to increase the net profit belonging to the shareholders of the listed company by about 1.4 billion yuan. 3. The share price of the Ningde era stock held by the company rose and the net profit attributed to the shareholders of the listed company was about 1.775 billion yuan.

It is not difficult to see from the financial report that although the overall profit situation of Changan Automobile is good, its main business has not been substantially improved. Changan Automobile is still in a state of loss after deducting non-operating profit and loss of 5.6 billion yuan. Of course, with the layout of a new generation of products and high-end brands, Changan Automobile may be able to change the status quo.

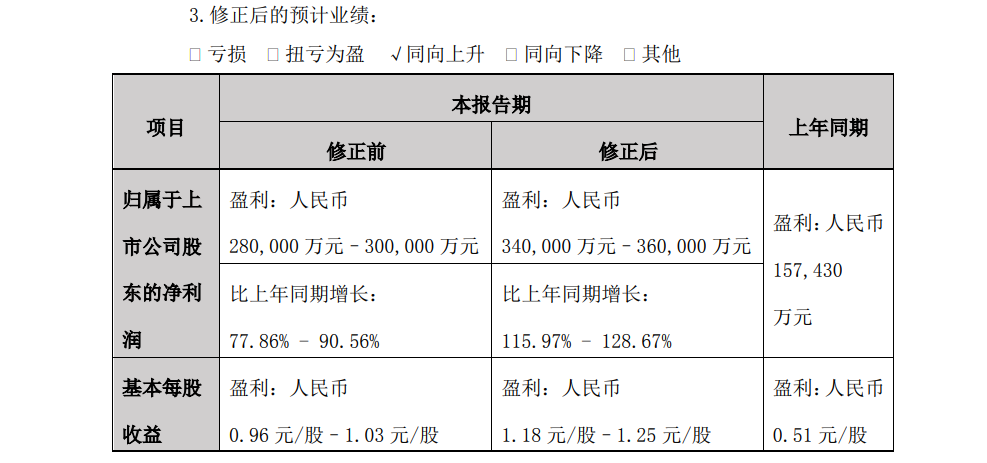

On the 12th, BYD issued a revised announcement on its results for the first three quarters, which revised its net profit from a pre-increase of 77.86% to 90.56% to a pre-increase of 115.97% to 128.67%. The total net profit for the first three quarters is expected to be 3.4 billion yuan to 3.6 billion yuan.

Previously, BYD expected net profit of 2.8 billion yuan to 3 billion yuan in the first three quarters. According to the actual market performance, BYD decided to raise its performance forecast, and the revised performance forecast was 600 million yuan higher than before, that is to say, BYD's net profit in the first three quarters is expected to be 3.4 billion yuan to 3.6 billion yuan.

BYD said that the automotive sector business achieved restorative growth in the third quarter of 2020, especially the rapid bottoming out of new energy vehicle sales and the rapid growth of its new energy vehicle sales.

According to BYD, cumulative sales from January to September 2020 were 269000, down 19.9% from a year earlier. Of this total, BYD's fuel vehicle sales rose 10.4 per cent to 158000, while BYD's new energy vehicles fell 42.4 per cent year-on-year to 110900. It is not difficult to see that some changes have taken place in BYD's sales structure this year. Although BYD's new energy recovered smoothly in September, BYD's new energy is still in the doldrums as a whole, and the development of the fuel car sector is slightly better.

Zhongtai seahorse can't hide the status quo, and the loss continues to expand.

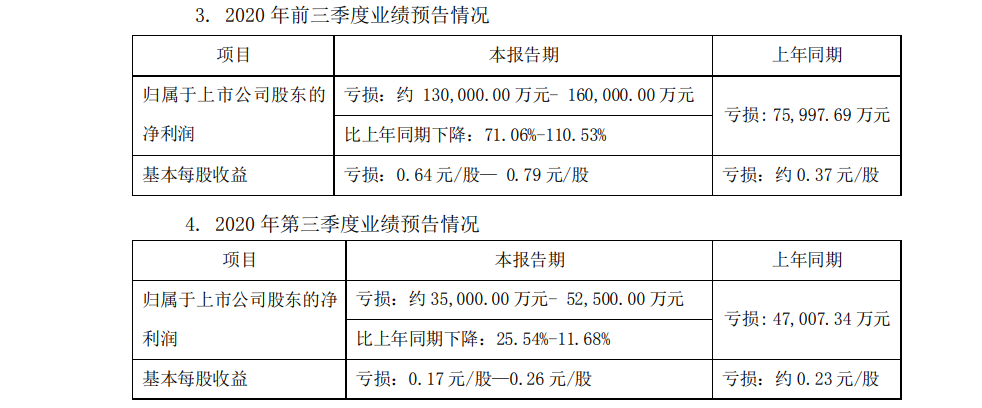

According to the results forecast for the first three quarters of 2020 disclosed by Zhongtai Motor, the company's net profit belonging to shareholders of listed companies is expected to lose 13-1.6 billion yuan, down 71.06% and 110.53% from the same period last year. Of this total, the net loss in the third quarter was 3.50-525 million yuan, down 25.54% and 11.68% from the same period last year.

Zhongtai Automobile said in the performance forecast that in the first three quarters of 2020, due to the influence of the shortage of funds superimposed by the COVID-19 epidemic and the low prosperity of the automobile industry as a whole, at the same time, due to the decline of the company's refinancing capacity and the aggravation of the capital shortage caused by overdue bank loans, the factories under Zhongtai Automobile were basically in a state of shutdown or semi-shutdown, the company's automobile production and sales dropped sharply, and sales revenue dropped sharply. As a result, the company lost a lot of money in the first three quarters of 2020.

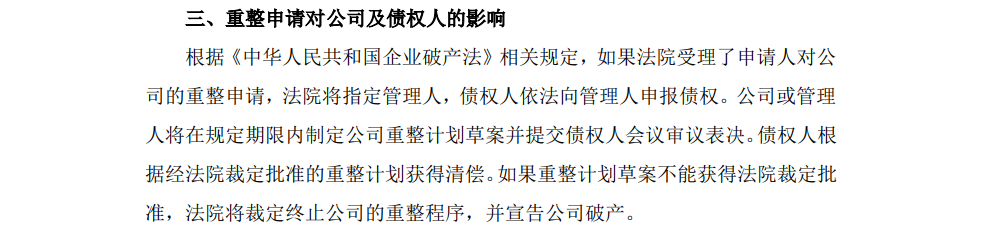

On the evening of October 12, Zhongtai Automobile announced that Zhejiang Yongkang Rural Commercial Bank Co., Ltd. submitted an application to Jinhua Intermediate people's Court for the reorganization of the company by Jinhua Intermediate people's Court. the creditors were repaid according to the reorganization plan approved by the court. If the draft reorganization plan cannot be approved by the court, the court will decide to terminate the reorganization procedure of the company and declare the company bankrupt.

The situation of seahorse cars is also not optimistic. Seahorse Motor released the latest performance forecast, the net loss in the first three quarters is expected to be 1.92-272 million yuan, of which the third-quarter net loss is 0.48-72 million yuan. Seahorse said that affected by the COVID-19 epidemic and other factors, the company's products in the domestic and overseas market performance did not meet expectations, car production and sales declined compared with the same period last year.

Haima has yet to release sales figures for the first three quarters. Data show that cumulative sales of seahorse cars fell 55.74 per cent to 8301 vehicles from January to August 2020, of which SUV sales fell 42.17 per cent to 864 and MPV sales fell 50 per cent to 33.

Seahorse Motor, which has been established for more than 30 years, is indeed at a critical juncture. After a loss of 994 million yuan in 2017, Haima continued to lose 1.637 billion yuan in 2018 and made a net profit of 85 million yuan in 2019, but the automobile business is still the biggest problem for its development.

Last month, media reported that the Hainan provincial government decided to acquire the shares held by FAW Haima (a joint venture between FAW and Haima). Hainan Development Holdings Co., Ltd. plans to replace FAW as FAW's second largest shareholder and take over with major shareholder Haima Motor.

Generally speaking, with the introduction and landing of various advantages of the government and the rapid recovery of the domestic macro-economy, a number of head car companies have been able to achieve a significant recovery in the third quarter, but it is still difficult to offset the losses caused by the first half of the year. In addition, the continuous cold winter of the car market and the difficulties encountered in the new energy automobile industry, the difficulties in the upward development of independent brands, coupled with the collective siege of joint venture brands, have also brought great pressure on the survival of independent automobile business in the stock market.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.