In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)04/11 Report--

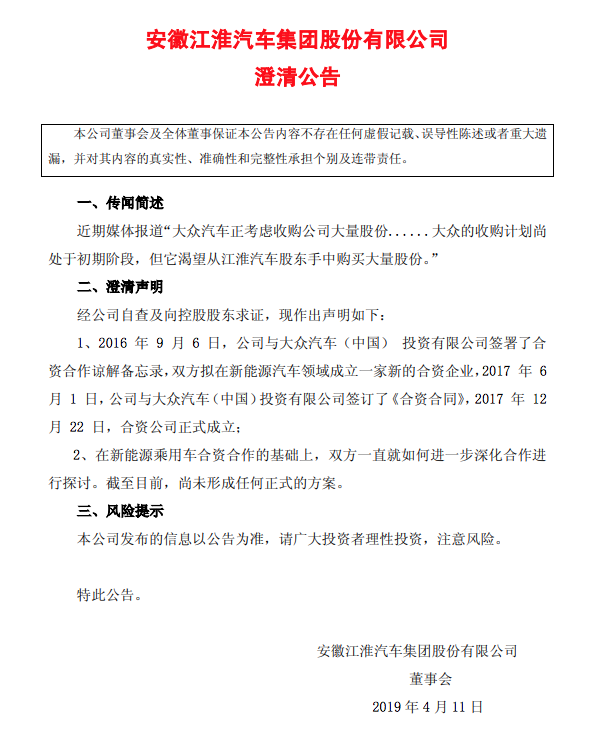

Since China announced last year that the restrictions on foreign shares in passenger cars would be lifted by 2022, many overseas car companies are ready to move. BMW is the first car company to increase its stake in brilliance BMW, except BMW. Volkswagen, Audi, Ford and Daimler all seem to be interested in increasing their holdings in the joint venture. Recently, it was reported that Volkswagen wants to buy a large stake in JAC and has hired Goldman Sachs as an adviser.

Volkswagen is considering buying a large stake in JAC Motor, its electric car joint venture partner in China, and has hired Goldman Sachs as an adviser, Reuters quoted sources as saying.

Jianghuai Motor currently has a market capitalization of about $1.7 billion. Anhui Jianghuai Automobile Group Holdings Co., Ltd., the parent company of Jianghuai Automobile, holds a 24 per cent stake in Jianghuai Automobile, which is mainly owned by state-owned enterprises and holds more than 40 per cent.

On the matter, Volkswagen said, "We are closely watching the impact of this on our business and joint venture partners." To this end, we will explore all possible options with all parties to ensure long-term success in China. "

Jianghuai Automobile responded that on the basis of the joint venture and cooperation of new energy passenger vehicles, the two sides have been discussing how to further deepen cooperation, and so far no formal plan has been formed.

Volkswagen has three vehicle joint ventures in China, including FAW-Volkswagen, SAIC Volkswagen and Jianghuai Volkswagen. Jianghuai Volkswagen is a joint venture in the field of new energy vehicles, which was formally established on December 22, 2017. JAC-Volkswagen is the key to Volkswagen's transition to electrification in China. According to the plan, Volkswagen will add 30 new energy models in the next two years, 50% of which will be produced in China. It plans to deliver about 400000 new energy vehicles in the Chinese market by 2020 and about 1.5 million by 2025.

Volkswagen already revealed its intention to increase its stake in the Chinese joint venture in March, when Volkswagen Group CEO Deiss said, "at present, Volkswagen Group is evaluating this possibility." We look forward to working with Chinese partners to announce the future development of Volkswagen Group in China in the second half of 2019 or early 2020, and to make a decision to consider the adjustment of the joint venture stock ratio, and relevant negotiations are under way. "

However, SAIC later issued a special statement denying that it had not discussed the issue of "adjusting the stock ratio" with Volkswagen Group, and Volkswagen Group had not formally put forward a plan to discuss the stock ratio with SAIC.

Jianghuai is not as powerful as FAW and SAIC, and the acquisition of JAC shares may give Volkswagen more control over the JAC-Volkswagen joint venture. According to media reports, the Volkswagen Group under Deiss has asked to increase its stake in Jianghuai Volkswagen shares since the fourth quarter of 2018 and has conducted three rounds of communication.

Jianghuai Automobile is an integrated automobile enterprise group integrating the research, production, marketing and service of a full range of commercial vehicles, passenger vehicles and powertrain. Jianghuai Automobile recently released its annual performance forecast for 2018, which shows that the net profit belonging to shareholders of listed companies is expected to lose about 770 million yuan.

In recent years, Jianghuai Motors has been poorly managed, and Volkswagen's acquisition of Jianghuai shares is not necessarily a bad thing for Jianghuai. Some experts said that Volkswagen also has a layout in commercial vehicles, which may also be a bargaining chip in negotiations.

In the early days, China's automobile technology was weak, and the government hoped to exchange "market for technology" through the "50-50" Sino-foreign joint venture vehicle share ratio system. At that time, the purpose of this policy was to ensure that China's fledgling automobile industry could exchange the market for technology by building factories with Volkswagen, General Motors and other companies, but the results were obviously not satisfactory.

As a result, on June 28 last year, the Ministry of Commerce of the National Development and Reform Commission issued the "Special Management measures for Foreign Investment access (negative list) (2018 version)", which showed that the restrictions on foreign equity ratio of passenger cars would be lifted by 2022. BMW then became the first car company to pry open the "50-50" joint venture stock ratio. BMW bought part of BMW brilliance for 3.6 billion euros, raising its shareholding to 75%.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.