In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)10/26 Report--

After Lifan Automobile and Zotye Automobile, Brilliance Group has also received extensive attention due to financial problems.

On October 26, Brilliance Automobile Group Holdings Co., Ltd. announced that the company had not paid the 2017 non-public issuance of corporate bonds (Phase II)(bond abbreviation: 17 Huaqi 05) to China Securities Shanghai Branch. The company is still struggling to raise capital and negotiate with investors. In order to guarantee the trading rights of other bond investors, all other bonds issued and existing by the Company have resumed trading on the fixed income comprehensive electronic platform of Shanghai Stock Exchange since the opening of the market on 26 October 2020 upon application by the Company to Shanghai Stock Exchange.

In response to the default of 1 billion bonds owned by Brilliance Group, it said that "the current capital is really in temporary difficulty, so it fails to pay the due bonds on schedule. The Group is actively working hard to find solutions, and believes that Brilliance will actively and properly solve the bond problem."

On October 23, Brilliance Group failed to pay the private placement bond "17 Huaqi 05" with a scale of 1 billion yuan on schedule, resulting in substantial default. According to relevant rules, the existing corporate bonds of Brilliance Group will be suspended from October 23. If the principal and interest of the bonds of "17 Huaqi 05" can be paid in full on October 23, the relevant bonds will resume trading on October 26, otherwise, the suspension will continue and the trading will resume after the relevant circumstances are eliminated.

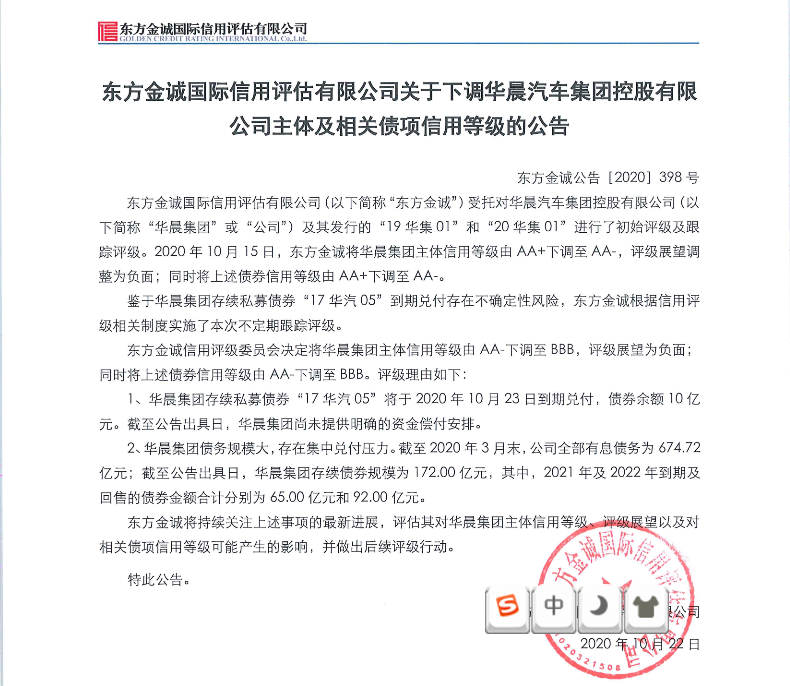

At present, Brilliance Group has a huge debt of 100 billion yuan. The semi-annual report of Brilliance Group's bonds in 2020 shows that the total liabilities of the Group are 132.844 billion yuan. After deducting goodwill and intangible assets, the asset-liability ratio is 71.4%. Before this, the credit rating agency Dongfang Jincheng twice downgraded the credit rating of Brilliance Group from AAA to BBB. Orient Jincheng said that the liquidity pressure of relevant bonds of Brilliance Group further rose, and the principal, interest and default interest of trust loans were not paid on time, facing greater debt repayment pressure.

Sky eye inspection shows that the registered capital of Brilliance Automobile is 800 million yuan, 80% and 20% respectively held by the State-owned Assets Supervision and Administration Commission of Liaoning Province People's Government and the social protection Fund Council of Liaoning Province. The actual controller is the State-owned Assets Supervision and Administration Commission of Liaoning Province People's Government. The company is mainly engaged in vehicle manufacturing business, products include Brilliance BMW and Brilliance Zhonghua, while the company also has some parts and other businesses. Among them, the company's revenue and gross profit mainly come from BMW Brilliance vehicle series products.

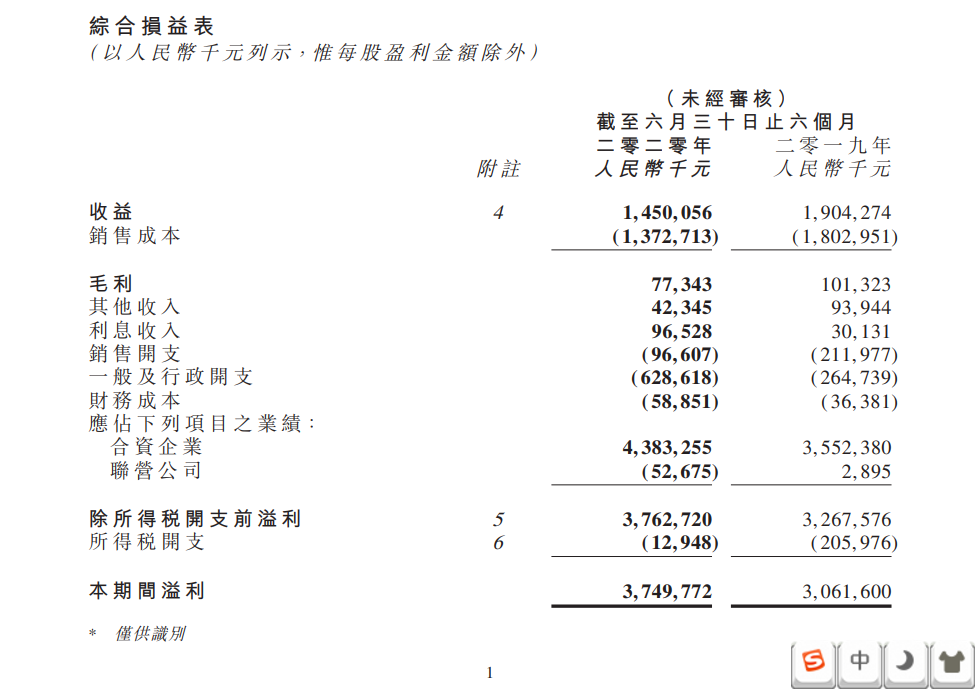

Brilliance China's financial report shows that in the first half of 2020, Brilliance China's revenue is 1.45 billion yuan and net profit is 4.025 billion yuan. However, excluding the net profit of 4.383 billion yuan contributed by Brilliance BMW, this means that Brilliance China itself lost more than 340 million yuan.

Brilliance Group is basically maintained by BMW, and the days of "lying down to make money" may come to an abrupt end in 2020. According to the agreement, Brilliance China will only hold 25% shares of Brilliance BMW by 2022, Brilliance Group will lose control over Brilliance BMW, Brilliance BMW's hematopoietic capacity will be greatly reduced, and the operation risk will be further deepened.

In terms of business operation, in addition to the sales volume of the joint venture brand Brilliance BMW, the sales volume of the other three independent brands Zhonghua, Huasong and Jinbei continued to decline, and even have been marginalized by the market. According to the data, the cumulative sales volume of Brilliance China in the first three quarters was only 4497 vehicles, down 78.31% year-on-year. Brilliance Gold Cup only 1635 vehicles, a year-on-year decline of 88.98%.

In this case, Brilliance Group has raised its sales target. Qi Kai, vice president of Brilliance Group, said that by the end of 2025, the annual sales volume of Brilliance Group's vehicle business is expected to reach 1.95 million vehicles. Among them, there are 650,000 Brilliance BMW passenger cars, 300,000 Brilliance Zhonghua passenger cars and 150,000 Brilliance Xinri passenger cars. Commercial vehicle plate China Morning Xinyuan 600,000, Brilliance Renault Gold Cup 150,000, trucks and special vehicles 100,000.

Brilliance Automobile relies too much on the hematopoietic ability of Brilliance BMW, which leads to the lack of motivation for the development of its own brand, which not only makes Brilliance Zhonghua brand gradually marginalized, but also makes itself fall into a state of continuous loss. At present, the decline of Brilliance's independent brand has become the epitome of Brilliance's current situation. Brilliance Holdings, which relies heavily on Brilliance BMW, has fallen into a development dilemma.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.