In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-21 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)10/28 Report--

Due to the recovery of the domestic new car market, passenger car sales in China have achieved continuous growth for many months in the second half of the year, helping a number of automobile companies to achieve a rebound in performance. Even so, Guanghui Motor, the largest dealer group in China, was greatly affected this year, and its net profit in the first three quarters still showed a negative growth trend.

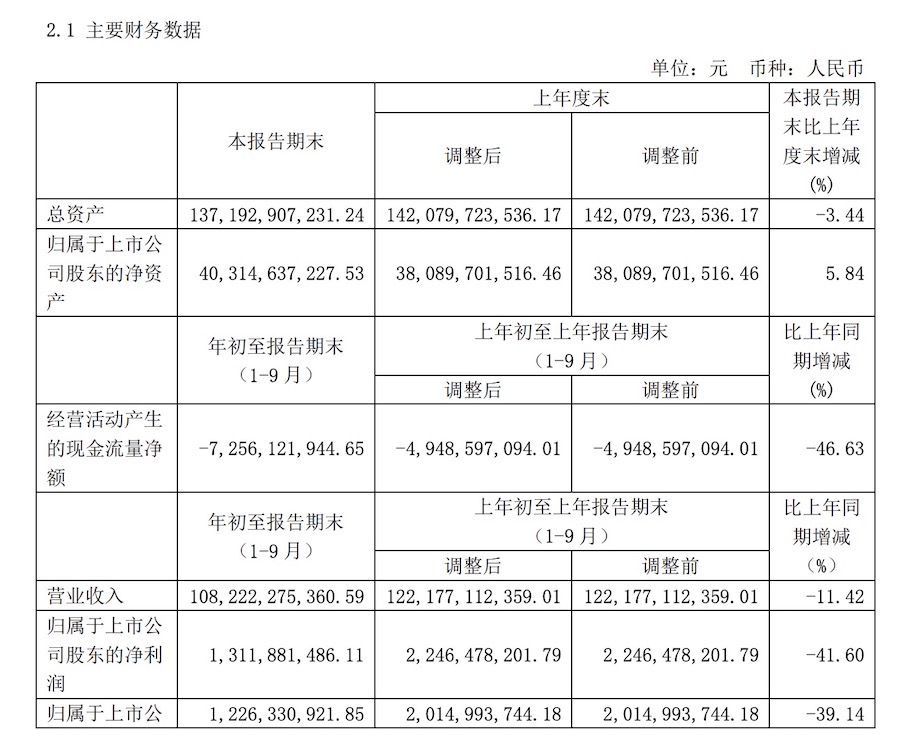

According to Guanghui Automobile's report for the third quarter of 2020 and the main operating data in the first three quarters of this year, Guanghui Automobile achieved 108.222 billion yuan in revenue and 1.312 billion yuan in net profit, both of which were negative growth over the same period last year, of which revenue fell 11.42% compared with the same period last year. Net profit fell 41.6%. Guanghui cars will change from profit to loss in 2020.

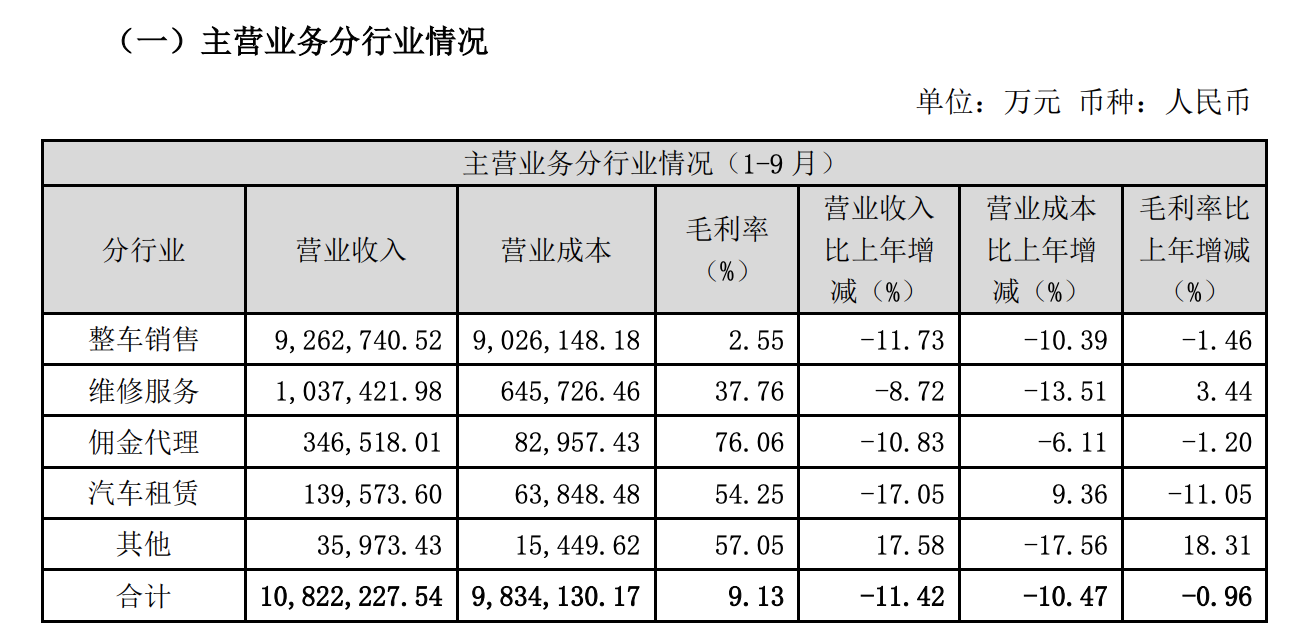

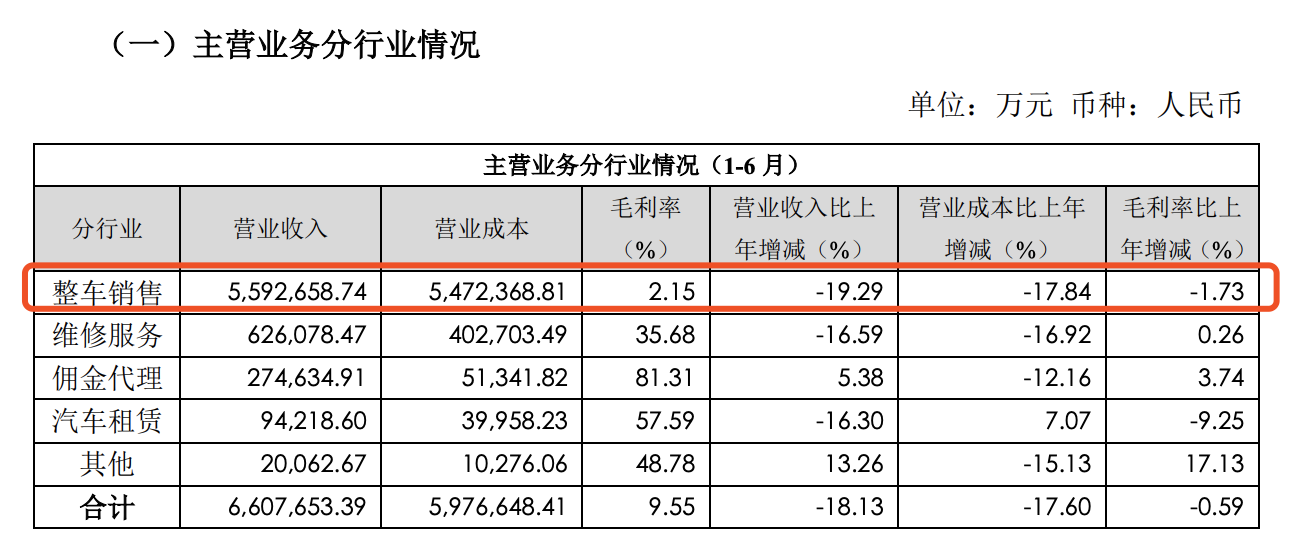

From the point of view of the operation, from January to September, the income of Guanghui Automobile, whether it is vehicle sales or maintenance services, has declined to varying degrees.

After the announcement of the quarterly report, Guanghui Motor shares fell 10.10% to 3.56 yuan per share, sealing off the daily limit, with a market capitalization of 28.9 billion yuan.

It is understood that Guanghui Automobile's single-quarter vehicle sales revenue in the third quarter was 36.701 billion yuan, an increase of 2.97% over the same period last year, and that of maintenance services was 4.113 billion yuan, an increase of 6.58% over the same period last year. This is not only due to the recovery of the market, but also to the fact that luxury cars in the domestic market have become the least affected and recovered most rapidly in this round of outbreaks.

In the first nine months of this year, domestic luxury car sales totaled 1.7879 million, up 10.9% from a year earlier, while the passenger car market fell 12.5% from a year earlier, creating a sharp contrast, according to the Federation of passengers. In September alone, the luxury car market surged 30.3% from a year earlier, maintaining an all-time high of about 15% of the market share.

Guanghui Automobile, as the leading passenger car distribution and service group in China, is also the largest luxury passenger car distribution and service group, so it benefits from the development of this market trend. In 2020, Guanghui Automobile further expanded the proportion of luxury car business through strategic adjustments such as store renovation, luxury car agency brand and sales channel expansion, thus accelerating the improvement of profitability.

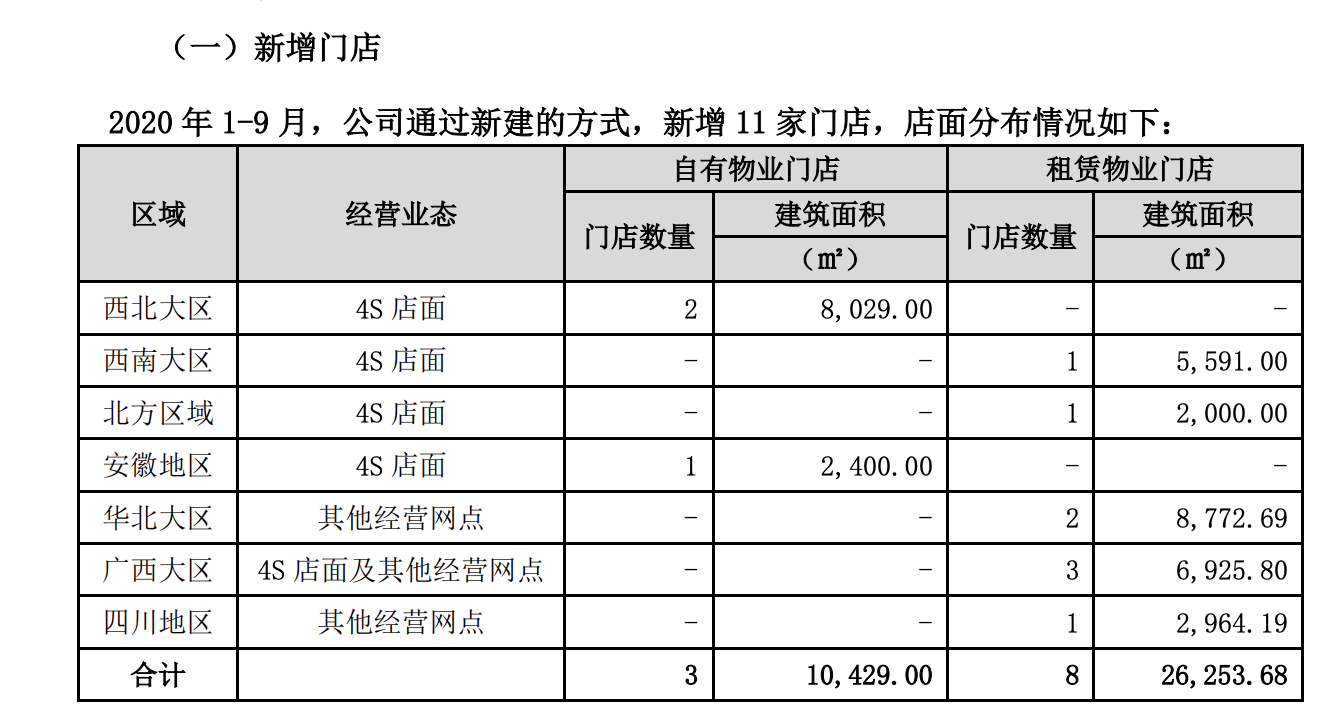

Judging from the operating data, Guanghui Automobile added 11 stores in the previous September, including 2 in the third quarter. In the same period, 31 stores closed due to demolition or policy adjustment, while only 5 stores were closed in the third quarter.

Through self-building stores and mergers and acquisitions, Guanghui Automobile has achieved the rapid expansion of the dealer network and the expansion of sales scale, but during the downward period of the industry, with the rapid decline in profitability and the increase of financial expenses, the company has to deal with the rapid erosion of profits as soon as possible.

Therefore, in order to solve the problem of funds affected by the epidemic. As of June 30 this year, Guanghui Motor's total debt was 90.636 billion yuan, the asset-liability ratio was 66.69%, and the company's shareholder pledge ratio was 45.90%.

However, for the reasons for equity pledge, the company said that it is mainly used to supplement the daily working capital of Guanghui Group. As for the repayment of funds, the source of funds mainly comes from its own and self-raised funds. At present, the group has sufficient capital solvency. Up to now, Guanghui Group, the parent company of Guanghui Automobile, holds a cumulative pledge of 1.837 billion shares, accounting for 22.65% of Guanghui Automobile's total share capital.

In fact, affected by the COVID-19 epidemic this year, the shortage of corporate liquidity is not only Guanghui Motor, as the largest dealer group in China, Guanghui Automobile is also a representative. Some data show that 70% of the operating performance data of domestic car dealers in the first half of this year showed negative growth. Only a few dealers of luxury brands have achieved positive growth, which is also reflected in the current market, only luxury brands and mainstream brands can help dealers maximize profits.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.