In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-18 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)10/30 Report--

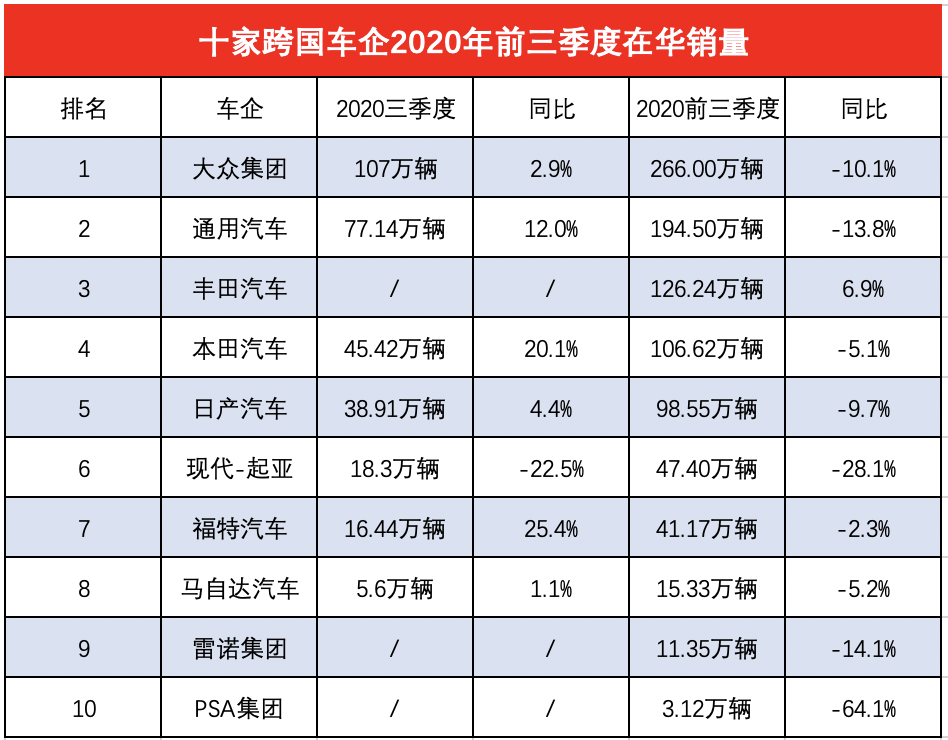

As the world's largest automobile market, China has become an important strategic market for major multinational car companies, and as the major multinational car companies have announced their sales in the third quarter of this year, their sales ranking in China has also been released. Volkswagen, General Motors and Toyota are still the biggest sellers in China, according to the data.

Volkswagen Group, the world's largest carmaker by sales, has also benefited from its expanding presence in China, which has helped brand global sales increase in the context of an early recovery. According to the sales announced by Volkswagen Group a few days ago. A total of 933600 cars were delivered worldwide in September, up 3.3 per cent from the same period last year.

Although the Chinese market growth in September was not Volkswagen's biggest growth region, sales of 387500 vehicles a month kept it the largest single market under the brand, close to the sum of Europe. Sales in China totaled 2.66 million in the first three quarters, down 10.1 per cent from a year earlier and accounting for 41 per cent of the 6.5047 million vehicles in the global market.

Following GM's gradual closure of many factories around the world, it will dominate the markets in the Americas and China, further expanding GM's share of sales in China. According to the latest figures released by GM, its retail sales in China grew by 12% in the third quarter of this year compared with the same period last year, the first quarterly growth in two years, which is also due to GM's growth in China, the largest single market since 2011. however, GM's share of the Chinese market has fallen to 12.2% from 14.3% in 2017.

Affected by the epidemic, GM's overseas markets have been significantly affected, and in the environment of earlier recovery in China, it will help brand sales pick up quickly throughout the year. GM's share of China is likely to rise further compared with 40% in 2019.

Even though Toyota sold 179400 new cars in China in September, up 25.3% from a year earlier and a record high in a single month, Toyota sold 1.2624 million new cars in China in the first three quarters of this year, up 6.9% from 1.181 million in the same period last year. It has become the best performing market in the world, but its share in China still lags behind Volkswagen and General Motors.

According to Toyota's global 837100 of new car sales in September, the Chinese market accounted for only 21%, far lower than other brands. It also reflects that Toyota's best-selling products come from all over the world. It is worth mentioning that the Volkswagen brand, which overtook Toyota in 2019, fell behind by 274000 vehicles in the first half of this year, meaning that sales in the third quarter of this year may continue to be the first.

Honda and Nissan, which are also best-selling Japanese brands in China, still lag behind Toyota, but there is a clear gap between Honda and Nissan. As the market gradually recovered under the epidemic, Honda rebounded strongly in the third quarter, up 20.1% from a year earlier, much higher than Nissan. The Nissan brand is affected by the old product formation, although it maintains a homeopathic trend in China, it is far behind the Toyota and Honda brands, and may lose the annual sales title of the Japanese system for two consecutive years.

At the same time, Japanese brand Mazda, a domestic niche model, sold only slightly more than the Discovery Brand in China, delivering a total of 153329 vehicles in China in the first three quarters, compared with 161742 in the same period last year, down 5.2% from the same period last year. FAW Mazda sold 58807 and Changan Mazda sold 94522.

The share of American and Korean brands that have declined significantly in the Chinese market in recent years has also continued to decline. Ford's decline is more pronounced than GM's sales in China, with only 164400 new cars sold in the third quarter of this year, compared with 421400 in the first three quarters, although there has been a marked increase. As for Korean brands, the decline was the worst. Even if there were obvious signs of recovery in the domestic market, Kia Hyundai fell sharply in China, falling 22.5% in the third quarter compared with the same period last year, becoming the only car company to decline in the third quarter.

Due to the gradual marginalization of French brands in the market, Renault has announced its withdrawal from the Chinese fuel market, but its sales are still higher than that of Peugeot Citroen, which is both legal and entered China earlier, which shows that the performance of these two brands in China is really difficult. Among them, the cumulative sales of PSA Group for the whole year was only 30, 000 vehicles, down 64.1% from the same period last year.

Throughout the performance of 10 multinational car companies in China this year, the Matthew effect is even more obvious due to the decline of the new car market and the epidemic. At the same time, because multinational car companies are too affected in the local and overseas regions, they have increased their investment in the domestic market, further pushing up the share of brands in China. However, the impact of the market environment is too great. Among the 10 multinational car companies, only Toyota has achieved full-year sales, which proves once again that the popularity of Japanese brands in China has increased steadily.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.