In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)10/31 Report--

Affected by Xinguan epidemic situation, the performance of domestic automobile enterprises in the first half of this year almost simultaneously declined, and loss-making operation also became a common phenomenon. In the second half of the year, a number of automobile enterprises are committed to sales growth, launching more new cars to occupy the market, and performance has also recovered to varying degrees.

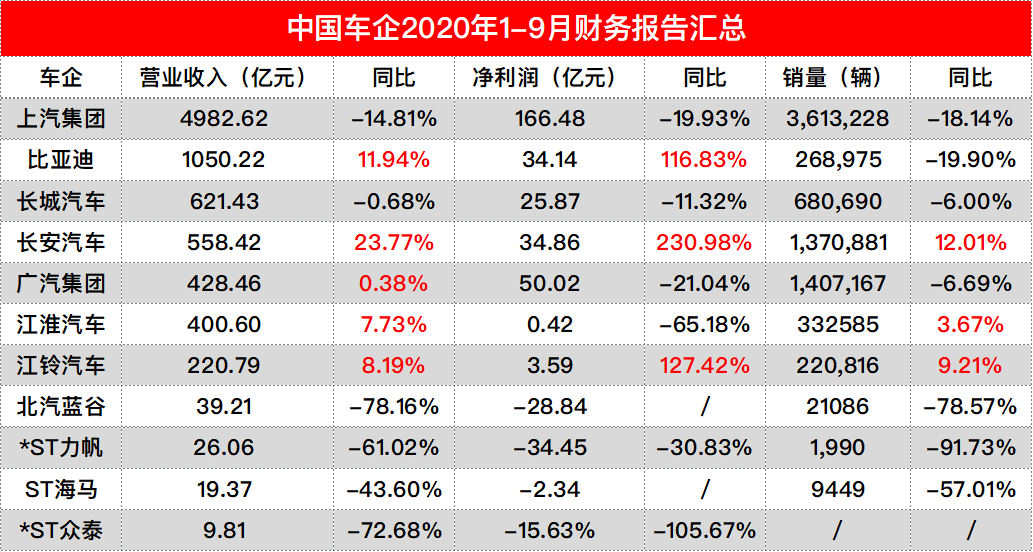

In the performance statistics of many domestic automobile enterprises in the first three quarters of 2020, the top five automobile enterprises are SAIC Group, BYD, Great Wall Motor, GAC Group and Chang 'an Automobile respectively, among which BYD and Chang' an have realized synchronous growth of net profit of revenue.

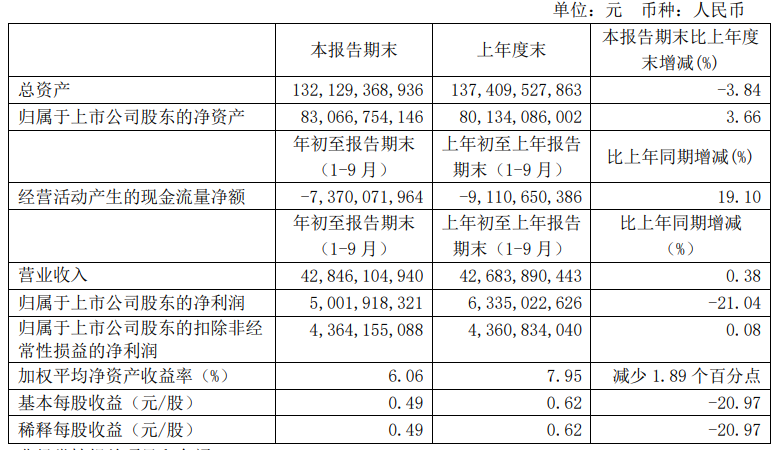

SAIC Group: Net profit fell by nearly 20%

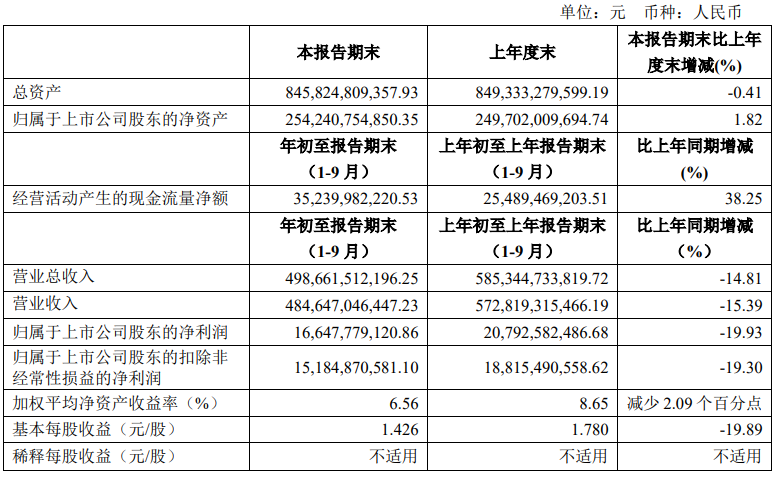

According to the performance report disclosed by SAIC Group, SAIC Group realized operating income of 498.262 billion yuan in the first three quarters, down 14.81% year-on-year; net profit attributable to shareholders of listed companies was 16.648 billion yuan, down 19.93% year-on-year.

The decline in car sales is an important reason for the decline in SAIC's net profit. In the first three quarters of 2020, the sales volume of SAIC Group is 3613228 vehicles, with a year-on-year decrease of 18.14%, which exceeds the overall level of domestic automobiles.

As the head of the domestic automobile industry, SAIC Group's profits mainly come from SAIC Volkswagen and SAIC GM joint ventures, but the performance of these two companies this year is not optimistic. The cumulative sales volume of SAIC Volkswagen and SAIC GM in the first three quarters was 1,031,385 vehicles and 951,561 vehicles respectively, down 25.92% and 21.97% year-on-year respectively, which were higher than the overall market level.

BYD: Net profit increased by 116.83% year-on-year

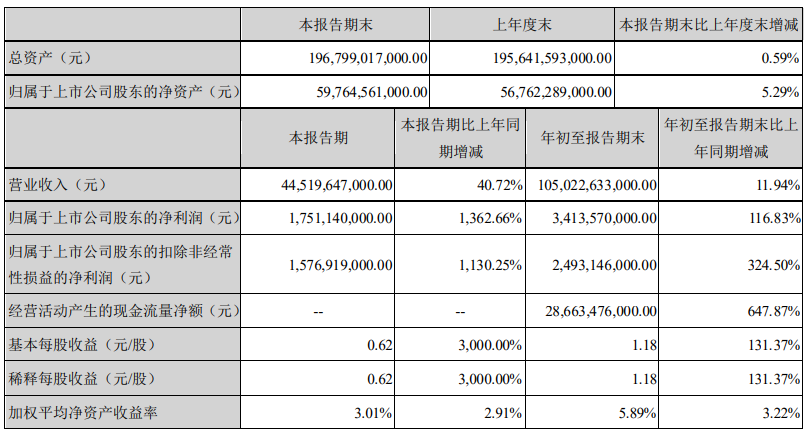

BYD released the first three quarters of financial results show, The company realized operating income of 105.022 billion yuan, Year-on-year growth of 11.94%; Attributed to listed company shareholders net profit 3.414 billion yuan, Year-on-year growth of 116.83%. It is worth noting that BYD's revenue profit source is not only the automobile business, but also includes mobile phone parts and assembly business, secondary rechargeable battery and photovoltaic business.

Specifically, BYD's cumulative car sales in the first three quarters fell 19.90% to 268,975 vehicles, of which fuel vehicle sales increased 10.38% to 158,034 vehicles and new energy vehicles fell 42.40% to 110,941 vehicles.

BYD said that as the economy continued to pick up, BYD's performance was still recovering rapidly with the help of diversified businesses. It is estimated that the net profit attributable to shareholders of listed companies in 2020 will be CNY 4.2 - 4.6 billion, with a year-on-year growth of 160.15%-184.93%.

Great Wall Motor: Net profit increased by 2.9% in the third quarter

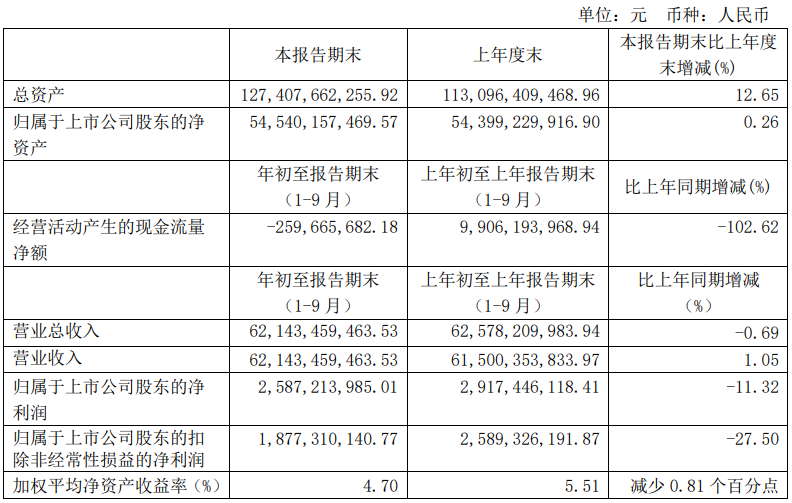

Great Wall Motor is one of the top three independent brands, with annual sales exceeding one million for four consecutive years. According to the latest performance report, Great Wall Motor's operating income fell 0.68% to 62.143 billion yuan, and net profit fell 11.32% to 2.587 billion yuan. Revenue rose 23.6% to 26.22 billion yuan in the third quarter, while net profit rose 2.9% to 1.44 billion yuan.

Great Wall Motor said the decline in net profit in the first three quarters was mainly due to the impact of the new crown pneumonia epidemic. The recovery in revenue was mainly due to the growth in car sales after the epidemic was brought under control.

According to the data, the sales volume of the four brands owned by Great Wall Motor increased significantly in the third quarter, among which Haval brand increased by 8.5% to 183,000 vehicles, WEY brand increased by 3% to 24,000 vehicles, Euler and Great Wall pickup truck increased by 179.9% and 93.2% respectively.

GAC Group: Revenue slightly increased by 0.38%

GAC Group has subsidiaries such as GAC Passenger Car, GAC Honda, GAC Toyota, GAC Mitsubishi, GAC Fick, etc. According to the financial report, GAC Group realized operating income of 42.846 billion yuan in the first three quarters, with a year-on-year growth of 0.38%; the net profit attributable to the owner of the parent company was 5.002 billion yuan, down 21.04% year-on-year.

In the first three quarters, the cumulative sales volume of GAC Group decreased by 6.69% to 1,407,167 vehicles, among which the sales volume of GAC Toyota increased by 9.52 to 543,449 vehicles, GAC Honda decreased by 5.69% to 550,565 vehicles, GAC Fick and GAC Mitsubishi decreased by 47.16% and 51.55% respectively.

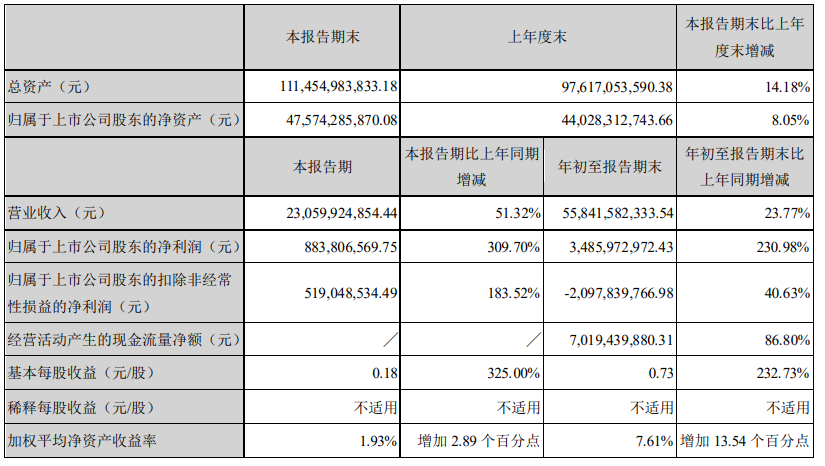

Changan Automobile: Year-on-year increase in revenue and profit

Chang 'an Automobile, which lost 2.65 billion yuan last year, achieved strong profits in the first three quarters of this year. In the first three quarters, Chang 'an Automobile's total operating income increased by 23.77% to 55.842 billion yuan, and net profit increased by 230.98% to 3.486 billion yuan.

In terms of sales volume, Chang 'an Automobile has indeed achieved a relatively large increase. The cumulative sales volume in the first three quarters increased by 12.01% to 1,370,881 vehicles, among which Chang' an Ford increased by 29.65% to 167,133 vehicles, Chang 'an Mazda increased by 1.58% to 94,332 vehicles, and Chang' an independently increased by 20.94% to 706559 vehicles.

However, the growth of automobile sales is not the main reason for Chang 'an automobile performance turnaround. After deducting non-recurring gains and losses, Chang 'an Automobile suffered a net loss of 2.098 billion yuan, but it still increased by 40.63% compared with the same period last year. It is undeniable that the growth of automobile sales greatly improved its profits.

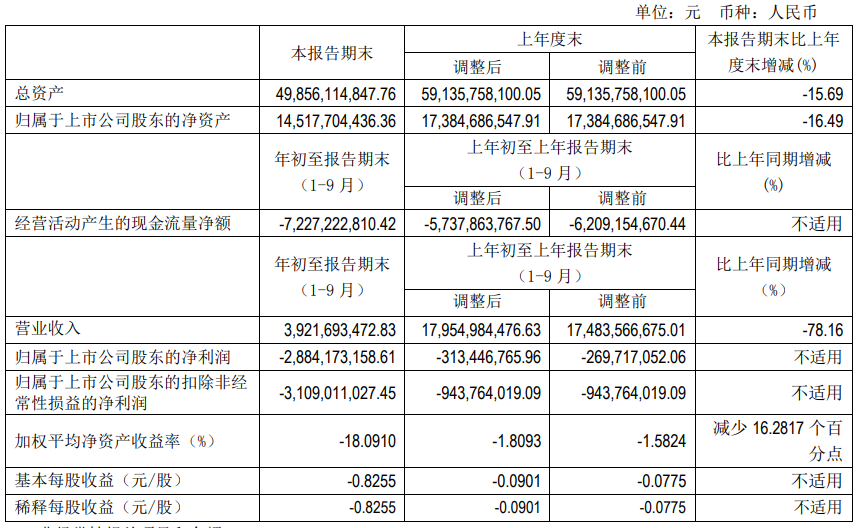

Beiqi Blue Valley: net loss of 2.884 billion yuan

As an automobile enterprise dedicated to the development of new energy, Beiqi Blue Valley's performance this year has been greatly surprised. In the first three quarters, Beiqi Blue Valley realized operating income of 3.921 billion yuan, down 78.16% year-on-year. The net loss attributable to shareholders of listed companies was 2.884 billion yuan.

In the first three quarters of this year, the cumulative sales volume of BAIC New Energy was only 21086 vehicles, a drop of 78.57%. Some insiders said,"Beiqi New Energy is the beneficiary of the era of high subsidies for new energy vehicles. As time goes by, consumers have higher and higher requirements for new energy models, including new requirements for intelligent and fashionable appearance and space." At present, the models launched by BAIC New Energy are relatively traditional, which has caused insufficient product strength."

Zhongtai, Lifan and Haima: losses of 1.563 billion yuan, 3.445 billion yuan and 234 million yuan

Zhongtai Automobile, Lifan Automobile and Haima Automobile also disclosed their performance for six consecutive times. As a domestic marginal automobile enterprise, the revenue profit plummeted year-on-year. Among them, the revenue of Zhongtai Automobile decreased by 72.68% to 981 million yuan, with a net loss of 1.563 billion yuan; the revenue of Lifan Automobile decreased by 61.02% to 2.606 billion yuan, with a net loss of 3.445 billion yuan; the operating income of Haima Automobile decreased by 42.60% to 1.937 billion yuan, with a net loss of 234 million yuan.

In terms of other automobile enterprises, the operating income of Jianghuai Automobile increased by 7.73% to 40.060 billion yuan in the first three quarters, and the net loss decreased by 65.18% to 42 million yuan; the operating income of Jiangling Automobile increased by 8.19% to 22.079 billion yuan, and the net profit increased by 127.42% to 359 million yuan.

From the current market point of view, Chang 'an, Great Wall, BYD and other head automobile enterprises continue to expand the product camp, committed to sales growth to recover the performance of the first half of the year, while Zhongtai, Lifan, Hippocampus and other marginal automobile enterprises sales continued to be depressed, revenue profits fell sharply, the last quarter is still not optimistic.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.