In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)11/26 Report--

Due to increased competition in the domestic market and shrinking volume, the performance of Dingfan shares has plummeted repeatedly, due to the inability to pay off maturing debts, and Lifan has been filed for bankruptcy reorganization by the supplier. Thanks to the fact that it still has the value of restructuring, Lifan shares have made new progress in bankruptcy restructuring recently.

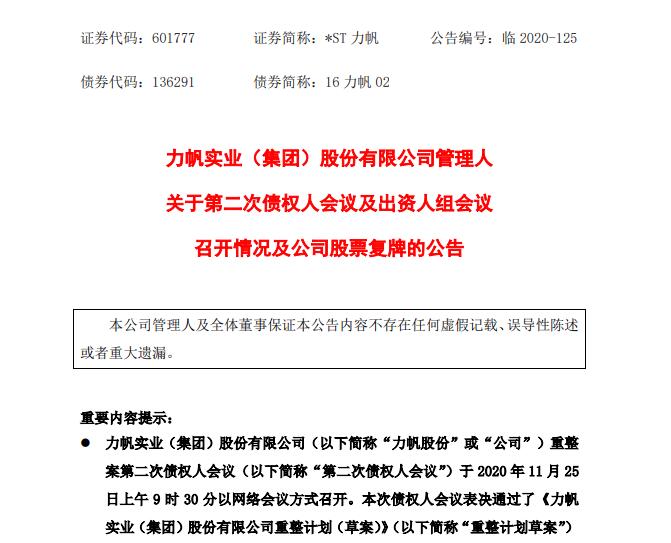

On November 25th, * ST Lifan announced that the second creditors' meeting and the investor group meeting of the reorganization bill passed the "Lifan Industrial (Group) Co., Ltd. Restructuring Plan (draft)" and "the Investor Rights Adjustment Plan (draft) of Lifan Industrial (Group) Co., Ltd.".

After the above two votes are passed, in accordance with the provisions of the Enterprise bankruptcy Law, the administrator will submit an application for approval of the reorganization plan to the court in accordance with the law. This means that Lifan Industrial (Group) Co., Ltd. is expected to revive.

Although the restructuring of Lifan shares is further, there are still many risks in the future. According to the announcement, according to the provisions of the Enterprise bankruptcy Law of the people's Republic of China, if the company restructuring plan is not approved by the court, there is a risk that the people's court will declare bankruptcy and enter the bankruptcy liquidation procedure. In addition, Lifan shares are at risk of being declared bankrupt because of restructuring failure. If the company is declared bankrupt, the listing of its shares will be terminated.

Therefore, the day before the restructuring meeting voted on November 24, * ST Lifan ushered in a strong limit, closing at 6.00 yuan, an increase of 5.08%, with a turnover rate of 1.75%. On November 26th, * ST Lifan fell to the limit again after the resumption of trading, trading at 5.71 yuan per share.

However, the announcement said that the approval and follow-up implementation of the restructuring plan of * ST Lifan's ten wholly-owned subsidiaries may have an impact on the company's long-term equity investment, accounts receivable and other receivables. The company will actively do a good job in daily operation on the existing basis to ensure the stability of production and operation.

In March this year, Lifan shares of the "16 Lifan 02" bonds appeared the risk of maturity can not be repaid, its size reached 530 million yuan, and then a series of debt crises broke out one after another. According to the financial report, as of December 31, 2019, Lifan shares had total assets of 19.407 billion yuan, total liabilities of 16.573 billion yuan, and an asset-liability ratio of 85.40%. Coupled with Lifan shares "hematopoietic capacity" of the cliff decline, there is no hope of taking on debt.

After bankruptcy, Lifan shares had to issue recruitment announcements and openly recruit reorganized investors. On September 14, Liangjiang Fund and Geely Maijie, as consortia, submitted application materials for investors who intended to restructure, and formally participated in the Lifan share restructuring plan.

Data show that Geely Maijie Investment Co., Ltd. was established on October 27, 2015, the legal representative is Xu Zhihao, the scope of business includes industrial investment; investment consulting, fiduciary enterprise asset management.

In the company's shareholder information, Geely Technology Group Co., Ltd. holds 99% of the shares, while Hangzhou Geely Technology Co., Ltd. holds 1%. Therefore, the actual control is Li Shufu. This also means that Geely has begun to participate in the restructuring of Lifan. The Liangjiang Fund is set up by Liangjiang Industrial Group, a wholly owned enterprise directly under the management committee of Chongqing Liangjiang New area.

On November 10th, * ST Lifan issued the announcement of * ST Lifan Manager on the investor's rights and interests adjustment plan (draft) of the restructuring plan, announcing that the Manjianghong Fund, jointly launched by Geely Maijie and Liangjiang Fund, will replace Lifan shares and become the controlling shareholder of * ST Lifan. At the same time, Geely holding Group, the parent company of Geely Maijie, will contribute 1.47 billion yuan, accounting for 14.7% of the shares indirectly, making it the second largest shareholder.

Therefore, under the reorganization and adjustment of Geely Group and Chongqing local government platform, Lifan shares will have new hope. According to what Lifan said at the second interim shareholders' meeting in 2020: "once the restructuring work is completed, we will first mass produce the electrified pure electric MPV' Maple Leaf 80V'of Geely Technology Group." It means that Lifan will continue to survive as the contract factory of Geely Maple Leaf brand.

It is understood that Maple Leaf was officially launched in April this year, the first model is Maple Leaf 30X, positioning pure electric small SUV, based on Geely Vision X3, the official guidance price is 6.88-79800 yuan.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.