In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-24 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)12/24 Report--

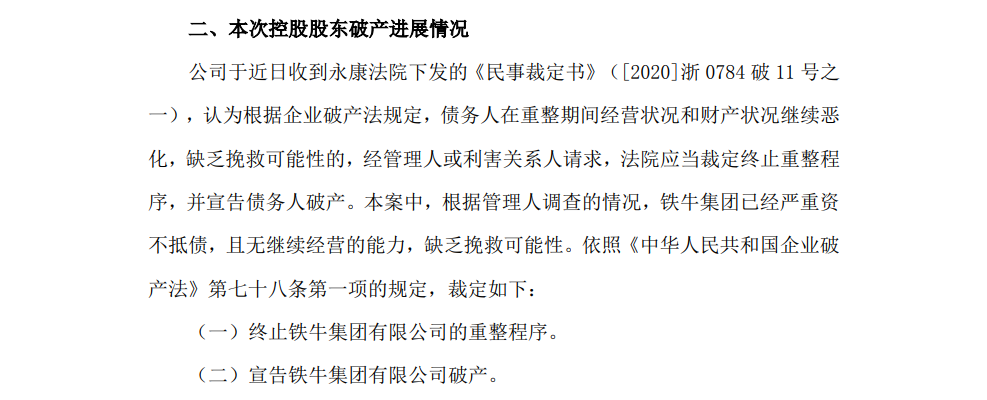

Finally, the Iron Niu Group could not bear it! On December 24th, * ST Zhongtai announced that the company recently received a "civil order" issued by the Yongkang Court that its parent company (the real controller) Tieniu Group was seriously insolvent and unable to continue to operate, so it lacked the possibility of rescue. The court ruled according to law as follows: (1) to terminate the reorganization procedure of Tieniu Group Co., Ltd.; (2) to declare the bankruptcy of Tieniu Group Co., Ltd.

However, * ST Zhongtai said in the announcement that the company and Tieniu Group remain independent in assets, business, finance and other aspects, and the company's main business is currently in a state of suspension of production, which will not have a significant impact on its daily operations, but the subsequent disposal of Tieniu Group bankruptcy may lead to changes in the company's actual control.

According to the data, Tieniu Group was first established in 1992, and its main business includes automobile manufacturing and sales, key automotive parts, new energy vehicles, electronics and electrical appliances, real estate development and investment management, and so on. Anhui Tongfeng Electronics and Zhongtai Automobile are two listed companies. According to Tianyanchu data, Tieniu Group is currently the largest shareholder of Zhongtai Automobile, holding 38.78% of Zhongtai shares.

Tieniu Group has promised that if the non-net profit deducted by Zhongtai Automobile from 2016 to 2019 is less than 1.21 billion yuan, 1.41 billion yuan, 1.61 billion yuan and 1.61 billion yuan respectively, Tieniu Group will make performance compensation. According to the financial report, Zhongtai Automobile deducts non-return net profit of-491 million yuan in 2018 and-9.3 billion yuan in 2019. According to the compensation agreement previously signed by the two sides, Tieniu Group should compensate about 468 million shares to Zhongtai Automobile, but the performance promise compensation has not been completed for a long time because the shares held by Tieniu Group have been judicially frozen and pledged.

In March this year, Tieniu Group proposed a solution to performance compensation, which will be completed through the sale of land storage and real estate proceeds if necessary; in May this year, Tieniu Group plans to carry out performance compensation by canceling its shares or repaying cash. Cash comes from the revitalization and disposal of the enterprise's assets; on September 1, the court ruled to accept the bankruptcy reorganization application of Tieniu Group. On November 20th, * ST Zhongtai issued an announcement that Tieniu Group failed to fulfill the above agreement to compensate Zhongtai Motor in time; on December 24th, Tieniu Group was ruled bankrupt by the court.

In fact, Tieniu Group has had a hard time in recent years. According to the data, the net profit of Tieniu Group fell 22.47% to 616 million yuan in 2018 and 160.39% to 125 million yuan in the first half of 2019.

Of course, the current situation of the Iron Niu Group has a lot to do with the experience of Zhongtai Motor. At present, Zhongtai Motors has no national six cars to sell, and its Junma, Hanteng and Hanlong brands continue to thunderstorm, and dealers and employees have joined the team of asking for wages. In June this year, Zhongtai Motor disclosed its 2019 financial results, with its annual operating income of 2.986 billion yuan, down 79.78% from the same period last year. The net loss of shareholders belonging to listed companies was 11.19 billion yuan, down 1498.98% from the same period last year. At the same time, Zhongtai Motor has been implemented "delisting risk warning" treatment, the stock abbreviation will be changed from "Zhongtai Automobile" to "* ST Zhongtai".

On September 16, Zhongtai Motor Co., Ltd. submitted an application for pre-restructuring of the company to the people's Court of Yongkang City on the grounds that it was unable to pay off its maturing debts and obviously lacked solvency, but still had the value of restructuring. According to the financial report, Zhongtai Motor's revenue in the first three quarters of this year was only 981 million yuan, down 72.68% from the same period last year, while the net loss was 1.563 billion yuan, down 105.67% from the same period last year.

In addition, Hangzhou Jieneng Power Co., Ltd., Hangzhou Yiwei Automobile Industry Co., Ltd., and Zhejiang Zhongtai Automobile sales Co., Ltd., the third-class wholly-owned subsidiaries of Zhongtai Automobile, were all ruled by the Yongkang Court for bankruptcy liquidation. Zhongtai New Energy, a second-class wholly-owned subsidiary, was also ruled by the court to accept bankruptcy liquidation.

Car companies that once had annual sales of more than 300000 vehicles and market capitalization of more than 30 billion yuan failed to adjust their development direction and product advantages in time, resulting in weaker and weaker terminal competitiveness of domestic brands and facing delisting.

In fact, Zhongtai Motors is having a hard time, regardless of whether Tieniu is liquidated or not. It's just that once Tieniu Group goes bankrupt, it may accelerate the pace of Zhongtai Motor delisting. Zhongtai Motors, which is now mired in a whirlpool of factory shutdowns, performance losses and subsidiary liquidation, is obviously in jeopardy, even if it is restructured, there are a lot of development uncertainties.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.