In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)01/06 Report--

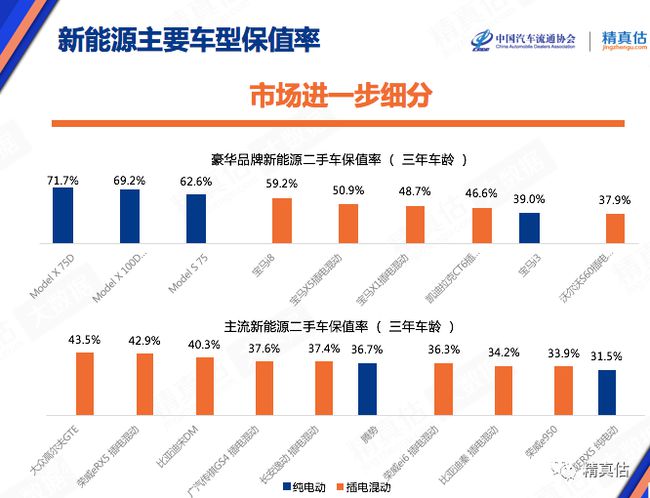

As we all know, electric vehicles generally perform poorly in the second-hand market due to factors such as fast product renewal, short battery cycle and difficulty in getting rid of them, and the depreciation rate of second-hand vehicles is much higher than that of traditional models. However, in the latest issue of China's second-hand car preservation report, for the first time, the electric brand preservation rate exceeds that of traditional models.

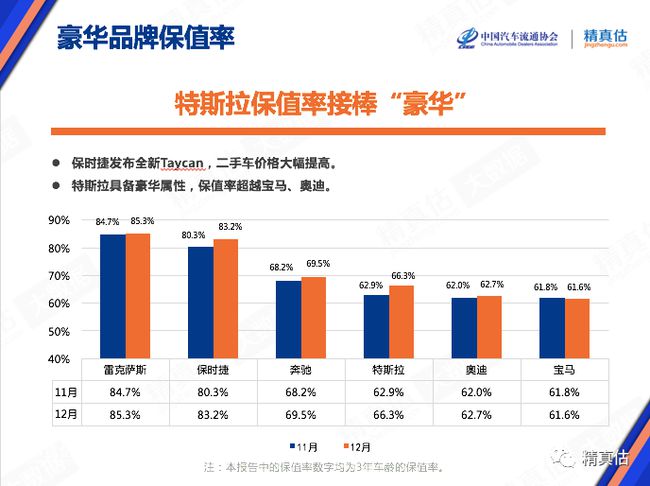

According to the latest "December 2020 China Automobile Maintenance Rate Research Report" released by China Automobile Circulation Association, Tesla, a pure electric vehicle company, has achieved 66.3% of its three-year product maintenance rate, which is also the first time Tesla has surpassed traditional luxury brands Audi and BMW, ranking fourth among high-end brands, second only to 69.5% of Mercedes-Benz brand maintenance rate.

The Lexus and Porsche brands owned by Toyota are still in the leading position. Since both models are imported models, there is an obvious growth trend of hedging rate under the continuous support of domestic market heat. Lexus continued to "worship God" with a three-year preservation rate of 85.3%, while Porsche followed closely with a stable performance of 83.2%.

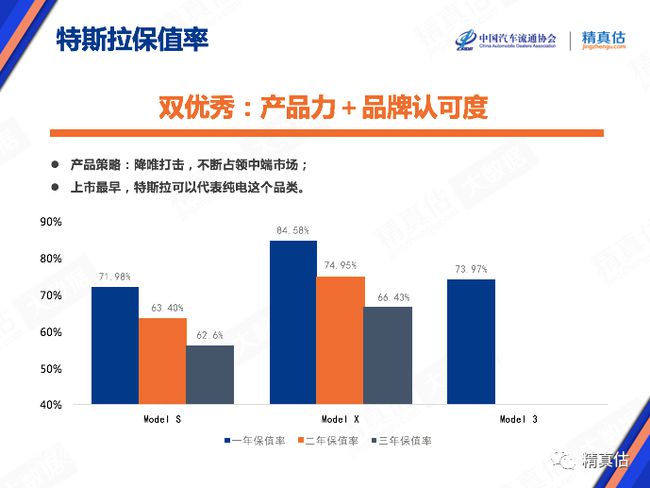

In fact, the main reason Tesla has a higher hedging ratio than Audi and BMW brands is its Model X/Model S models. As Tesla's highest-positioned models, the two models currently maintain high market pricing in China, and do not have frequent sharp price cuts like its lower-end Model 3 models, allowing it to stabilize the domestic second-hand market.

At the same time, Tesla, as a domestic high-end electric brand, has been in a leading position in core technology, and gradually changes the thinking of electric vehicle price reduction in consumer impression under the increasingly mature market of domestic electric vehicle market. Of course, Tesla's rising market heat further reflects the market's recognition of Tesla products. This also makes Model 3 not available for a long time in China, with a one-year hedging rate of 73.97%, which is similar to that of most joint venture brands.

Although Tesla's price in the domestic market continues to drop, Tesla's maintenance rate in the domestic second-hand market is supported by the expansion of the car's market share and the limited production capacity environment. And thanks to Tesla's advanced battery management system and battery energy storage technology, coupled with remote OTA upgrade technology, the product competitiveness of older models is guaranteed to the greatest extent, thus improving the recognition of Tesla by second-hand consumers. At the same time, this also makes Tesla the best performing brand in the new energy market.

As for traditional car companies, the overall market price rose this month, there was no significant differentiation, no matter German, Japanese, Korean second-hand car preservation rate is an upward trend. The top value-preserving rate is still Japanese brands, even individual niche brands also because of the scarcity of vehicle sources, prices appear larger rise. The top three are "Liangtian" and Subaru.

At present, Wuling ranks first with 67.5% of its value preservation rate, followed by Baojun, Lingke, Chang 'an, WEY, GAC Chuanqi, Haval, Geely and other brands.

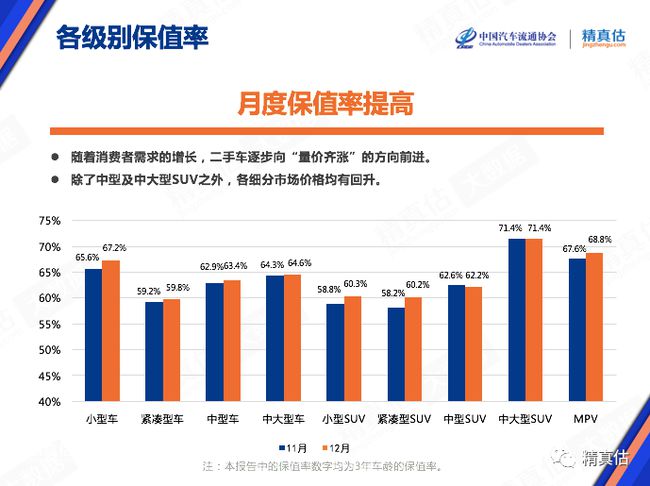

From the perspective of segment model market, medium-sized and medium-sized SUV cannot become the mainstream model in the second-hand market due to high unit price, emission problems and fuel consumption problems, which also reflects that the current second-hand market mainly prefers low-priced models, among which the car market is still the mainstream.

From the current domestic "Qi Fei" second-hand car market performance, but also because of the expansion of car demand before the year and the end of the new car price factors caused by the second-hand car preservation rate month-on-month increased a lot.

In any case, the hedging rate has become more and more an important indicator considered by consumers, which is the embodiment of the comprehensive level of automobiles. The advantage of models with high hedging rate lies in that consumers bear less economic losses caused by product depreciation, and it is also the embodiment of brand premium and product value. Therefore, the 3-year preservation rate of different models has a high reference value for consumers to purchase new cars.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.