In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)01/21 Report--

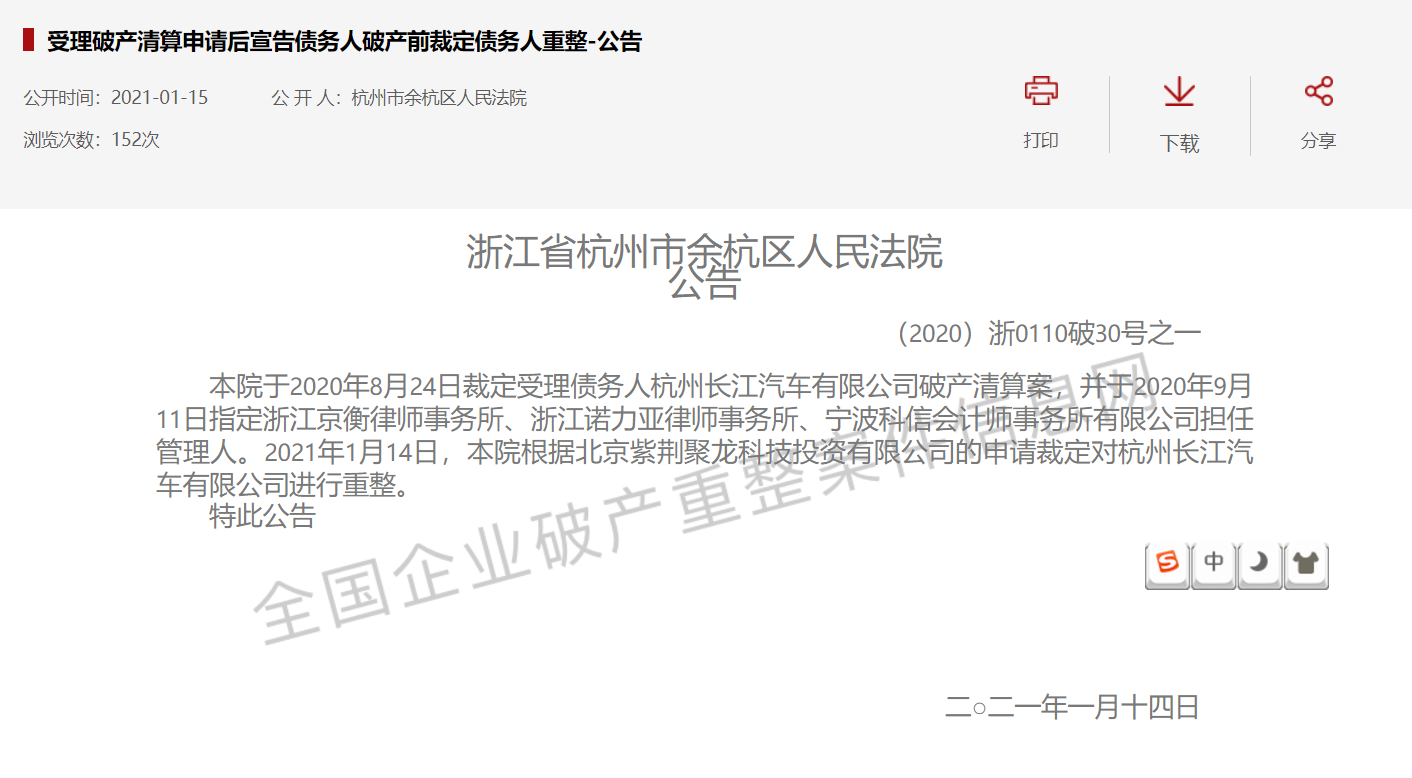

Recently, Hangzhou Yuhang District people's Court issued a notice to restructure Hangzhou Changjiang Automobile Co., Ltd. (hereinafter referred to as "Changjiang Automobile") according to the application of Beijing Zijing Julong Science and Technology Investment Co., Ltd.

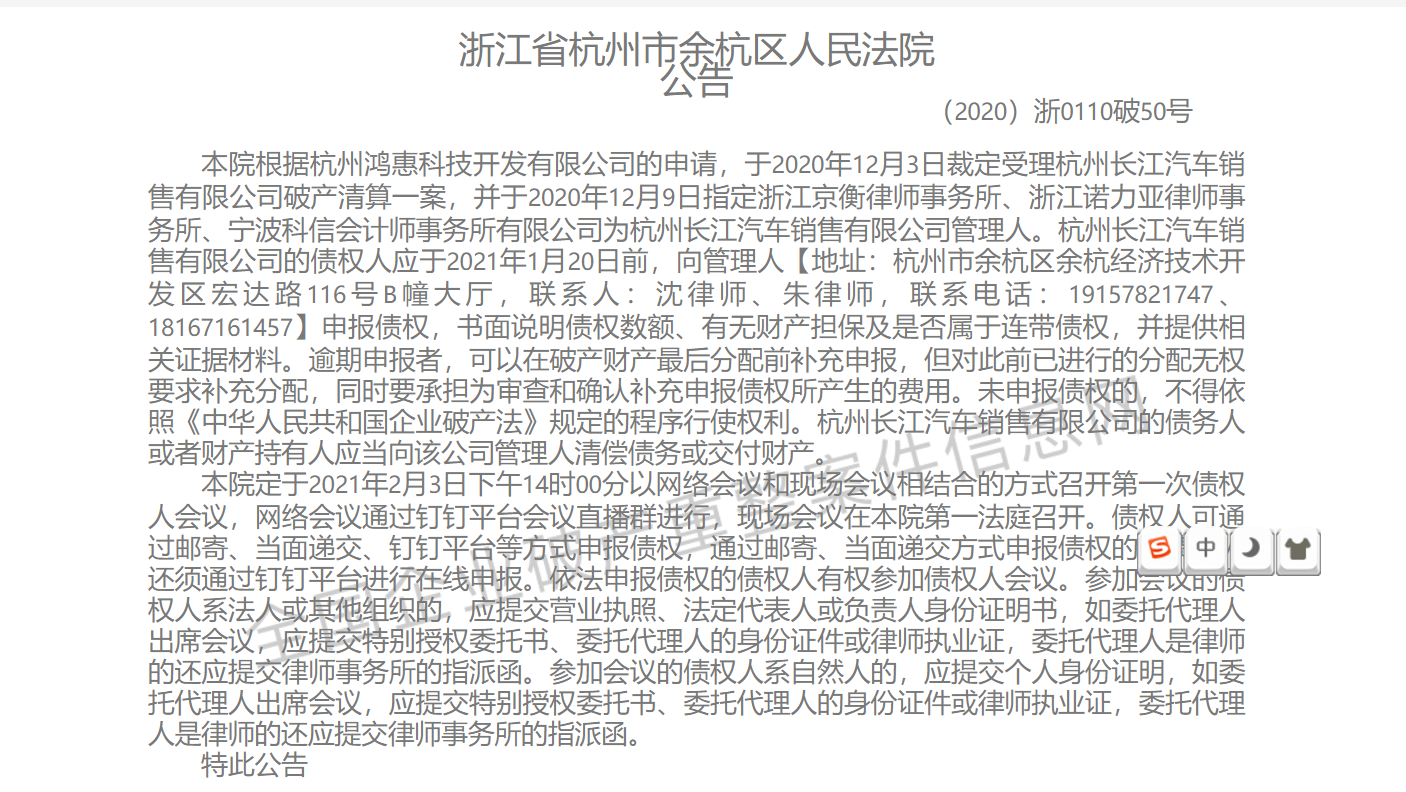

In August 2020, the Yuhang District people's Court ruled to accept the bankruptcy liquidation case of the debtor Hangzhou Changjiang Automobile Co., Ltd. on September 11, 2020, Zhejiang Jingheng Law firm, Zhejiang Nuoliya Law firm and Ningbo Kexin Accounting firm Co., Ltd. were appointed as managers. In December 2020, the bankruptcy liquidation administrator of Changjiang Automobile publicly issued a recruitment announcement for project investors, which means that Changjiang Automobile bankruptcy liquidation has entered a substantive stage.

As the first batch of "Chinese car-making new power enterprises", Changjiang Automobile originally had a bright development prospect and was even optimistic by Li Ka-shing, but in the end it could not escape the elimination of the market.

Data show that Hangzhou Changjiang Automobile Co., Ltd., formerly known as Hangzhou Changjiang bus Co., Ltd., is one of the few tram manufacturers in China. In 2013, on the verge of bankruptcy, Wulong Electric vehicle (Group) Co., Ltd. invested to reorganize Hangzhou Changjiang bus Co., Ltd., and changed its name to Hangzhou Changjiang Automobile Co., Ltd. Under the leadership of Wulong electric vehicles, Hangzhou Changjiang Automobile has successively obtained the production qualification of medium and large passenger cars and the access qualification of pure electric passenger car enterprises.

It is worth mentioning that Changjiang Automobile is also a favorite car manufacturer for Hong Kong tycoon Li Ka-shing. According to Tianyan check, at present, the largest shareholder of Changjiang Automobile is Beijing Zijing Julong Technology Investment Co., Ltd., with a stake of 49.83%; the second largest shareholder is Wulong Electric vehicle, which holds 49%, which is the ultimate beneficiary of Changjiang Automobile.

Behind Wulong is Li Ka-shing, who bought 400 million shares of Wulong at HK $0.73 a share in 2010 and has since increased its stake several times, becoming the third-largest shareholder in Wulong with a share ratio of 8% in 2015.

Changjiang Automobile launched the electric car brand "Changjiang EV" in 2016, which was put into production at the Hangzhou plant, with an annual production capacity of 100000 vehicles in the first phase and 300000 vehicles in the second phase. Subsequently, Changjiang Automobile also established subsidiaries such as Guizhou Changjiang, Shenzhen Changjiang, Chengdu Changjiang and so on.

However, Changjiang EV not only failed to achieve mass production and sales, but also suffered the decline of new energy subsidies, coupled with the lack of competitiveness of products, the capital chain of Changjiang Automobile was broken.

Since July 2019, news of wage arrears has been reported one after another by Changjiang Automobile, including Guizhou Changjiang, Chengdu Changjiang and Hangzhou Changjiang Motor. Some employees even pulled banners to ask for wages, and some employees complained to the labor supervision department. But the problem of wage arrears has never been solved. It is understood that Changjiang Automobile owed employees' wages for as long as 12 months, and there is no accurate information on when the wages will be paid.

Since it was ruled to enter the bankruptcy procedure by the Hangzhou Yuhang District people's Court on August 24, 2020, Changjiang Motor is said to have issued a notice about "waiting at home" once a week, and then many employees received the company's "notice of termination of Labor contract" and "Agreement for termination of Labor contract relationship" one after another.

Prior to this, some media visited the Changjiang Automobile headquarters and found that there were few personnel activities in the company's office building, most of the factories were closed, and the charging pile equipment in front of the company had already been covered with thick dust.

According to the heavenly eye investigation, as of January 21, 2021, Changjiang Motor currently had 119 cases of insolvency and applied for execution of the subject matter of about 274 million yuan, of which the outstanding amount reached 270 million yuan.

After entering 2020, due to the epidemic and market factors, auto companies continue to hear the news of bankruptcy and delisting, including Boxun Automobile, Sailin Automobile and so on. Changjiang Automobile, which once had dual qualifications, is now insolvent. It can be said that Changjiang Automobile has become a classic example of car manufacturing enterprises, but with the reshuffle of the market, Changjiang Automobile is not the only one to fall.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.