In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-24 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)01/30 Report--

Entering 2021, the market of new energy vehicles is particularly hot. The biggest of these is Evergrande, whose shares soared 50% on the day after its official announcement introduced HK $26 billion in financing, bringing its total market capitalization to HK $399.8 billion (330 billion yuan), surpassing SAIC after BYD and Great Wall Motor.

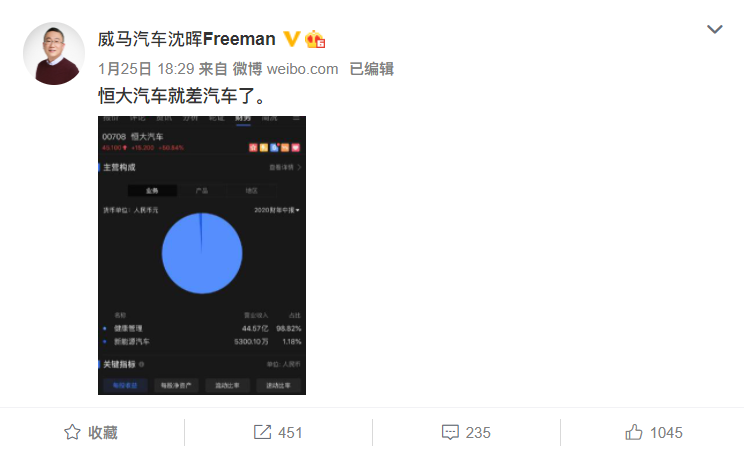

On the same day, Weimar Chairman and CEO posted on Weibo, "Evergrande needs cars!" According to pictures posted on Shen Hui's Weibo, health management accounts for 98.82% of Evergrande's main business structure, while new energy vehicles account for only 1.18%.

Shen Hui's Weibo soon aroused heated discussion among netizens. Some netizens commented, "this is really true. I have seen Weima's car in the street no matter how waterlogged it is. Who has ever seen it in Evergrande?" Some netizens believe that Evergrande relies on Evergrande Group and does not need to worry about the sense of urgency brought about by capitals. its one-time financing of HK $26 billion and its market value soared at one time. Although Shen Hui was right to the point, he could not help feeling "sour".

According to relevant statistics, at least seven car companies will land on Kechuang in 2021, including zero-running cars, Aichi cars, Weima cars, Evergrande cars and so on, in addition to Geely. According to the information of the regulatory authority, Haitong Securities has conducted the second phase of counseling for Evergrande, while Weimar has now completed the listing tutoring. By contrast, Weimar moves faster, but it remains to be seen who will win the first share of the Kechuang board.

With Ulai, ideal, Xiaopeng and other car brands listed in the United States one after another, "listing" seems to have become a ticket for the second half of the game. Industry insiders said that car brands urgently need to get a pass for listing, and if they cannot be listed on the market, it will be difficult to meet the demand for funds, and the capital can not find exits for exchange.

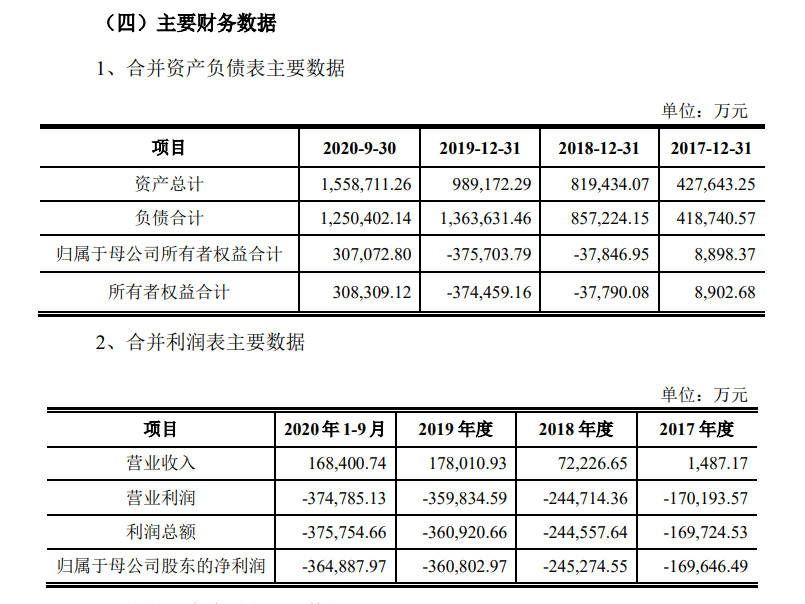

According to the listing guidance report, Weimar achieved operating income of 14.8717 million yuan, 720 million yuan, 1.78 billion yuan and 1.68 billion yuan respectively from 2017 to the first three quarters of 2020, and net losses of 1.696 billion yuan, 2.453 billion yuan, 3,608 million yuan and 3.649 billion yuan, respectively. It is not difficult to see that Weimar's loss is much higher than its operating income, and the loss in less than four years has reached 10 billion yuan. for the current Weima Automobile, "listing" seems to be the only breakthrough, and capital demand has become the biggest problem at present.

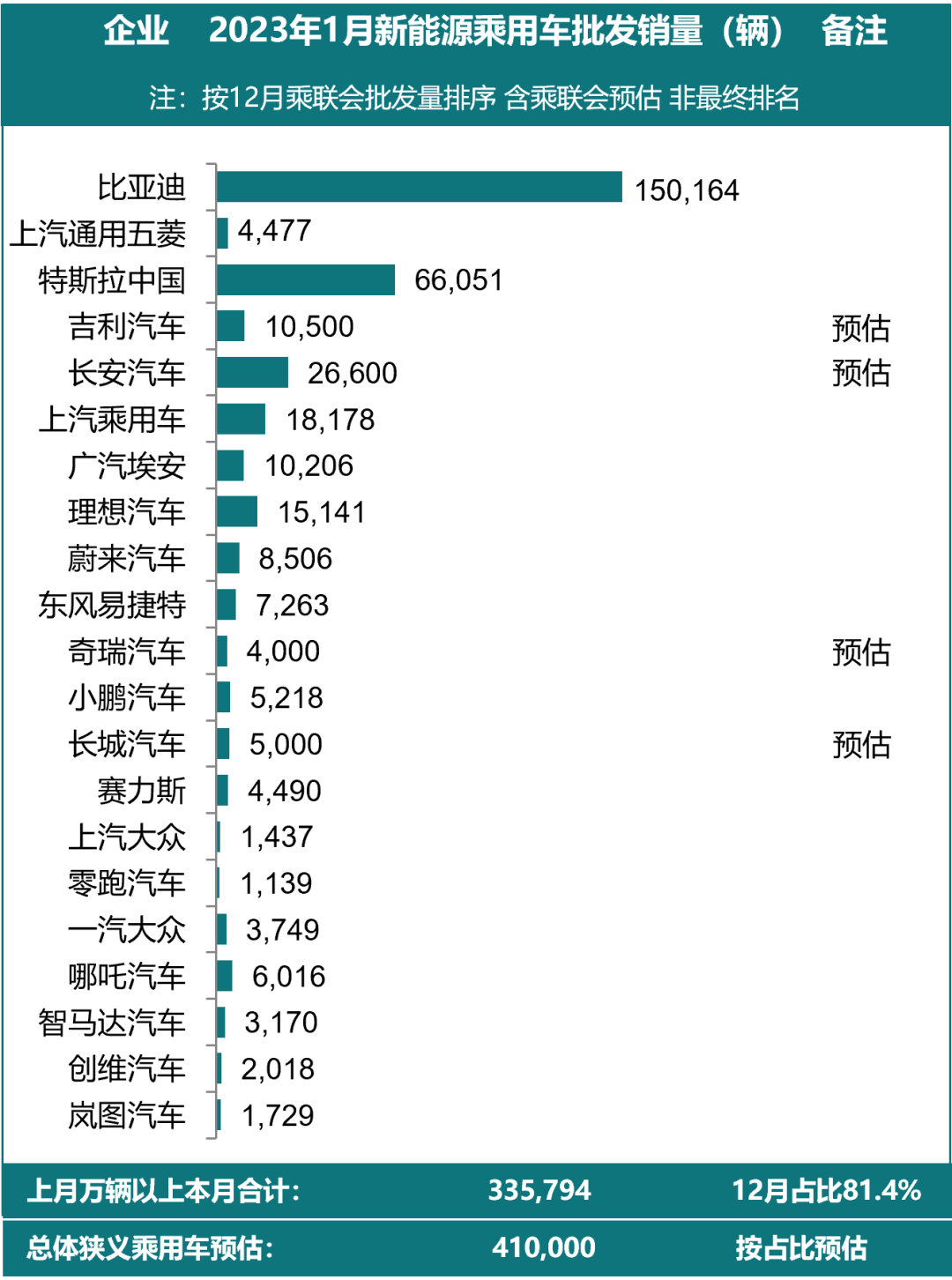

As for whether Weima Motor can achieve the desired results after listing, it is still not known. However, judging from the current development of Weima Automobile, the distance between it and the first echelon of car brands seems to be getting bigger and bigger. From the delivery data, in 2020, NIO, ideal and Xiaopeng were 43728, 32624 and 27041 respectively, while Weimar was 22495.

However, the automotive industry is concerned to find that according to the insurance data of the car gathering network statistics, the insured volume of the three brands of NIO, ideal and Xiaopeng are 43331, 33492 and 27343 respectively, which is not much different from the official delivery data, while Weimar is 17477, with a difference of nearly 5000, which is the sales volume of Weimar in two months.

It is understood that the reason why there is a large gap between the insurance volume and the actual publicity data, it is speculated that there are three possibilities: first, manufacturers press dealers, second, online ride-hailing channels increase the number of cars, third, major customer procurement and other reasons.

In terms of IPO, NIO, ideal and Xiaopeng have successively landed in US stocks, and the market capitalization of these three brands has risen sharply in 2020. At this point, Weimar has obviously lagged behind. As for compared with Evergrande, although Weimar moves faster, the first share of the beach-grabbing board can not only get more sufficient financial support, but also get more living space under public opinion, but the more urgent Weimar is, the more it can reflect its current dilemma.

In addition, the product performance is also significantly separated from the first echelon. It is understood that Weimar currently has EX5 and EX6 models on sale. Although Weima EX5 is the main selling product, it lacks enough bright spots to compete with NIO and Xiaopeng. It is understood that Weimar W6 plans to start pre-sale in March and delivery in April, but compared with existing products, the product strength is still not obvious.

More directly, its products were recalled because of spontaneous combustion. On October 5, October 13 and October 27, 2020, three accidents of spontaneous combustion and explosion occurred in Weimar, which finally led to the recall of Weima. According to the recall announcement, the reason for the recall is that the battery supplier mixed with impurities in the production process, resulting in abnormal lithium precipitation of the power battery. In extreme cases, it can lead to a short circuit in the cell, causing the power battery to heat out of control and the risk of fire. The recall involves 1282 Weimar electric vehicles.

At that time, there were media reports that the battery maker was ZTE High Energy. Subsequently, ZTE High Energy announced that the vehicles involved in the first two fires were indeed carrying ZTE high energy batteries, and the vehicle that caught fire and exploded on the 27th was not carrying ZTE high energy batteries. Well, which supplier's batteries were carried by the vehicles involved in the fire and explosion, and whether the recall of 1282 electric vehicles was aimed at the fire on the 27th or the first two fires? Weimar is still unanswered.

Weima Automobile has created the first share of the board in order to alleviate the financial problems and seek greater development opportunities, but its product safety and product competitiveness are also the main factors to support the later development. Some analysts believe that "if you do not have the ability to compete with other enterprises in the market, it will be out sooner or later."

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

More than 13000 Hyundai Kia Solanto have been recalled.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.